Sovereign Debt Disaster Will Favor Hard Assets

Stock-Markets / Global Debt Crisis Apr 12, 2010 - 05:35 PM GMTBy: Justice_Litle

In the event of a full-blown sovereign debt crisis, hard assets will become deeply desirable as one of the few “stores of value” left.

In the event of a full-blown sovereign debt crisis, hard assets will become deeply desirable as one of the few “stores of value” left.

…all too often the size of debts, especially government debts, is hidden from investors until it comes jumping out of the woodwork after a crisis. – Prof. Ken Rogoff, Financial Times column, “Bubbles lurk in government debt”

Last week, in “How to Protect Against Currency Collapse,” we talked about the mounting debt problem and how Western governments will deal with it.

If the debt is issued in your own currency, you ultimately just print more currency to inflate that debt away. (If the debt is issued in someone else’s currency, you are in deep trouble… as Greece, Latvia, Iceland and others have all found out.)

Right now the global economic recovery has the appearance of being cost-free. This is due to an age-old confidence trick known as “ignoring the bill.” To pull off this trick, you spend huge amounts of money on a high-limit credit card… ignore the mail when the bill comes due… and conveniently forget to reconcile your accounts.

Complacency reigns because the true costs are not being tallied. The Bank for International Settlements – an age-old central banking watchdog based in Switzerland – is having none of it.

The “simmering fiscal problem” of sovereign debt is set to bring industrial economies “to the boiling point,” the BIS reports in a new study. “Bond traders are notoriously short-sighted,” the BIS further scolds, “assuming they can get out before the storm hits… the question is when markets will start putting pressure on governments, not if.”

The Bank of International Settlements further believes that, if we do not turn from this path, inflation will spiral out of control. "Monetary policy may ultimately become impotent to control inflation,” the BIS scowls, “regardless of the fighting credentials of the central bank.”

Not China or Japan

Last week, readers wrote in to ask whether China’s currency might count as a viable hedge against collapse – perhaps through a vehicle like the Dreyfus Chinese Yuan Fund (CYB:NYSE).

The answer there would have to be: “Nope. Too risky.” China’s fortunes are still deeply linked to those of the United States:

- China’s currency is still pegged to the USD.

- China’s economic future is still heavily dependent on exports.

- China still owns massive quantities of U.S. Treasuries.

The above factors make it hard to determine how China will fare in the event of Western currency meltdown. The Japanese yen is also a deeply risky proposition, given its heavy export dependence, major UST holdings and massive internal debts.

This all goes back to a talk your editor gave in Chicago last summer, discussing the shape of the world’s next reserve currency. The gist was that all those who would seek to dethrone “King Dollar” are impostors.

China’s currency regime is not ready for primetime. Japan is struggling with a demographic death spiral. And the euro is crumbling before our very eyes.

In a paper-debased world, that leaves hard assets as the last option standing.

Where Have You Gone, Joe DiMaggio

Try as they might, investors will not be able to ignore the sovereign debt problem forever. When the reckoning comes due, the printing presses will kick into hyperdrive… and faith in the system will crumble (or perhaps shatter like brittle glass).

At this point, investors will turn their lonely eyes to hard assets, looking at precious metals and basic building-block commodities in a new light.

Up till now, hard assets have more or less been treated as a “hot money” play on global economic recovery. Price movements have been linked to speculative appetite and the general degree of optimism.

The onset of a sovereign debt panic could thus lead to a short, sharp and temporary drop in hard asset prices, as the “hot money” beats a hasty retreat. But over time, a post-crisis shift in psychology will occur. In a world where all major currencies are being debased, oil and metal in the ground will stop looking like speculative plays and start looking more like stores of value.

A Pending Rocket Ride

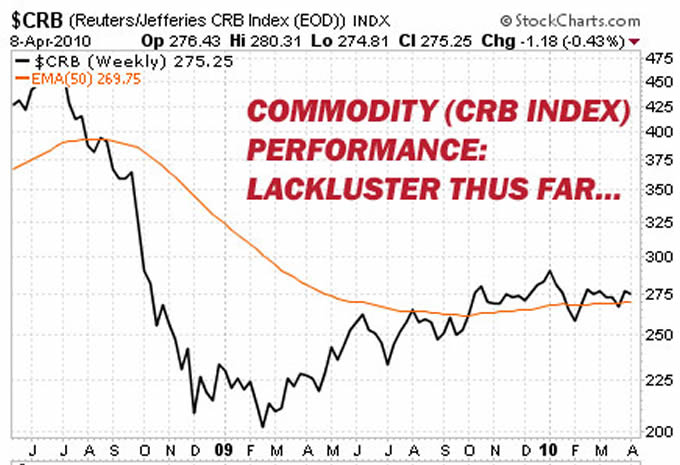

The Reuters/Jefferies CRB index tells the story of commodities’ lackluster performance. While equities have been going gangbusters, the CRB has been more or less flat for half a year.

That is because focus remains on cost-free recovery for now. There is widespread belief that the U.S. economy is in a sweet spot, with a goldilocks-like ability to push profits up while keeping short-term interest rates near zero. The Fed is widely revered at moment for having succeeded in its mission. Some bulls are even musing aloud now whether the “great recession” was even all that “great” – as if it were over and done, finis, all consequences postponed indefinitely.

It is an environment, in other words, that very much favors “paper” (leveraged financial plays) over “stuff” (hard assets).

But when faith in Western governments’ ability to shoulder the sovereign debt load evaporates, that equation will reverse rapidly. (And as the BIS noted in its gloom-and-doom report, it is a question of “when,” not “if.”)

And so, after a period of renewed fiscal panic, in which it is driven home, yet again, that the grossly indebted central bankers of the world do NOT have control – only the illusion of it – a need to take shelter from the ensuing inflationary paper-debasement storm will become paramount.

THAT is when hard assets will become most attractive… not as hot money speculative vehicles, but emergency stores of value. A true rocket ride for commodity prices – the likes of which we haven’t seen yet – could be the result.

A Simple Proxy

The countries represented in the Ultra Resource Index CD were selected not just for their attractive cash positions, but their rich abundance of hard assets. Countries with vast quantities of natural resources “in the ground” – like Canada, Australia and Norway for instance – will be seen as sitting on vast treasure chests.

Such resources would have permanent and lasting value even if the entire global financial system melted down completely. (People can go without paper, but they will always need to eat, drive, and build, and so on.) As the sovereign debt crisis unfolds, investors may well flock to these “hard” currencies in droves as their home-based scrip turns to confetti.

Source: http://www.taipanpublishinggroup.com/taipan-daily-041210.html

By Justice Litle

http://www.taipanpublishinggroup.com/

Justice Litle is the Editorial Director of Taipan Publishing Group, Editor of Justice Litle’s Macro Trader and Managing Editor to the free investing and trading e-letter Taipan Daily. Justice began his career by pursuing a Ph.D. in literature and philosophy at Oxford University in England, and continued his education at Pulacki University in Olomouc, Czech Republic, and Macquarie University in Sydney, Australia.

Aside from his career in the financial industry, Justice enjoys playing chess and poker; he enjoys scuba diving, snowboarding, hiking and traveling. The Cliffs of Moher in Ireland and Fox Glacier in New Zealand are two of his favorite places in the world, especially for hiking. What he loves most about traveling is the scenery and the friendly locals.

Copyright © 2010, Taipan Publishing Group

Justice_Litle Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.