Gold Succumbs to Profit Taking After Breaking Above Resistance

Commodities / Gold and Silver 2010 Apr 13, 2010 - 07:56 AM GMTBy: GoldCore

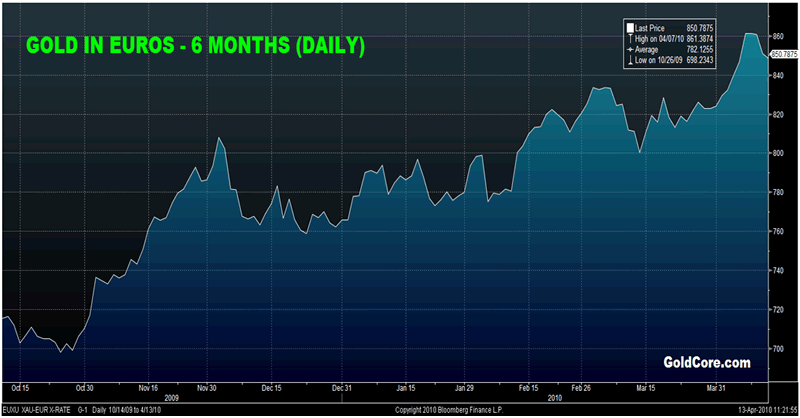

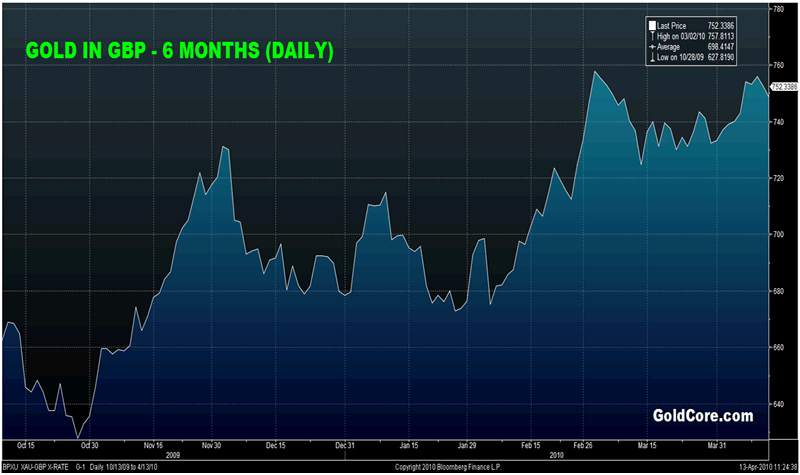

Yesterday, gold jumped to $1,169/oz in Asia before falling in New York, it then recovered to close with a small gain of 0.11%. It range traded from $1,150/oz to $1,157/oz in Asian trading this morning. Gold is currently trading at $1,154/oz and in euro and GBP terms, it is trading at €847/oz and £750/oz respectively.

Yesterday, gold jumped to $1,169/oz in Asia before falling in New York, it then recovered to close with a small gain of 0.11%. It range traded from $1,150/oz to $1,157/oz in Asian trading this morning. Gold is currently trading at $1,154/oz and in euro and GBP terms, it is trading at €847/oz and £750/oz respectively.

Gold has come under pressure today but has risen from the lows of the day at $1,147.80/oz. After gold reaching a 4-month high at $1170 an ounce yesterday, it was due a pullback and a period of consolidation may be necessary prior to any further gains. After multi-month gains some profit taking is to be expected and financial markets await key US earnings data.

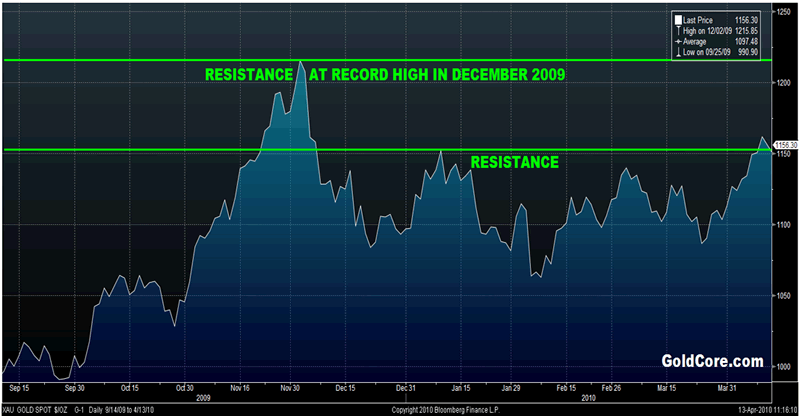

Technically, gold looks well after taking out resistance between $1150/oz and $1160/oz and looks set to challenge the December 2009 record highs. Gold has reached multiyear and all time record highs in euros, pounds, yen and other currencies (see charts) and given the strong technicals and fundamentals may soon replicate that performance in dollars.

Gold - 8 Months (Daily)

Silver

Silver has range traded from $18.06/oz to $18.20/oz this morning in Asia. Silver is currently trading at $18.10/oz, €13.31/oz and £11.80/oz.

Platinum Group Metals

Platinum is trading at $1,718/oz and palladium is currently trading at $516/oz. Rhodium is at $2,825/oz.

News

Soros Fund Management LLC increased its investment in SPDR Gold Trust, the world's largest exchange-traded fund for the metal, by 152 percent in the fourth quarter. Soros Fund Management LLC manages about $25 billion. Soros believes gold will be the biggest bubble of them all.

Inflation in Germany, Europe's largest economy, was the highest for 15 months in March, driven by a spike in energy and fuel costs. Inflation on a 12-month basis was 1.1% and on a monthly basis, prices rose by 0.5%. The main reason for the jump was a rise in the cost of heating oil (up by 32%) and fuel (up 19.4%). Food prices also rose for the first time since March 2009, albeit by a marginal 0.3%.

The Spanish government has been working hard to avert a crisis similar to Greece's. Spain has one of the biggest unemployment problems in the developed world and its government is trying to bring about labour market reform to tackle it. Yesterday, the Spanish government presented its ideas to the social partners, and they hope to agree a deal by the end of this month. A top Spanish official said Monday that Sunday's agreement on details of a Greek bailout package showed the euro zone won't allow the default of a member nation. "It shows the unanimous decision of the European Union, and especially the euro zone, to support financial stability, and it leaves no room for the hypothesis that a euro-zone country could ever default," Diego Lopez Garrido, secretary of state for European affairs, said Monday.

China's foreign exchange reserves rose to a new high of $2.447 trillion (£1.59 trillion) at the end of March, figures from the central bank showed. It was a 25pc increase on the same period a year ago, and a rise from $2.399 trillion at the end of December. Chinese officials are on record regarding diversifying out of dollars and into tangible assets, other currencies and gold.

This update can be found on the GoldCore blog here.

Mark O'Byrne

Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.