U.S. Consumers Are Back", Mish Says "Show Me The Money"

Economics / US Economy Apr 09, 2010 - 01:38 AM GMTBy: Mike_Shedlock

MarketWatch is reporting March sales are fresh signal that U.S. consumers are back.

MarketWatch is reporting March sales are fresh signal that U.S. consumers are back.

U.S. retailers' March sales rose by their highest percentage in more than a decade, another sign that U.S. shoppers are back spending beyond what they need.

Total March sales rose 9.1%, the highest since data began to be compiled in 2000, with 92% of reported numbers topping Wall Street expectations, according to Thomson Reuters. International Council of Shopping Centers reported sales rose 9%, their highest since March 1999.

With the benefit of Easter falling this year on April 4, and thus being included as part of retailers' March reporting month, instead of April 12 last year, they also said combining retailers' March and April results would be a better gauge of shoppers' spending power.

From high-end retailers Saks Inc. (SKS) and Nordstrom Inc.(JWN) to discounters Costco Wholesale Corp. (COST) and Target Corp. (TGT), same-store sales gains of more than 10% were seen across the board.

Easter Bonus

Yahoo!Finance says Shoppers hand retailers a basket of Easter cash.

Shoppers are finally coming out of hibernation.

Better weather and an earlier Easter enticed Americans to shell out for spring clothes in March, the fourth straight month of gains for retail sales. Target, Macy's, Gap and the parent of Victoria's Secret all beat Wall Street expectations.

The improvement was broad, spanning discounters, mass merchants, specialty stores and luxury retailers. The gains offer strong evidence that people are feeling more confident in the economic recovery and are more willing to spend.

Retailers had several factors on their side. The earlier holiday combined with comparisons to notoriously weak sales in March 2009 had analysts expecting solid improvements. But it's also clear that shoppers' mindset is changing.

"There was a lot of talk about the frugality of the American consumer and that the recession taught people to save more," said Sherif Mityas, a partner in the retail practice at management consultant A.T. Kearney. "But U.S. consumers have short-term memories."

Before anyone gets excited about same store sales, please ponder the effect store closings had on comparisons.

31 Retailers File For Bankruptcy In 2009

- Penn Traffic:11/18

- Hackett's Department Store: 11/10

- InkStop: 10/1

- Sacino & Sons: 9/11

- Samsonite: 9/2

- Escada: 8/13

- Finlay: 8/5

- Bashas: 7/12

- Crabtree & Evelyn: 7/1.

- Best & Co: 6/26

- Eddie Bauer: 6/17

- Arcandor: 6/9

- Oilily: 5/28

- Anchor Blue: 5/28

- Door Store: 5/27

- Filene's Basement: 5/4

- Bi-Lo: 4/19

- Z Gallerie: 4/10

- Ultra Jewelry: 4/9

- Big 10 Tires: 4/2

- Zounds Hearing Aid Centers:3/30

- Al Baskin Co: 3/23

- Drug Fair: 3/18

- Strasburg-Jarvis: 3/11

- Joe's Sports & Outdoor Stores: 3/4

- Everything but Water: 2/25

- Ritz Camera; 2/22

- S&K Famous Brand: 2/9

- Fortunoff: 2/5

- Bruno's Supermarkets: 2/5

- Gottschalks: 1/14

The above list thanks to: Retail Insights

Are Retail Sales Up?

Supposedly retail sales are up 4 months in a row. They aren't. Same store sales may be, but that is a different matter.

Some of those stores may still be in business. However, those chains that are still in business closed many poorly performing stores, boosting same store sales figures in the remaining stores.

Moreover, same store sales are invalid because of store closings across the board, not just in chains involved in bankruptcies.

Improvements over horrendous numbers from a year ago are hardly unexpected.

Finally, Easter Sales shifting into March from April certainly added to the effect.

State Sales Tax Collections Tell The Real Story

State tax collections are a far better measure of spending than same store sales. Please consider Retail Sales Rise: Where? Let's Take a Look.

That report is from February 28, 2010, arguably a bit out of date. Nonetheless, state tax collections are horrid.

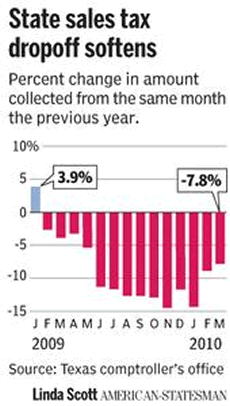

Texas Sales Tax Collections

Inquiring minds are investigating sales tax receipts in Texas. Please consider State sales tax still sinking, but pace slows.

Wednesday, April 7, 2010

Wednesday, April 7, 2010

Texas has fallen a bit deeper into the budget hole with another month of disappointing sales tax collections, according to a Texas comptroller's office report released on Wednesday.

A closely watched indicator of Texas' fiscal health, the state's sales tax revenue is now $1.5 billion below where it was at the same time last year, the figures showed.

Even so, state officials say they have not yet decided to pull the trigger on proposed agency budget cuts, aimed at saving about $1 billion in the current two-year budget.

The $1.46 billion collected from February sales — and remitted to the state in March — was 7.8 percent less than the amount brought in during the same month a year ago.

Those figures are from February. Note that sales tax collections were down 14 consecutive months in Texas, not up four consecutive months. The discrepancy is same store sales vs. actual sales tax collections. The latter is what I believe.

Email From A Texas Reader

Please consider an Email from a reader about sales tax revenue in Texas. Byran writes ...

Mish,

This is from the Austin American: State sales tax still sinking, but pace slows

This is the official notice: Local Governments to Receive $394 Million in Sales Tax Revenue

Texas Comptroller Susan Combs said today the state received $1.46 billion in sales tax revenue in March, down 7.8 percent compared to March 2009.

“For the second month in a row, the decline in sales tax collections continued to moderate,” Combs said. “Following an eight-month stretch of double-digit declines, the pace of revenue losses is slowing. The oil and gas, construction, manufacturing, and retail industries registered lower sales tax revenue collections than one year earlier. We expect further declines in the near term followed by a return to sales tax revenue growth later this year.”

From what I gather from these articles, a big increase in auto sales due to various incentive programs was a big part. In addition, I noticed that sales tax receipts in some rural areas picked up. This is due to a wet winter breaking a 3-year drought. This will be a very good farm year in Texas, and many rural sales are based on that.

So, let's see, massive auto promotions, unusually good weather for agriculture, and all we get is a slowing in the rate of decrease, over an already bad year. Does that sound like a recovery?

Byron

Thanks Byron.

Clearly, sale tax collections in Texas are neither a sign of a recovery in consumer sales nor a sign of an economic recovery in general. Unless it's different in Texas (it's not), reported growth in same store sales is an inaccurate representation of what is actually happening.

By Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.comClick Here To Scroll Thru My Recent Post List

Mike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management . Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction.

Visit Sitka Pacific's Account Management Page to learn more about wealth management and capital preservation strategies of Sitka Pacific.

I do weekly podcasts every Thursday on HoweStreet and a brief 7 minute segment on Saturday on CKNW AM 980 in Vancouver.

When not writing about stocks or the economy I spends a great deal of time on photography and in the garden. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at MichaelShedlock.com .

© 2010 Mike Shedlock, All Rights Reserved.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.