Gold Rallies to New 2010 High, 27 Year Record High in Yen

Commodities / Gold and Silver 2010 Apr 12, 2010 - 08:20 AM GMTBy: GoldCore

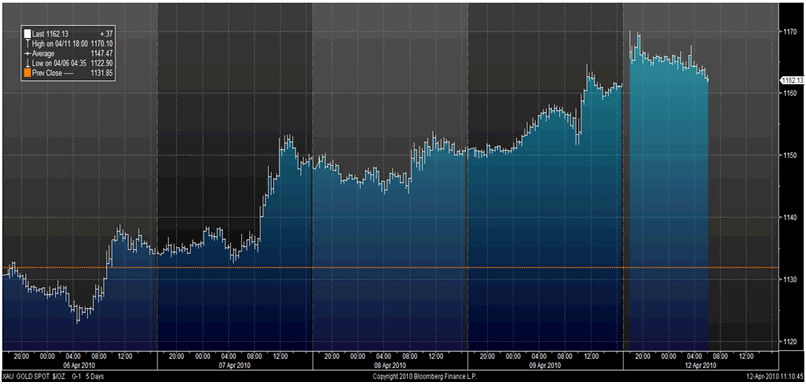

Gold jumped to as high as $1,164.38/oz in New York on Friday, and rose 0.69% on the day and 3% on the week. It rallied sharply on the open in Asia (from $1,159/oz to over $1,169/oz) and has since range traded from $1,162/oz to $1,169/oz in Asian and early European trading this morning. Gold is currently trading at $1,164/oz and in euro and GBP terms, at €855/oz and £754/oz respectively.

Gold jumped to as high as $1,164.38/oz in New York on Friday, and rose 0.69% on the day and 3% on the week. It rallied sharply on the open in Asia (from $1,159/oz to over $1,169/oz) and has since range traded from $1,162/oz to $1,169/oz in Asian and early European trading this morning. Gold is currently trading at $1,164/oz and in euro and GBP terms, at €855/oz and £754/oz respectively.

Gold has surged to record highs (in USD) for the year and gold futures in Tokyo (see below) reached the highest in almost 27 years as sovereign debt and currency concerns are leading investors to seek out less risky assets. Gold looks very good technically having breached recent near term resistance and should target the next levels of resistance at the psychological $1,200/oz and the previous record (nominal) high of $1,226/oz. Investment demand remains robust as seen in the record ETF gold holdings.

Gold JPY - 30 Year (Weekly)

The euro has responded positively to the €30 billion (EUR) pledged to Greece in an "emergency aid mechanism" (three year loans at 5%). The risk of default has abated for now but longer term solvency issues remain for Greece and for other countries internationally. These risks are set to remain elevated for the foreseeable future and will likely see the euro and other currencies remain under pressure. Poland's zloty declined against the euro due to the tragedy that saw its nation's president and central bank chief die in a plane crash on Saturday. Polish Prime Minister Donald Tusk's pro-euro Civic Platform party is likely to cement its grip on power in a presidential election that must now be held by June after President Lech Kaczynski died in a plane crash.

Gold USD - 5 Day (Tick)

Silver

Silver has range traded from $18.48/oz to $18.58/oz this morning in Asia. Silver is currently trading at $18.50/oz, €13.60/oz and £11.98/oz. Silver has surged 10% in two weeks and looks very bullish both technically and fundamentally (see http://www.goldcore.com/goldcore_blog/silvers-surges-10-2-weeks-near-record-euro-terms).

Platinum Group Metals

Platinum is trading at $1,729/oz and palladium is currently trading at $510/oz. Rhodium is at $2,775/oz. Platinum and palladium have hit multi-month highs on expectations of strengthening industrial demand due to the global economic recovery.

News

The yen's recent falls led to record gold prices on the Tokyo Commodity Exchange. Gold prices for February 2011 delivery rose to 3,505 yen, the highest since mid-April 1983. Japanese investors concerned about continuing devaluation of the yen in an effort to avert deflation may continue to buy gold in the expectation of gold reaching record (nominal) highs in the coming months (see chart above).

The eurozone area and wider European Union is now "on the brink" of disintegration unless Germany steps up and provides loans at below-market rates to Greece, George Soros, the hedge fund manager and billionaire investor, warned yesterday. However, Mr Soros added that he still hoped that Germany and others would be willing to forge a last-minute solution, since the consequence of a break-up would be so dangerous. He was speaking before an announcement on Sunday afternoon by eurozone finance ministers of the terms of a support package for Greece. It is 50-50 whether the eurozone breaks up. The damage that break up would cause is so great, that I think that as people realise it, they will pull back from the brink," Soros told the Financial Times in an interview. "But we are at the brink now...a solution has to be found in a matter of days."

Soros said the next UK government after the May 6 election should decide whether to allow a further devaluation of the pound to rebalance the economy and assist the recovery. This would likely see sterling fall against the dollar, most currencies and particularly gold and continue to act as a safe haven for UK investors.

Oil prices remain above $85 a barrel due to Asian demand prospects and continuing hopes for the global economic recovery. This is leading to concerns that inflation could take hold and that high oil prices could sniff out the tentative economic recovery.

This update can be found on the GoldCore blog here.

Mark O'Byrne

Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.