Gold Inflation Perspective

Commodities / Gold and Silver 2010 Apr 14, 2010 - 05:26 PM GMTBy: David_Galland

David Galland Casey Research writes:

As the price of gold rises and the inevitable quacking begins again about the “barbaric” metal being overvalued, I thought a quick check-in with the historical perspective might prove useful.

David Galland Casey Research writes:

As the price of gold rises and the inevitable quacking begins again about the “barbaric” metal being overvalued, I thought a quick check-in with the historical perspective might prove useful.

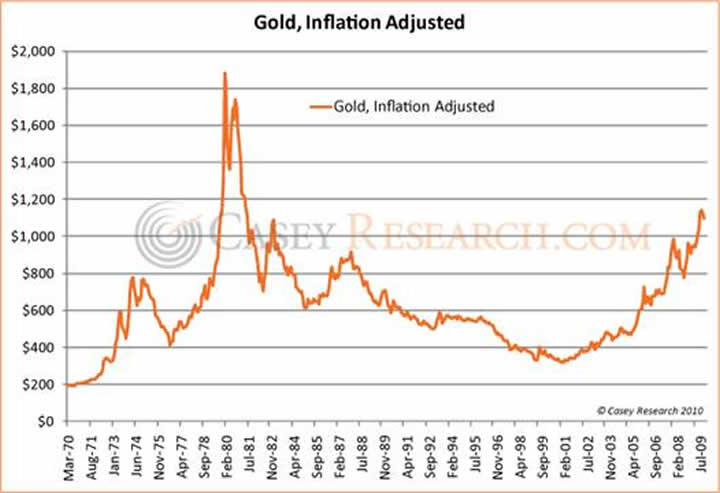

The first of two charts that follow shows the long-term picture of gold from 1970 to the present, correctly adjusted for inflation.

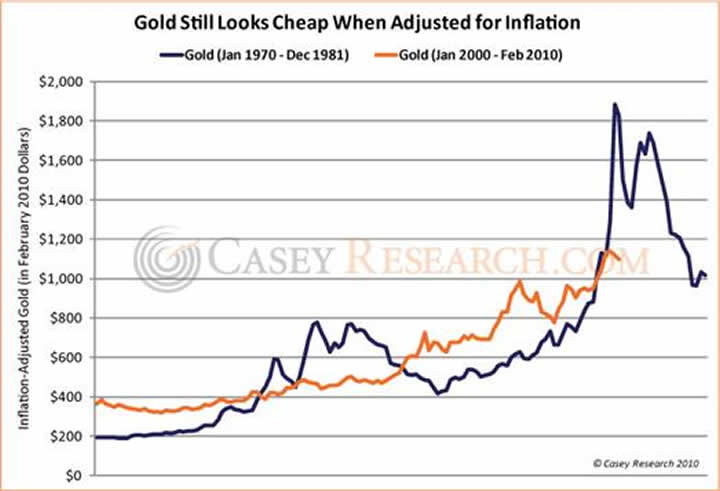

In the second chart, we overlay the inflation-adjusted price of gold from the last secular gold bull market in the 1970s, with the secular bull market we’re now in.

As you can see, if the current bull ends with the sort of grand finale we saw at the end of the last big blow-off, then prices have a long way to go from here. That said, a credible case can be made that this time around, the price could go much higher.

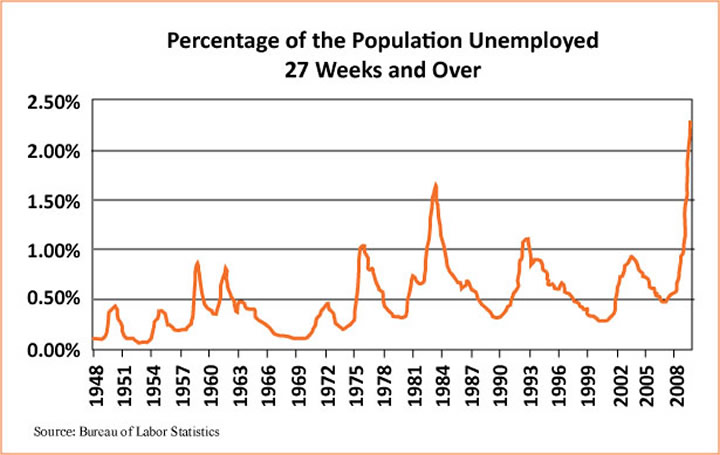

For starters, in the 1970s, though not good by any means, the economy was in much better shape than it is today. The chart here uses long-term unemployment as a proxy for that contention.

As you can see, at the end of the 1970s, the employment picture was quite healthy.

Today, in addition to wildly out-of-control debt on both the private and public levels, we have a massive problem with unemployment and the consequences of a burst housing bubble. Thus, Paul Volcker’s somewhat simplistic solution to inflation – and the trigger for the end of the last gold bull market – seriously ratcheting up interest rates, is off the table. (Since we’re trying to gain perspective, I’ll remind you that at the beginning of the 1980s, mortgage rates topped 18%.)

But wait, I heard someone in the back shout, “There is no inflation today!” Wrong, there is unprecedented inflation – properly defined as an increase in the monetary base. What’s missing, so far, is the inevitable consequence of the inflation – steadily rising prices.

That will come, and when it does, the government will find it is going into a gunfight with a (dull) knife – because raising interest rates in the Kingdom of Debt will lead to a predictable outcome.

Unfortunately, thanks to the inflation, interest rates are going up no matter what the government would prefer to happen, a contention of ours that is now gaining traction in the mainstream.

And, yes, up to a point, history shows gold and interest rates moving upwards in concert.

Don’t go crazy about buying gold, but by all means, if you don’t own some, begin a monthly program of purchases.

While it would be perfectly natural to see the gold stocks give back some of the big gains they have offered since last year’s correction, any further corrections should be viewed as opportunities. But again, don’t go overboard. If you have an investment portfolio with 20% to 30% in a combination of precious metals bullion, large-cap and small-cap stocks, you’ll be well positioned – and protected – for what’s coming.

To learn where to buy physical gold and where to store it… and which major gold stocks, mutual funds, and ETFs are the safest while giving you handsome upside… read Casey’s Gold & Resource Report. At $39 per year, it’s a steal for the value you get out of it. Click here for more.

© 2010 Copyright Casey Research - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.