Goldman Sachs Black Swan Triggers Stock Market Sell Signal?

News_Letter / Financial Markets 2010 Apr 19, 2010 - 10:11 PM GMTBy: NewsLetter

The Market Oracle Newsletter

The Market Oracle Newsletter

April 18th, 2010 Issue #24 Vol. 4

Goldman Sachs Black Swan Triggers Stock Market Sell Signal?Inflation Mega-Trend Ebook Direct Download Link (PDF 3.2m/b) Dear Reader The out of the blue news that the S.E.C. will actually do its job and attempt to hold Goldman Sachs' to account for mortgage fraud on an epic scale that played a large part in bringing about the whole financial crisis as Goldman's sold toxic mortgage backed securities (MBS) to gullible greedy investors (other banks) that it was betting AGAINST, i.e. was priming the U.S. housing market to collapse so that it could profit from the collapse as the value of MBS were wiped out. Not only that but Goldman Sachs, other banks and hedge funds were shorting the stock prices of banks that were drowning in MBS holdings such as Bear Stearns and the vast array of European banks and not forgetting the catalyst for financial armageddon Lehman Brothers. As an example of the systematic way the financial crisis progressed since July 2007, In March 2008 (17 Mar 2008 - Bear Stearns Collapses Into Arms of JP Morgan ) I wrote concerning the take out of Bear Stearns by the likes of Goldman Sachs, JP Morgan and hedge funds shorting Bear Stearns stock and then pulling their cash out of the bank to cause the bank to collapse from $90 a share to $2 so that JP Morgan could pick up the bank for peanuts coupled with a $30 billion handout from the U.S. Treasury. This was 6 months ahead of the next target for the wall street vampires as they prepped and prepared to sink their fangs into their fellow but dumber vampire bank Lehman Brothers which I again warned of back in March 2008 (18 Mar 2008 - Lehman Brothers Next Wall Street Bank to Go Bust? ) . So here we stand today with the S.E.C. several years behind the curve filing a civil suit against Goldman Sachs which amounts to being just the tip of the MBS fraud ice-berg that was gamed right form the beginning, from BEFORE 2006, primed all the way to sucker the poor into Ninja mortgage loans so that their toxic mortgages could be sliced and diced and hidden in Triple rated AAA CDO's sold to fellow gullible greedy bankster's. Few of the many thousands involved in this epic fraud have been held to account and as I elaborated at length in the Inflation Mega-trend ebook (FREE DOWNLOAD) that the politicians will NOT enact any credible reform as they remain firmly in the back pockets of the bankster elite. However the Goldman news could spark the start of banks suing fellow banks that sold them toxic sludge that exploded in spectacular style during 2008. Where the S.E.C. is concerned, the best that can be expected for main street is for Goldman's to receive a flea bite sized fine. Stock Market Dow Trend The stock market has been in a rare trend that has seen it rise relentlessly without even triggering a minor sell signal since February as elaborated upon several times during the course of the past 7 weeks. Yes the stock market has been overbought for some weeks, yes we can conclude that a correction of sorts is imminent, however without an actual sell signal there is only a continuation of the strong up trend. Whilst perma-bears can dig out reams of data to explain why the market must fall, just as has been the case for an imminent end of the bull market for the duration of the past 13 months. However regardless of what the market 'should' do based on fitting the data to the market, the bottom line where trading should be concerned is in reacting to high probability price triggers i.e. Break of X targets a trend to Y. Existing Forecast My last in depth analysis of 23rd March concluded towards a forecast Dow trend higher into Mid may 2010 towards a target of 12,000, it allowed for a minor correction to occur on meeting resistance at Dow 11k. Subsequent analysis illustrated the failure of ANY sell signals to for a short-term correction as the primary trend continued higher in the face of on-going buy triggers which brings us to this weeks price action and Friday's Black Swan announcement of S.E.C. Fraud prosecution against Goldman Sachs triggering a sharp intra-day spike lower. Current Market Outlook Market Psychology - Perma-bears that populate the BlogosFear despite the fact that had they actually traded their persistent expectations would have been wiped out many times over trading account wise are salivating once more on Friday's Goldman's news. Get ready for a crescendo of views and evidence of why this is it, the big one has arrived (AGAIN!). Meanwhile bulls (whether or not there perma) have gotten tired, exhausted by the relentless nature of the rally WITHOUT ANY correction, which is NOT NORMAL, NOT in my 25 year experience of trading the Dow anyway. There are also the bulk of investors (retail / small) sat on the sidelines WAITING for the BIG SELL OFF to try and get some exposure to the stocks stealth bull market which has relentlessly sought to exclude them from one of the greatest bull markets in history as corrections during the past 12 months were just never enough, never the right time to buy, waiting for that bit more downtrend that never came. This to me on balance suggests that a significant down-trend is NOT imminent, now to the technical's. TREND ANALYSIS - Fridays reaction lower was the strongest intra-day swing since February, which therefore suggests that there is a high probability that Fridays low will break, i.e. it will take some days to put a low in or for prices to resume the uptrend. SUPPORT / RESISTANCE - Resistance is at 11,160, Support is at 11,000 and then 10,950 and then 10,850. There is strong support under the market between the zone of 10,850 and 10,950 which implies that unlike Fridays plunge, a downtrend into this zone will be tougher to slice through. EWAVE - My interpretation of the EWave component is not clear, all I can determine is that the late Feb correction was a wave 2, the subsequent up trend does not show any real discernable pattern. My EWAVE conclusion is that the Dow is under going a minor correction right now that will ultimately confirm a Wave 3 high at 11,154 that targets a Wave 4 correction to 10,850 which would also be inline with a rally that sets the Dow up for a uptrend to 12k by mid May. MACD - This is not mid Feb when the MACD was oversold that signaled a significant bull run was underway. The MACD is overbought and wants to rollover, this is manifesting in greater intra-day volatility that is attempting to work out some of this overbought state, give it a few more days of drifting lower than enough of the overbought state can be worked out to set up for another sustained run into overbought territory. VOLUME - The BlogosFear pounced on Friday's heavy volume, however quietly forgetting that they whole rally since March 2009 has been on lighter volume on the rallies and heavier volume on the declines which flies in the face of technical analysis consensus, which is as I have oft mentioned these past 13 months a manifestation of the stocks stealth bull market. So does not mean ANYTHING in terms of a MAJOR REVERSAL. SEASONALS - We will soon be in the "Sell in May and Go Away" seasonal weakness window that coincides with my existing Dow target, so the perma bear crowd may soon get an opportunity to crow loudly as eventually a significant sell off does materialise, but first.... Dow Conclusion - The uptrend remains intact. The forecast of March 23rd remains intact for the Dow to target 12k by Mid May 2010. The immediate future appears to be resolving towards a minor correction (pending a minor sell signal) that looks set to see a trend lower of about 150 points from the Dow's Fridays close of 11,019. For the existing forecast to be negated a string of sell signals and targets need to be overcome as elaborated below.

Dow Trading Triggers - The above chart illustrates that there still have been NO SELL SIGNALS since February 2010. Fridays sharp swing lower FAILED to trigger ANY short-term reversal. However there is a good probability that the nearest minor sell signal at Dow 10,990 (Fridays low was 10,974 therefore slippage of 16 points ignored), which given Fridays close of 11,019 looks likely to be triggered early next week to target a minor downtrend to between 10,850 to 10,900. With the more significant SELL signal still at 10,830 as mentioned a couple of weeks ago that would target Dow 10,550, On the upside the more probable Continuation BUY triggers are minor at 11,065 and Major at 11,160. Bottom line - I expect a volatile choppy trend next week within the range 11,100 and and 10,900 that would do the job of suckering in many shorts in advance of the forecast trend to Dow 12k by mid May as of 23rd March 2010. UK Hung Parliament Probability Increases The clear winner in the first Prime Ministerial debate was the Leader of the Liberal Democrats, Nick Clegg. The net result of this was to virtually immediately boost the Liberal Democrats by an average of 5% in the opinion polls which firmly pushes the election results into hung parliament territory. The latest opinion poll by ICM for the Sunday Telegraph puts the Conservatives on 34%, Labour on 29% and Liberal Democrats on 27%.

The Conservatives require an election result of a minimum of 40% to win. Whilst the Conservatives were recording a poll leads of 38% and 39% there was still a chance of an overall majority due to the margin of error and the fact that the election result will be decided in the bitterly fought out 120 of marginal constituencies (20%), however losing 4-5% for a drop to 34% means the Conservatives would have virtually a zero chance of an overall majority. The Liberal Democrats should not be prematurely celebrating as Britain's first past the post system ensures that being third in the polls does NOT translate into many more seats i.e. the latest opinion poll would translate into Labour being the largest party in parliament on 280 seats, Conservatives second on 260 seats and Liberal Democrats third on just 72 seats, so the 27% poll does not translate in anywhere near the gains that some Lib Dems may be deluding themselves of, to achieve a political earthquake the Liberal Democrats need to be polling 2% ahead of Labour. However the Liberal Democrats opinion poll boost may prove short lived as especially worried Conservative party strategists sharpen their knives and go on the offensive against Nick Clegg in the remaining two prime ministerial debates. Given Nicks lack of experience there is a high probability that the Liberal Democrat poll surge will mostly evaporate over the next 2 weeks, therefore I am holding off making any revision to my long standing and unchanged UK general election forecast as of June 2009 which called for small Conservative majority of 343 seats against Labour on 225 and Liberal Democrats on about 45. Clearly from a strategic point of view a rise in the Lib Dem vote plays into the hands of the Labour party that will ironically retain more seats the better the Lib Dems perform in the election (upto a limit) as the Liberal vote will prevent Labour seats from swinging over to the Conservatives. Therefore Gordon Browns ever calculating mind may have conceived of such a strategy on the realisation that a Labour win is not probable and therefore Labour is ingratiating itself with the Liberal Democrats both to maximise Labour seats and in advance of a post election Lib-Lab pact that on the recent polls would but the Lib-Lab government on 352 seats. Labours strategy puts the Conservatives at a huge disadvantage as Conservatives pandering to a party that is to the left of Labour is not going to work and is just going to further dilute the Conservatives appeal amongst potential voters, therefore it will increasingly come down to the Conservatives having to battle against both Labour and the Lib Dems, which increases the probability of a hung parliament. Labour will shortly be playing its Election Ace which will be an economic growth surprise to the upside on release of UK GDP Data for the 1st quarter of 2010 on 23rd April as per the forecast (31 Dec 2009 - UK Economy GDP Growth Forecast 2010 and 2011, The Stealth Election Boom ) and in depth analysis in the Inflation Mega-Trend Ebook (FREE Download). Which is set against the mainstream press / academic economists continuing debate of a potential double dip recession. This is definitely turning out to be an exciting and highly volatile election with voter loyalties in constant flux as a consequence of the expenses scandal. The too hard to call election is less than 3 weeks away, the likes of which we have not seen since the 1992 surprise when Labour blew their virtually assured election win of ousting John Major primarily as a consequence of Neil Kinnocks triumphalist public performance at the Sheffield Arena just prior to voting day which turned many voters away from Labour at the very last minute. It will be interesting to see if the Lib Dems will be able to hold on to a poll rating anywhere near as high as today's 27% for another 19 days. Your stocks stealth bull market investing, index trading, election watching analyst. Comments and Source here : http://www.marketoracle.co.uk/Article18753.html By Nadeem Walayat Copyright © 2005-10 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved Featured Analysis of the Week

Most Popular Financial Markets Analysis of the Week :

By: Graham_Summers While the market cheers on the fantastic job “growth” of March 2010, the more astute of us are concerned with a growing tide of personal bankruptcies. March 2010 saw 158,000 bankruptcy filings. David Rosenberg of Gluskin-Sheff notes that this is an astounding 6,900 filings per day.

By: Nadeem_Walayat Whilst politicians of all the major parties during the general election campaign continue to ignore the giant debt elephant in the room as the general public continue to prefer to be deluded into thinking that Britain can skip the debt crisis that faces the country as a consequence of Greecesk levels of annual deficits and foreign liabilities that have pushed Britain significantly along the path towards hyperinflation and bankruptcy (debt default to foreigners), as many of the trend projections concerning the looming debt mountain, banking and public sector's liability expectations made in November 2008 (Bankrupt Britain Trending Towards Hyper-Inflation?) have come to pass, against which NOTHING has been done or stated will be done to prevent ultimate national bankruptcy as warned of in November 2008.

By: Darryl_R_Schoon When the end comes, it will be a surprise even to those who expect it When Professor Antal E. Fekete began lecturing on Austrian economics in Hungary in the spring of 2007, the global economy had not yet experienced the collapse which Austrian economist Ludwig von Mises had predicted over a half century before, to wit,

By: Mike_Shedlock The Business Insider has a very interesting presentation by Richard Koo on The Real Reason Why This Recession Is Completely Different. Here are a few slides.

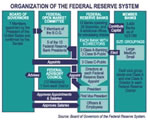

By: Douglas_French If you follow economic affairs at all, you know who Ben Bernanke is. He's the chairman of the Federal Reserve. He was Time's 2009 "Man of the Year." CBS News said he may be the most important Fed chairman in history when Scott Pelley interviewed him for the highly watched 60 Minutes program.

By: Gordon_T_Long A distracted and preoccupied amateur is no match for a determined, organized professional with a strategy. Though the collapse of the shadow banking system was a near fatal miscue for the global bankers, they have been quick to adjust their strategy. With an army of MBAs, quants and lobbyists they have reworked their strategy at the expense of the still comatose and shaken taxpayer.

By: Matt Taibbi How the nation's biggest banks are ripping off American cities with the same predatory deals that brought down Greece If you want to know what life in the Third World is like, just ask Lisa Pack, an administrative assistant who works in the roads and transportation department in Jefferson County, Alabama. Pack got rudely introduced to life in post-crisis America last August, when word came down that she and 1,000 of her fellow public employees would have to take a little unpaid vacation for a while. The county, it turned out, was more than $5 billion in debt — meaning that courthouses, jails and sheriff's precincts had to be closed so that Wall Street banks could be paid.

By: Nadeem_Walayat Whilst the blogosfear still asks the question whether this is a bear market rally or a new bull market, the stocks stealth bull market achieves a new milestone right at the end of the week by touching the Dow 11k target as indicated in last weeks brief update as the weeks most probable trend outcome.

You're receiving this Email because you've registered with our website. How to Subscribe Click here to register and get our FREE Newsletter To access the Newsletter archive this link Forward a Message to Someone [FORWARD] To update your preferences [PREFERENCES] How to Unsubscribe - [UNSUBSCRIBE]

The Market Oracle is a FREE Financial Markets Forecasting & Analysis Newsletter and online publication. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.