Silver's Surges 10% in 2 Weeks - Near Record in Euro Terms

Commodities / Gold and Silver 2010 Apr 09, 2010 - 08:11 AM GMTBy: GoldCore

Gold climbed steadily to as high as $1,153.70/oz in New York before reverting slightly to close unchanged for the day. It has risen from $1,150/oz to $1,158/oz in Asian trading this morning. Gold is currently trading at $1,157/oz and in Euro and GBP terms, gold is trading at €864/oz and £753/oz respectively. Gold and silver have given up some of their earlier gains as the dollar rose and then fell today.

Gold climbed steadily to as high as $1,153.70/oz in New York before reverting slightly to close unchanged for the day. It has risen from $1,150/oz to $1,158/oz in Asian trading this morning. Gold is currently trading at $1,157/oz and in Euro and GBP terms, gold is trading at €864/oz and £753/oz respectively. Gold and silver have given up some of their earlier gains as the dollar rose and then fell today.

Gold ended slightly lower yesterday and took a breather after the gains seen this week and last week. Gold is set for a higher weekly close (some 3%) and is it at a three month high. In two weeks gold has risen from $1,090/oz to over $1,156/oz or by some 6% and would be expected to take a breather. However, given the improved technical picture and the strong fundamentals gold looks set to test resistance at $1,060/oz. Above this level of resistance, gold will likely again target the record highs seen in early December.

Physical demand for gold remains robust as seen in premiums in Asia and in the gold ETF reaching a record metal holding. With the sovereign debt issues set to remain prevalent for the foreseeable future, safe haven demand for gold is likely to continue.

SILVER

Silver has risen from $18.08/oz to $18.34/oz this morning in Asia. Silver is currently trading at $18.33/oz, €13.70/oz and £11.93/oz.

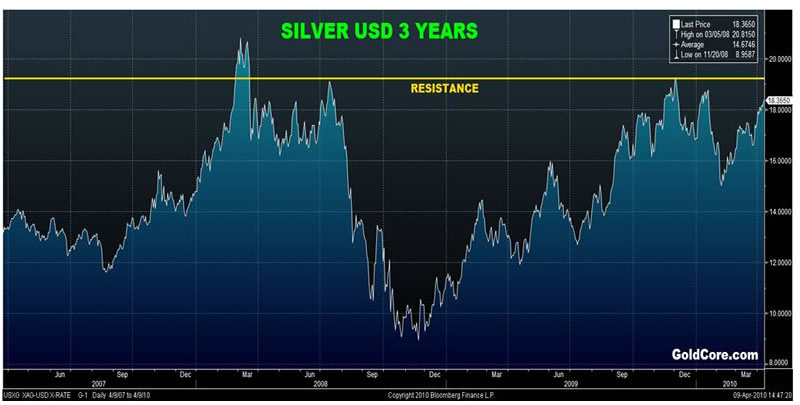

Silver looks like it might be on the verge of breaking out and resistance is at $18.84/oz and then at $19.42/oz. A close above these levels should see silver target the record (nominal) highs of $20.88/oz seen in March 2008 when Bear Stearns collapsed.

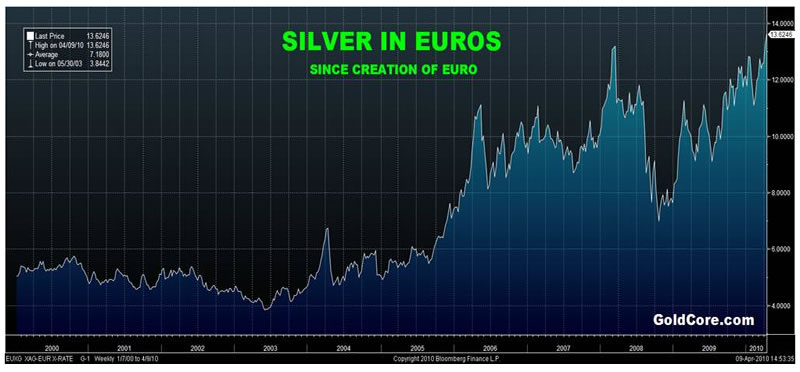

Interestingly, silver is very close to record highs in euros. Silver traded at below EUR5.00 per ounce when the euro was launched in 1999 and is trading at EUR13.70 per ounce today.

Silver remains the laggard and has underperformed gold since it reached its March 2008 highs. This has changed in recent weeks with silver again beginning to outperform gold. The gold/silver ratio remains favourable to silver at 63 ($1,157/oz divided by $18.35/oz) and is falling. "Poor man's gold" remains far from recent record highs and long term record (nominal) highs near $50/oz in 1980.

Silver could be the surprise outperformer in 2010 as it was in 2009. Silver's industrial uses should mean that the gold/silver ratio will likely gradually regress to the average in the last 100 hundred years which is around 45:1. If the tiny silver market was to see real funds enter it than the ratio could return closer to the historical average of 15:1 as it did as recently as in 1968 and in 1980, this could result in silver surpassing its 1980 nominal high at $50/oz

Silver remains very undervalued vis-à-vis gold and remains a contrarian play with little or no media coverage and little or no retail investors having any allocation to silver whatsoever.

PGM’s

Platinum is trading at $1,720/oz and palladium is currently trading at $510/oz. While rhodium is at $2,725/oz.

This update can be found on the GoldCore blog here.

Mark O'Byrne

Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.