Is Your Bank a Failure Waiting to Happen?

Companies / Credit Crisis 2010 Apr 13, 2010 - 01:49 AM GMTBy: Graham_Summers

Yesterday I explained the TRUE underlying cause of the Financial Crisis (derivatives). Today, I’m going to show you which institutions are most vulnerable to this massive, unregulated market.

Yesterday I explained the TRUE underlying cause of the Financial Crisis (derivatives). Today, I’m going to show you which institutions are most vulnerable to this massive, unregulated market.

Now, the most common derivatives are based on typical financial entities/ issues: commodities, stocks, bonds, interest rates, etc. However, the vast bulk of them (84%) are based on interest rates:

Let’s put these percentages into perspective. With the total value of derivatives over $1 QUADRILLION, even equity based derivative contracts (a mere 1.1% of the total market) are roughly $10 TRILLION in notional value. Commodities, the smallest slice of the derivative pie at 0.6% of the total derivative market still represent about $600 BILLION in notional value.

However, the largest segment is the Interest Rate Contracts, which comprise 84% (some $800 TRILLION) of the derivatives market. If you’ve been confused as to why Bernanke claims the US is in recovery but promises to keep interest rates at 0% for a long time, there’s your answer.

After all, in 2008 the Credit Default Swap (CDS) market (which incidentally is only

1/10th the size of the interest rate-based derivative market) nearly destroyed the entire financial system. One can only imagine what would happen if the interest rate-based derivative market (which is ten times as large) suffered a similar Crisis.

At some point, and I cannot tell you when, the ticking time bomb that is the derivatives market will implode again. We’ve already had a warning shot with China telling its state owned enterprises to simply default on their existing commodity based derivative contracts with US investment banks.

We are also discovering that Greece and Italy (and likely other) countries have used derivatives to hide their true debt levels. This realization has sparked an investigation into derivatives in Europe, which could of course spark off a chain reaction if things get too ugly.

Suffice to say, the “derivative issue” is nowhere near over. It’s only a matter of time before we have another glitch in the system which will kick off Round Two of the Financial Crisis. In the meantime, there are a few steps you can take to protect your savings.

First off, you need to examine the derivative exposure of the bank where you store your savings. All told, there are 1,065 insured US commercial banks that trade/ use derivatives. However, the vast majority of derivative exposure involves only a small handful of institutions.

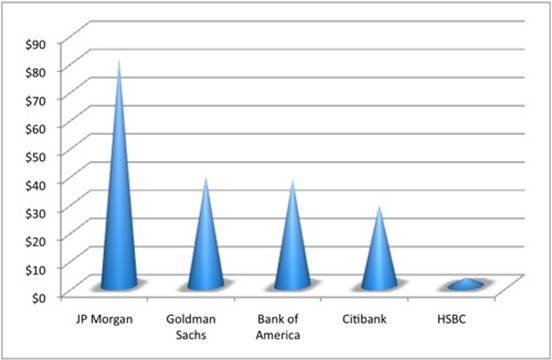

They are: JP Morgan, Goldman Sachs, Bank of America, Citibank, and HSBC. I’m sure you’ll notice that four of these received the BULK of all bailout money. When you see the below chart, you’ll know why (BTW the chart is denominated in TRILLIONS).

Derivative Exposure

All told, these five banks account for 97% of the $203 trillion in derivatives sitting on US commercial bank balance sheets (that we know of). Let’s put this into perspective:

Total equity at these five banks is about $737 billion. So if you assume that only 1% of derivatives are “at risk” (odds are it’s more) and 10% of that “at risk” money is lost, you’ve wiped out nearly 1/3 of the banks’ equity.

If 2% of these derivatives are “at risk” and 10% of those bets go bad, you’ve wiped out $400 billion or nearly HALF of the banks’ equity.

If 4% of derivatives are “at risk” and 10% of those bets go bad, you’ve wiped out ALL OF THESE BANKS’ EQUITY and they go to ZERO.

Remember, I’m only accounting for derivatives here… I’m not even including ON BALANCE sheet risks, mortgage backed securities, and all the other junk floating around.

Suffice to say, if you’ve got your savings planted in one of these banks, you might want to consider shifting at least a portion of it into another bank with less derivative exposure.

Understand, I am in no way suggesting people start a “run” on these banks. After all, these are the very institutions that the US Government has refused to let fail (and likely will continue to do so given the MASSIVE derivative threats they possess).

However, I AM suggesting that you should at least consider having some of your savings in a bank with less derivatives exposure than the Big Five.

But how do you know which banks have the least amount of derivative exposure?

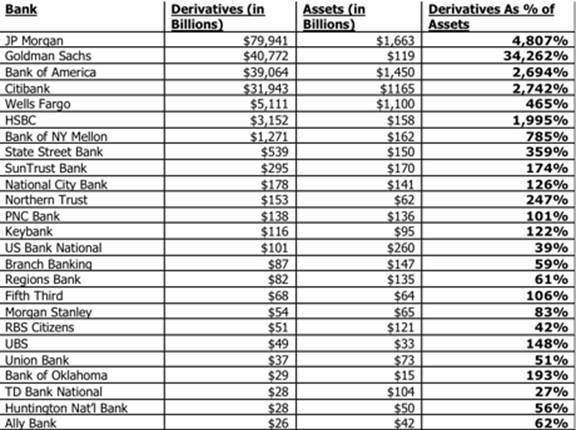

Well, I’ve put together the following chart showing the top 25 banks in the US based on derivative exposure. These guys have the largest derivative exposure relative to asset levels of any US commercial banks, so I would recommend steering clear of them if you’re looking for a bank with low derivative exposure:

*data as of 3Q09: the most recent data available.

I want to be clear here. The above chart MAY not be as bad as it looks. Remember, NOT ALL notional value of derivatives are “at risk.” For instance, only 1% of the above derivative numbers might actually be REAL cash that would vanish if the bet went bad.

But, by the same token, NO ONE knows how much money is at risk here. No one. But considering that:

- The derivatives market is TOTALLY unregulated…

- The entire financial system nearly imploded due to instruments that were allegedly regulated (mortgage backed securities, etc.)…

- EVERY attempt to increase transparency or accounting standards at the banks has been met with threats of financial Armageddon…

… it’s very difficult NOT to be deeply disturbed by the above numbers. Personally, I sure hope that less than 0.0001% of that stuff is “at risk.” I hope bankers were more careful with interest-rate based derivatives than they were with mortgage-backed securities.

But somehow I doubt it.

Good Investing!

Graham Summers

PS. I’ve put together a FREE Special Report detailing THREE investments that will explode when stocks start to collapse again. I call it Financial Crisis “Round Two” Survival Kit. These investments will not only help to protect your portfolio from the coming carnage, they’ll can also show you enormous profits.

Swing by www.gainspainscapital.com/roundtwo.html to pick up a FREE copy today!

Graham Summers: Graham is Senior Market Strategist at OmniSans Research. He is co-editor of Gain, Pains, and Capital, OmniSans Research’s FREE daily e-letter covering the equity, commodity, currency, and real estate markets.

Graham also writes Private Wealth Advisory, a monthly investment advisory focusing on the most lucrative investment opportunities the financial markets have to offer. Graham understands the big picture from both a macro-economic and capital in/outflow perspective. He translates his understanding into finding trends and undervalued investment opportunities months before the markets catch on: the Private Wealth Advisory portfolio has outperformed the S&P 500 three of the last five years, including a 7% return in 2008 vs. a 37% loss for the S&P 500.

Previously, Graham worked as a Senior Financial Analyst covering global markets for several investment firms in the Mid-Atlantic region. He’s lived and performed research in Europe, Asia, the Middle East, and the United States.

© 2010 Copyright Graham Summers - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Graham Summers Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.