Gold Strong on Global Fiat Currency Crisis Risk

Commodities / Gold and Silver 2010 Apr 08, 2010 - 07:53 AM GMTBy: GoldCore

Gold climbed steadily to as high as $1,153/oz in New York before reverting slightly to close with a gain of 1.56%. It has since range traded from $1,144/oz to $1,147/oz in Asian trading this morning. Gold is currently trading at $1,145/oz and in euro and GBP terms, gold is trading at €861/oz and £755/oz respectively.

Gold climbed steadily to as high as $1,153/oz in New York before reverting slightly to close with a gain of 1.56%. It has since range traded from $1,144/oz to $1,147/oz in Asian trading this morning. Gold is currently trading at $1,145/oz and in euro and GBP terms, gold is trading at €861/oz and £755/oz respectively.

Gold in Sterling (Year to Date)

Gold rose some 1.5% to 2% in most major currencies yesterday including the US dollar, Swiss franc and the recently strong commodity currencies, the Aussie and Canadian dollars. Gold rose the most versus the embattled euro and against sterling. Gold is flat in most currencies today despite the growing concerns about Greece leading to risk aversion and a selloff in equity markets. Greece's borrowing costs have surged to record levels on doubts that the EU will provide a debt rescue, and the euro has come under slight pressure. The yield on Greece's 10-year sovereign bond soared to 7.423pc, the highest since the country adopted the euro in 2001, amid mounting fears it might be unable to repay huge debts falling due soon (see News below).

The European Central Bank looks set to indicate today that borrowing costs will remain low for much, if not all, of this year as the recovery from recession in the 16 countries that use the euro currency remains fragile. Continuing record low interest rates in the eurozone will not help the beleaguered euro and should see gold priced in euro continue to rally.

People are losing faith in the euro and gold is reasserting itself as a monetary alternative to fiat currencies internationally.

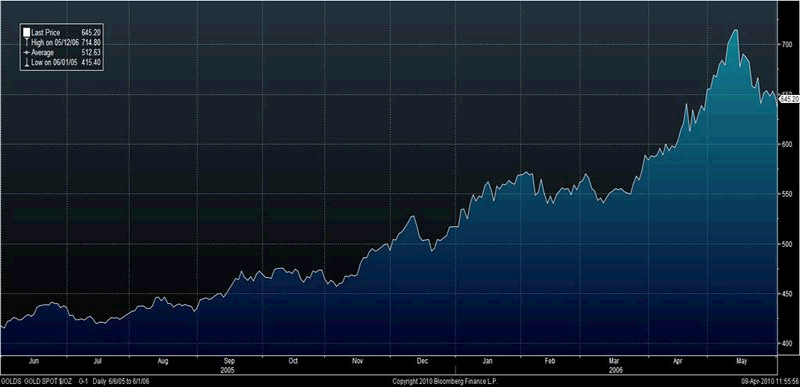

Gold in USD (May 2005 to May 2006)

Also being questioned is the notion that gold's strength is purely a function of dollar weakness or euro strength. This is erroneous as seen with the recent surge in the price of gold in euro terms. While there is indeed a long term inverse relationship between the dollar and gold, there can be periods of dollar strength and gold strength and this is when gold rises strongly against other international currencies.

A clear example of how gold can rise significantly in dollars even if the dollar remains flat or rises in value was seen between May 2005 and May 2006. During this period gold rose from a low of $415/oz to over $714/oz or some 72% (see chart above).

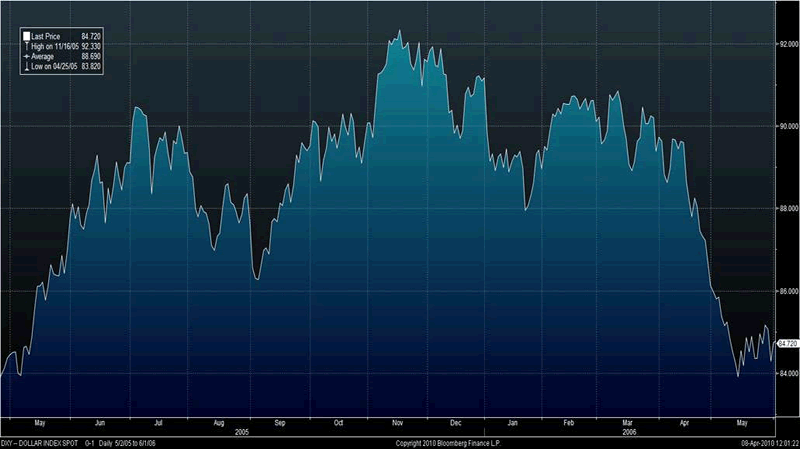

During the same period the dollar did not strengthen materially. The US Dollar Index rose from 84.00 to over 92.0 before falling to 84.0 again.

Thus, gold surged in value by 72% in dollar terms and by similar amounts in other currencies despite the dollar being flat in the same period. Gold rose from below €400/oz to nearly €600/oz during the period.

This clearly shows that gold's price performance is not predicated on dollar weakness per se rather it is supply and demand and the weakness of international currencies and fiat currencies in general that is the primary driver of the gold price. And concerns about the debasement of currencies through zero percent interest policies, quantitative easing and massive fiscal deficits will likely lead to gold remaining strong in all fiat currencies for the foreseeable future.

US Dollar Index (May 2005 to May 2006)

Silver

Silver has dropped from $18.16/oz to $17.98/oz this morning in Asia. Silver is currently trading at $18.01/oz, €13.55/oz and £11.87/oz.

Platinum Group Metals

Platinum is trading at $1,710/oz and palladium is currently trading at $509/oz and rhodium at $2,725/oz.

News

The continuing Greek debt crisis may overshadow the European Central Bank's policy meeting today as markets seek clarity as to how the EU and IMF may prevent the sovereign bankruptcy of Greece. Also of importance are the details of a new policy with regard to the collateral that eurozone banks must put up in order to get ECB funds. The policy should give investors a better idea of the risk involved in buying Greece's sovereign debt. Also there are hopes that clarity may help ease uncertainty and volatility in government bond markets that could easily spread to other weak eurozone members such as Portugal or Spain.

A US federal judge ruled yesterday that bondholders can seize $105 million in Argentine central bank deposits held in the United States. Argentina quickly said it would file a court appeal and a spokesman told The Associated Press that Argentina was optimistic because similar rulings had been overturned. The decision, nevertheless, drove down Argentine bond prices just as the cash-strapped government prepares a $20 billion debt-swap offer in hopes of satisfying the bondholders and ending the lawsuits.

Live cattle futures soared to an 18-month high yesterday, due to strong demand and fund buying. Copper fell slightly below the $8000 level. The 19-Commodity Reuters/Jefferies CRB index was slightly lower as crude oil closed lower for the first time in seven sessions but oil remains over $85 a barrel and energy costs for buyers in euro, sterling and other currencies have risen given rise to inflation concerns.

This update can be found on the GoldCore blog here.

The Bullion Services Team

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.