Stock Market Rally, Is It Live? Or Is It Memorex?

Stock-Markets / Stock Markets 2010 Apr 15, 2010 - 03:48 PM GMTBy: David_Grandey

Is it Live? Or Is It Memorex? Anyone remember that commercial?

Is it Live? Or Is It Memorex? Anyone remember that commercial?

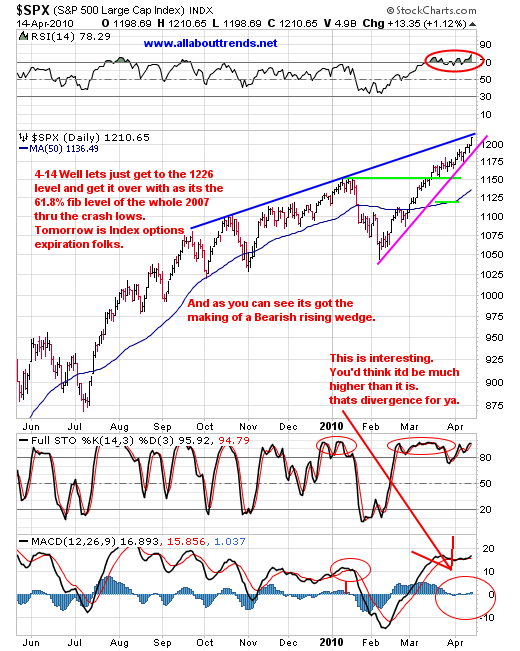

We'll add our two cents to that in the form of the chart below:

Basically said another way? Outside of the financials, our REAL economy is pretty much barely getting a pulse. This is why many of you who we hear from wonder what the deal is with the disconnect between Main St. and Wall St.

So Is It Live? Or Is It Memorex?

Well Price sure is we'll give it that, but does it have the staying power up here? That to us is the Memorex part.

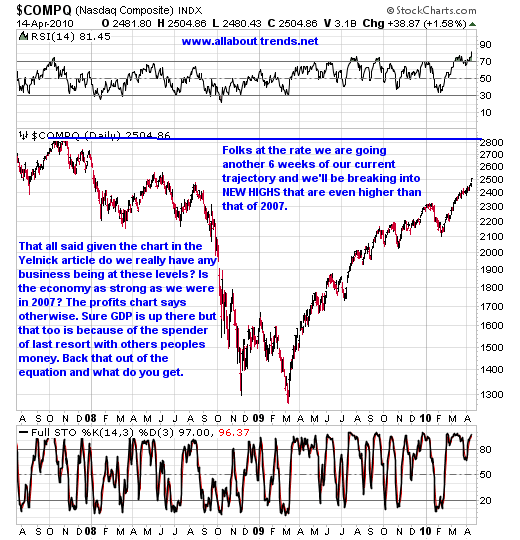

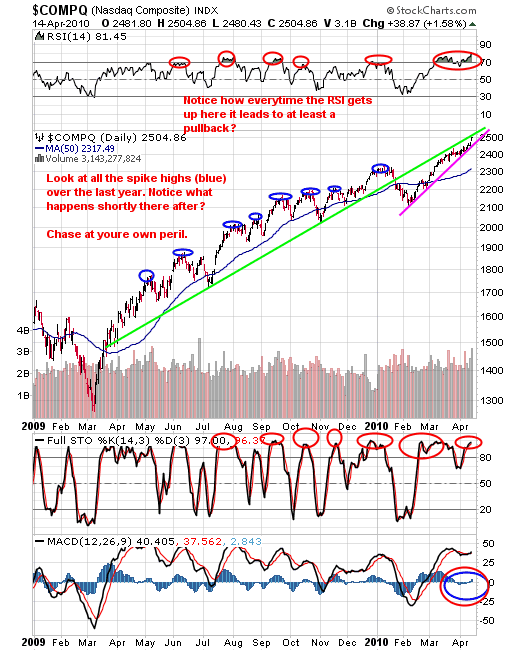

Here are the daily charts of the S&P 500, OTC Comp:

Banging away on Trendline resistance. And of course the makings of a rising bearish wedge.

Looks like a rising bearish wedge if you ask us.

In Summary:

We've said it before and we'll say it again. You can't help but to look at charts of AAPL, CREE, WYNN (finally working lower) and ASH just to name a few and say these names haven't been run -- because they have.

They offer no low risk entries. We'll watch where prior support levels and the 50 day averages are. But not here. That's what its going to take to get us to put money to work on the longside in names such as those. It also means you'll be buying them on bad days in the market.

We're all for buying them, but just not here. We're all about buying stocks on the longside that have quality patterns much like pullbacks off highs and initial pullbacks.

Remember WE DO NOT CHASE STOCKS especially going into earnings season.

Really it's all about letting them come to you and in order for that to happen they need to get slammed down to the 50 day average or some sort of really nice basing structure much like CREE had before it popped.

By David Grandey

www.allabouttrends.net

To learn more, sign up for our free newsletter and receive our free report -- "How To Outperform 90% Of Wall Street With Just $500 A Week."

David Grandey is the founder of All About Trends, an email newsletter service revealing stocks in ideal set-ups offering potential significant short-term gains. A successful canslim-based stock market investor for the past 10 years, he has worked for Meriwest Credit Union Silicon Valley Bank, helping to establish brand awareness and credibility through feature editorial coverage in leading national and local news media.

© 2010 Copyright David Grandey- All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.