Gold Near Record Sterling Price on UK Hung Parliament and Devaluation Concerns

Commodities / Gold and Silver 2010 Apr 15, 2010 - 06:46 AM GMTBy: GoldCore

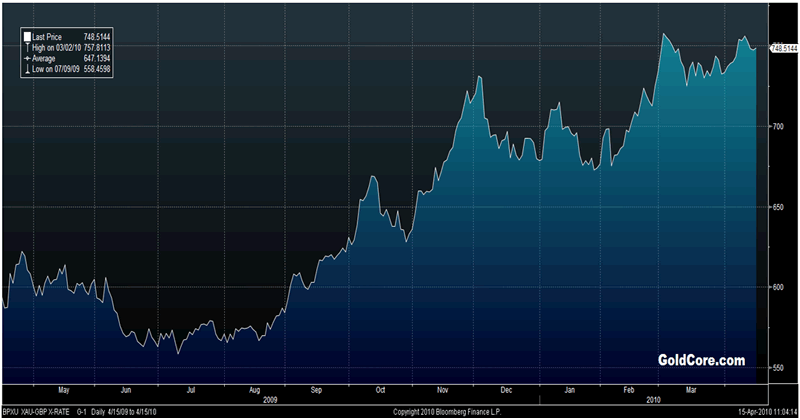

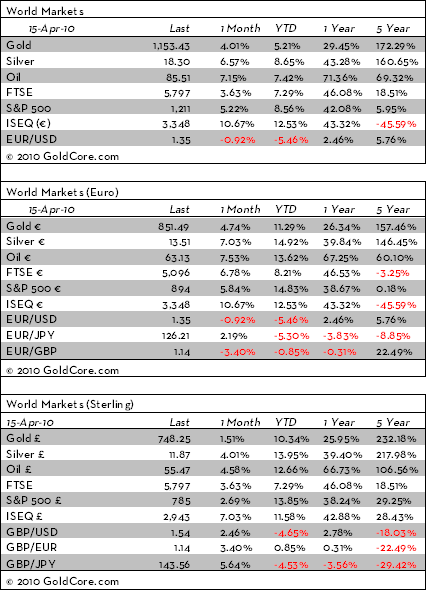

Yesterday, gold rose to $1,161/oz early in New York, it then dropped to $1,152/oz before recovering to close with a gain of 0.59%. It has dropped from $1,158/oz to $1,152/oz in Asian and European trading today. Gold is currently trading at $1,152/oz and in euro and GBP terms, gold is trading at €850/oz and £748.50/oz respectively. Gold remains near record nominal highs in sterling terms and sterling is down by more than 10% versus gold year to date (see chart).

Yesterday, gold rose to $1,161/oz early in New York, it then dropped to $1,152/oz before recovering to close with a gain of 0.59%. It has dropped from $1,158/oz to $1,152/oz in Asian and European trading today. Gold is currently trading at $1,152/oz and in euro and GBP terms, gold is trading at €850/oz and £748.50/oz respectively. Gold remains near record nominal highs in sterling terms and sterling is down by more than 10% versus gold year to date (see chart).

Gold seems to be consolidating near the recent record high of £757.81 per ounce set on March 2nd, 2010. Prospects of a hung parliament in the UK and increasing talk of a devaluation of the pound could see further gains in the price of gold in sterling terms in the coming weeks.

Gold in euro terms has remained robust near €850/oz and has not fallen as much as in dollar terms due to concerns about the risk of eurozone countries bankruptcy and the consequent impact on the euro. Gold is being supported by continuing concerns about the sustainability of the economic recovery and about sovereign debt risk. Support for gold is currently seen at $1,120/oz and resistance at $1,1170/oz. While gold may be overbought in the short term and may correct and consolidate, the medium and long term fundamentals remain as sound as ever as seen in the GFMS report showing how investment demand had surpassed jewellery demand in 2009 - the first time since 1980 (see News).

Silver

Silver has dropped from $18.45/oz to $18.30/oz this morning in Asia. Silver is currently trading at $18.31/oz, €13.51/oz and £11.84/oz.

Platinum Group Metals

Platinum is trading at $1,725/oz and palladium is currently trading at $546/oz. Rhodium is at $2,950/oz. Palladium has not fallen by as much as one would expect given the very large move which suggests that this may be the pause that refreshes.

News

The price of gold could hit $US1300 an ounce this year, according to GFMS, the precious metals analyst. The consultancy predicted that gold will rise in the second half of this year as investors seek a safe haven from inflation.

Investment demand for physical gold surpassed jewellery buying for the first time since gold hit its inflation-adjusted high in 1980.

Investment demand almost doubled over the course of 2009, while rising prices and the global economic downturn caused demand for gold jewellery to slide 20pc, according to metals consultancy GFMS. GFMS said that the amount of gold bought for investment quadrupled to 1429 tonnes last year. This was primarily invested through exchange-traded funds, which allow consumers to buy shares in physical gold without holding the metal themselves. Demand for traditional forms of investment gold, such as coins and bars, was also strong. Total global demand for gold increased by 8.3 per cent to 4287 tonnes last year. Central banks were also net buyers of gold in 2009 for the first time since 1987.

There are growing concerns that China's economy is at serious risk of overheating deepened on Thursday after official data for the first three months of this year showed the economy grew by 11.9pc year-on-year. Analysts said the faster-than-expected growth figures strengthened the case for continued policy tightening in China which is facing inflationary pressure and a potentially dangerous boom in residential property prices.

Oil was little changed near $86 a barrel as the dollar gained against the euro. Oil rose 2.1 percent yesterday after the Energy Department said crude stockpiles in the US, the world's biggest energy consumer, dropped 2.2 million barrels last week, the first decline in 11 weeks. China is the second-largest oil user and their booming economy and robust demand for oil is leading inflationary pressures.

This update can be found on the GoldCore blog here.

Mark O'Byrne

Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.