Financial Industry Regulatory Authority (FINRA) Conflict of Interest in Market Transactions

Politics / Market Manipulation Apr 22, 2010 - 07:18 AM GMTBy: PhilStockWorld

Ilene writes: FINRA may have potential massive conflicts of interests in its dealing with its internal investment portfolio. A clear example is FINRA’s behavior with its Auction Rate Securities. Evidence suggests FINRA sold its Auction Rate Securities months before the market collapsed. Insider information or really good luck?

Ilene writes: FINRA may have potential massive conflicts of interests in its dealing with its internal investment portfolio. A clear example is FINRA’s behavior with its Auction Rate Securities. Evidence suggests FINRA sold its Auction Rate Securities months before the market collapsed. Insider information or really good luck?

Interview with Larry Doyle at Sense on Cents

INTRODUCTION

Larry Doyle’s career on Wall Street began in 1983 on the mortgage-backed securities trading desk for The First Boston Corporation. Seven years later, Larry joined Bear Stearns. In 1996, Larry became Head of Mortgage Trading at Union Bank of Switzerland (UBS). After Swiss Bank’s takeover of UBS in 1998, Larry transitioned from trading to sales, serving as a senior salesperson at Bank of America. The move into sales led to his role as National Sales Manager for Securitized Products at JP Morgan Chase in 2000. He left JP Morgan in 2006. Larry served as Chair of the Mortgage Trading Committee for the Public Securities Association in the mid-90s.

In 2008, Larry was invited by NoQuarterUSA to write on the turmoil in world of global finance. The internet allowed him to leverage his experience and insights to a broad audience. He began providing financial and economic commentary to anyone searching for answers at his website, Sense on Cents. His goal was to give his readers an understanding of the economy, markets and global finance from a longstanding Wall Street veteran.

Larry is also a contributing author at Seeking Alpha and Wall Street Pit. He has appeared on Fox Business News, CNBC, and Al Jazeera English. Larry has been quoted by Bloomberg and the Associated Press. His work has been featured in the Financial Times, New York Post, New York Daily News, Chicago Sun-Times, the Tribune family of newspapers, Yahoo! Finance, the financial magazines Waters and The Deluxe Knowledge Quarterly, and the UK-based eFinancial Careers.

Background Information

Financial Industry Regulatory Authority (FINRA)

The Financial Industry Regulatory Authority, Inc., or FINRA is a private corporation which functions as a self-regulatory organization (SRO, an organization that exercises regulatory authority over an industry or profession). It is not a government agency. FINRA was formed by the merger of the enforcement arm of the New York Stock Exchange, NYSE Regulation, Inc., and the National Association of Securities Dealers, Inc. (NASD). The merger was approved by the Securities and Exchange Commission (SEC) in July, 2007.

FINRA performs market regulation under contract with brokerage firms and trading markets. It focuses on regulatory oversight of all securities firms that do business with the public. FINRA regulates by adopting and enforcing rules and regulations governing its members’ business activities. It often provides advice to the U.S. Securities and Exchange Commission. (See FINRA’s website is at http://www.finra.org/. Also FINRA, http://en.wikipedia.org/wiki/FINRA).

Auction Rate Securities (ARS)

An auction rate security (ARS) refers to a debt instrument (corporate or municipal bonds) with a long-term nominal maturity for which the interest rate is regularly reset through a dutch auction. (Auction rate preferreds are similar in nature but are shares in a fund and as such are not tied to an underlying longer term maturity loan.)

The auction failures in February 2008 led to widespread freezing of the ARS assets in clients’ accounts. Currently, the instruments trade in a secondary market but at a significant discount to par. A renewed investigation of the ARS industry was led by Andrew Cuomo, the Attorney General of New York, and William Galvin, Secretary of the Commonwealth of Massachusetts. These investigations found industry-wide violations of law. Investors in ARSs maintain these instruments were misrepresented as liquid cash alternatives and allege that broker dealers failed to disclose the liquidity and credit risks involved. (See also http://en.wikipedia.org/wiki/Auction_rate_security.)

INTERVIEW

Ilene: Larry, I read your recent article, “FINRA Fraud Team Must Look in the Mirror” (April 16, 2010), in which you discuss FINRA’s “new initiative to target fraud within its purview of the financial industry.” You seem skeptical. Can you explain?

Larry: FINRA and SEC are agencies charged with protecting investors and these organizations have failed to perform for years, leading up to the financial crisis. In addition, FINRA has displayed a potential massive conflict of interest in its dealing with its internal investment portfolio. A clear example is FINRA’s behavior with its Auction Rate Securities (ARSs).

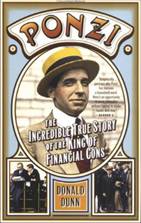

FINRA acquired its ARSs through the NASD and NYSE Regulation Inc. merger. I believe ARSs were the greatest Ponzi scheme perpetrated by Wall Street on investors, and FINRA was in the position to oversee this market. FINRA not only failed, but the question that needs to be fully explored is whether it acted on material, nonpublic information as it liquidated its ARS bonds in 2007, at the expense of the investors it was supposed to be protecting.

Ilene: Can you quickly review what ARSs are?

Larry: Auction Rate Securities are financial instruments which were largely marketed and distributed as “cash equivalents” by Wall Street. The securities were a means by which long-term financings were funded via the short-term market. Almost every ARS investor has indicated that the risks embedded in these ARS securities were not fully disclosed. Buyers have repeated that dealers represented ARS as cash-surrogates or cash equivalents, when in reality they were not. But while money was flowing in during the regular auctions, the ARS market remained viable.

The scheme worked like a charm for a long time. New money would come in allowing old money to cash out. However, as in typical Ponzi schemes, liquidity depended on continued sales to new buyers. It depended on new money coming in.

The ARS market operated smoothly until the credit markets seized up. First signs of trouble emerged in 2007 when the spreads started to blow out (widen significantly). Spreads widened because dealers realized the true nature of the risks and backed away from supporting the market. Selling intensified as investors were trying to get out in the late spring and summer of 2007. Investors stopped buying, though the dealers maintained an intermediary market for a while. Finally, sellers so overwhelmed buyers that Wall Street had to stop serving as an intermediary. This developed over a period of months, but was not shared with the clients. Wall Street was trying to lay these ARSs out on investors. When the market collapsed in February 2008, the “cash equivalency” disappeared.

ARSs made Bernie Madoff’s Ponzi scheme look small. Money managers involved in the ARS market have largely not been held accountable. The theme emerging from court cases addressing ARSs has been “buyer beware.” Investors who still own ARSs may very well not get their money back for 20 to 30 years.

Ilene: Are the ARSs are currently trading?

Larry: Yes, there’s a secondary market. If investors try to sell their ARS positions, they could get some of their money out, but they would have to take a substantial discount.

Ilene: And FINRA owned many ARSs in its investment portfolio and sold them in 2007?

Larry: Yes. The regulator, FINRA, sold its ARS bonds in 2007.

Going into 2007, FINRA had $647 million dollars of ARSs. It was holding ARSs as the credit markets started to freeze in mid 2007. FINRA says it did nothing nefarious when it sold its ARSs. But that fails the smell test. It sold its ARS holdings before the markets collapsed. Meanwhile, investors got stuck with approximately $150 billion of ARSs.

One would have to be exceptionally naïve to think FINRA officials did not have material, nonpublic information on the ARS market before it decided to sell its holdings. ARS investors are screaming for FINRA’s ARS liquidation to be explored. Having information about the securities and acting on it without that information being available to the public would potentially qualify as front-running and insider trading.

Ilene: As the regulator of the markets, how could FINRA not have information?

Larry: It’s not a credible story. While FINRA sold its ARS in mid 2007, the fact that it cautioned investors on these instruments was not displayed on its website until March 2008. I ask–when did the concerns arise? Did FINRA sell its own position while having “concerns” months earlier?

The officials were either incompetent or, in my opinion, they acted on insider information. It’s hard to conclude otherwise given what we do know. We do know the sales were made in the middle of 2007, and we do know the market collapsed months later. I believe FINRA was protecting the industry and protecting itself, to the detriment of investors. Where did FINRA’s ARS bonds end up? They went somewhere. Which investors own the ARS bonds previously owned by FINRA? How might these investors feel if they knew their ARS bonds were owned by the regulator FINRA?

Ilene: in “FINRA Fraud Team Must Look in the Mirror,” you wrote:

From the MarketWatch report entitled,

Wall Street Watchdog Promises to Show More Teeth:

“Wall Street’s self-regulatory body that self-admittedly failed to detect 2008s major financial scandals has a plan to not miss the next one. The Financial Industry Regulatory Authority is touting its new fraud team as the key to spotting another Bernard Madoff.

“’I’ve been encouraged to pursue anybody who’s engaged in fraud, with unfettered access to sources with industry connections,’ Funkhouser said.”

Would Mr.Funkhouser agree to inspect and pursue potential fraud within his own organization’s portfolio management group? I am referring specifically to FINRA’s ‘timely’ liquidation of its $647 million auction-rate securities position in 2007. Will Funkhouser agree to release all pertinent details of that liquidation so the public can determine if FINRA used material, nonpublic information for its own benefit and at the expense of the thousands of ARS investors who continue to be unable to access their $150 billion?

In the spirit of full disclosure, the reporter of the MarketWatch story contacted me for information while he was writing the article. I spoke to him for an hour, highlighting a number of issues within FINRA. I am extremely disappointed the reporter and/or the editors of MarketWatch chose not to highlight FINRA’s ARS liquidation. In my opinion, whoever decided to hold that topic out of this article did ARS investors and all investors an enormous disservice.”….

In regard to the proposed financial regulatory reform in front of Congress currently, I highlighted for this reporter the fact that FINRA barely receives mention in the comprehensive legislation. The fact that Congress can propose Financial Regulatory Reform without serious attention paid to the Financial Industry Regulatory Authority is a virtual fraud unto itself. In my opinion, that reality is hard evidence of the power of the Wall Street lobby….

Ilene: Is FINRA then refusing to open up its books and records to show when it sold its ARSs and to reveal what it knew or didn’t know at the time? Do you think Congress is looking the other way?

Larry: Yes, FINRA never responded to my inquiries about the sales of its ARSs, and if the SEC or Congress requested information on FINRA’s sales, it has never been made public.

Thousands of investors cannot get their money now. Bloomberg reported that the state of Hawaii, for example, invested over a billion dollars in ARSs, with much of that in 2007. Chances are not zero that the state of Hawaii even bought securities previously owned by FINRA. FINRA’s ARSs ended up somewhere. There’s a pending case in which executives from Lehman Brothers are being investigated for dumping ARSs in 2007. (I believe it is pending. I have not seen nor heard information indicating the case has been dismissed or resolved.) A sales manger from UBS was fined approximately $2.7 million for dumping his personal ARS position in late 2007. The SEC should be reviewing FINRA’s sale of its ARS as well. The public at large and ARS investors especially deserve to know what happened. This is a regulatory system that failed, yet no one’s looking into what appears like conflict of interests, self-dealing, and front-running by the very regulator charged with protecting investors.

Ilene: It’s amazing that the system is set up so a regulatory body owns the instruments it is supposed to be regulating.

Larry: Yes, it defies logic. FINRA is a self regulatory agency which is supposed to oversee the broker dealer community. It invested in sectors of the market it was charged with regulating. It invested in risky instruments including hedge funds, funds of funds, ARSs, etc. It has one foot on Wall Street and one in Washington. While FINRA’s supposed to regulate, overwhelming evidence indicates that it served more at the behest of the industry. Even though it is a nonprofit, non-government agency, FINRA paid its executives extremely well with a number of executives making million dollar, if not multi-million dollar, compensation. Additionally, FINRA is anything but transparent.

There is an outstanding lawsuit by Amerivet Securities requesting the release of all the details around the liquidation of FINRA’s ARSs. This lawsuit alleges that FINRA also had money invested with Bernie Madoff. It’s hard to believe FINRA didn’t have information on Bernie Madoff. FINRA’s head at the time, Mary Schapiro, was called a ‘dear friend’ by Mr. Madoff.

Now Ms. Schapiro is the head of the SEC. What chance do you think that the SEC will investigate FINRA’s activities under Ms. Shapiro’s oversight?

Ilene: None?

Larry: Well, we will see. I’m not optimistic. Governmental and non-governmental regulatory bodies are granted absolute immunity under banking rules from the 1930s. Although in my opinion the management of FINRA’s financial assets is not a regulatory activity. Is the cop on the financial beat above the law?

Ilene: What are your thoughts on FINRA’s or the SEC’s involvement in the Bernie Madoff scandal?

Larry: I view Bernie Madoff’s Ponzi scheme as the ultimate insider job. Whether the Madoff family knew everything or not, they curried favor with the regulatory community for a long time. They were above reproach. The financial cops were literally asleep at the wheel. Other parties who knew were silent. JP Morgan was probably aware, perhaps late in the game, but other traders also likely knew something untoward was going on. Harry Markopolos spoke with a number of traders at different firms who realized Bernie’s operation was some sort of fraud, but no one said anything. The failure of anyone to come forward, besides Harry Markopolos, says a lot about the industry. Harry deserves a great deal of credit. That no one listened to him says a lot about the Wall St.-Washington incestuous relationship, and the so-called-regulators. Maybe FINRA was de-fanged by Washington and the SEC. If so, they should tell the American people that these markets are NOT truly regulated.

Securities Investor Protection Corporation (SIPC) was set up by Wall Street to protect investors when broker dealers failed. Until the last year or so, the annual SIPC premium paid by Bear Stearns, Lehman, Goldman Sachs, JP Morgan, and others for more than the past decade was only $150. SIPC and the Wall Street dealers felt that SIPC had enough money already, at the time about $1 Billion.

Gives a sense of comfort to investors, right? It took only one failure to use up the money. This was effectively another fraud perpetrated by Wall Street on investors. The Madoff scam devastated the SIPC fund. Money went to some of the Madoff investors. There are ongoing legal battles about who should get paid. The SIPC fund is another example of systemic fraud. Broker dealers benefitted by having the appearance of protection. In reality, the protection was not nearly extensive enough. I mean, a $150 premium paid by Goldman Sachs et. al. to be able to put the SIPC stamp of protection on their client statements. That’s a joke, but the joke is on investors.

The broker dealers should be accountable for their misrepresentations, frauds and criminal activities. They talk about moving forward, but not about paying back losses. Trillions of dollars in losses and very few people have been indicted. Why haven’t there been more indictments? Perhaps there will be, but America has little confidence in the legislature and regulators who have been either negligent or complicit or both. Evidence suggests that those who should be conducting investigations, FINRA, SEC, Congress, should themselves be investigated.

Regarding FINRA’s liquidation of its ARS bonds, this stuff deserves a public investigation. Books were cooked, regulators didn’t do their jobs, significant money spent lobbying… It all looks corrupt. ARS investors can’t get their money out, but FINRA liquidated months before the market collapsed. FINRA should be forced to open its books. This lack of transparency is why people don’t have confidence in the markets.

Ilene: Do you think FINRA will be investigated?

Larry: I interviewed and discussed this FINRA situation at length with the Project On Government Oversight (POGO), an organization established 30 years ago to oversee wasteful military spending. It is a watchdog for government activities. About a month ago, POGO sent a letter to four Congressional subcommittees in which it recommended investigating FINRA. Ultimately POGO questioned the very validity of a self-regulatory model for our financial industry. Will Congress act? Great question.

Will anyone in Washington do anything about it? We have Chris Dodd’s regulation reform bill that barely mentions FINRA. Minor reform changes nothing by leaving FINRA in place.

This is the power of Wall Street lobbying, it’s business as usual. They want the regulatory model exactly where it is right now, and the American public is not going to know. The SEC gets all the attention. America hardly knows what FINRA is. A private agency funded by the industry. How did that work? To a very large extent, it didn’t.

Wall Street has turned into a massive oligopoly. Washington strikes me as a massive oligarchy. There’s limited transparency. Regulators know the firms are undercapitalized. There’s a rush to help banks replenish their capital base, keep rates at zero, so they can borrow at next to nothing. The focus is on healing the banking system through a transfer of wealth to banks from consumers. While banks pay close to zero interest, credit card rates are 15%-30%. People can’t roll their debts easily anymore and are not putting money into the markets. This won’t change with the lack of transparency and loss of trust.

I’m not railing against the majority of people working on Wall Street who are good people. But the power structure corrupted the system, with blessings from the Washington crowd. I worked in this industry for 23 years. The lesson is like in Animal House: “you screwed up, you trusted us.”

Congress and Mary Schapiro should be telling FINRA to provide transparency, but they’re not. This has to get into the court of public opinion. The public needs to pressure Congress to act. People in Congress want to be reelected. This is not about parties, many politicians get their campaign donations from the banks. It’s on both sides. But as long as politicians are bankrolled by the banks, we’re all hurt. Without public outcry, nothing will change. Who’s the regulator closest to the problems? FINRA. The timing of its ARSs sales was such that it’s hard to believe there was no front-running and insider trading. Maybe it didn’t do anything wrong, but then why aren’t the records made public?

In 2009, Wall Street gave it’s executives $140 B in bonuses. There’s $150 B in ARSs that are not getting repaid. Regulators are standing up for the industry, but not for the investors. Not many are looking out for the investors. I think people realize there’s not much true reform happening.

Ilene: Do you believe the average investor is disillusioned with the markets, as reflected, for example, in the low volume on the exchanges?

Larry: Volume on the NYSE is dropping like a rock. That’s the American investors saying they don’t want to play the game any more. Wall Street risks losing investors and they deserve to. The banks can’t keep marking up their own investments (stocks). Ultimately, Wall Street needs customers.

Ilene: But, at least in the short-term, they’re making money.

Larry: Yes, but this is not self-sustaining. The banks are getting a benefit from borrowing money at about zero rates, and playing the market. We’ll see a flight of capital from Americans and see foreign money disappear. This is inevitable unless we get our house in order.

We can start by introducing FINRA to the American public and show how it operated in the ARS market. If FINRA front ran the ARS market, and I believe it did, the sun will still come out tomorrow and our nation will move on. It won’t be the first time an illegal activity occurred in a government or quasi-government agency. It’s all about confidence. Americans may not know about FINRA, but they do know the financial system is plagued with corruption.

Ilene: How long do you think the market will keep trending up?

Larry: Until the Federal Reserve starts saying they have to turn off the spigot, ending the zero funds rate. About six weeks ago, the Fed said we would have unemployment for an extended period. This is a telltale sign that the funds rate isn’t going up any time soon. Words of wisdom: “don’t fight the Fed.” Markets correct by price and by time, I can see us just sitting here as we grind along on low volume. On the other hand, there could also be an unforeseen event that drives the market down, I can see that happening. Will this Goldman Sachs charge of fraud mushroom? Perhaps.

These zero percent loans to the banks are a huge transfer of wealth from people having money sitting on the side lines, earning nothing, to the banks with their high frequency trading activities. It’s nothing more than a wealth transfer from savers to banks, which run up the markets and collect their bonuses. $140 B went right out the front door–from the taxpayers to the banks. These banks were saved by the taxpayers and now use to the money to further enrich themselves.

The Wall Street banks have leverage over the government. This system is not capitalism, it’s a heavily manipulated oligarchy in which the few benefit at the expense of the many. People at both ends of the spectrum–the ultra-rich and the ultra-poor–benefit at the expense of the middle and upper middle classes. The tea party crowd, part of the middle class, is saying no one’s looking out for us, and of course, no one is. The establishment wants to marginalize these people. The tea parties are going to gain more momentum if the system does not get fixed. While I don’t agree with everything they have to say, they do elevate topics and expose issues. For that, they provide a public service by calling our attention to our broken and corrupted political system.

Ilene: Do you think the fraud charges brought by the SEC against Goldman Sachs will be a start to reforming the financial system?

Larry: I am not too optimistic that these charges will bring real change within Goldman Sachs or the industry, but what I do believe may happen is that the public’s case against the Wall Street-Washington incest will gain further momentum and I have a strong opinion what the verdict will be.

Ilene: Thank you, Larry, for doing this interview with me and sharing your perspective on FINRA, financial regulation, the banks, the stock market, and the (hopeful) path to reforming our financial system.

By Phil

Philip R. Davis is a founder of Phil's Stock World (www.philstockworld.com), a stock and options trading site that teaches the art of options trading to newcomers and devises advanced strategies for expert traders. Mr. Davis is a serial entrepreneur, having founded software company Accu-Title, a real estate title insurance software solution, and is also the President of the Delphi Consulting Corp., an M&A consulting firm that helps large and small companies obtain funding and close deals. He was also the founder of Accu-Search, a property data corporation that was sold to DataTrace in 2004 and Personality Plus, a precursor to eHarmony.com. Phil was a former editor of a UMass/Amherst humor magazine and it shows in his writing -- which is filled with colorful commentary along with very specific ideas on stock option purchases (Phil rarely holds actual stocks). Visit: Phil's Stock World (www.philstockworld.com)

© 2010 Copyright PhilStockWorld - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.