Stocks Bear Market Rally Update, Dissent with Authority

Stock-Markets / Stocks Bear Market Apr 08, 2010 - 03:15 AM GMTBy: Joseph_Russo

One of the most essential elements present at the very founding of America was that of well-reasoned and persistent dissent.

One of the most essential elements present at the very founding of America was that of well-reasoned and persistent dissent.

A healthy and aggressive dissent against proclamations of those in authority often results in clearer perspectives on matters of substantial import.

Things can get ugly when peaceful means in resolving such dissent go unheard. Case in point was the violent and bloody revolution ground in dissent, which was the ultimate cost of freeing America.

Without inherent unwavering confidence to intensely question, prudently conclude, and decisively take action, the founders would have failed in their valiant effort to break free from those who bound them.

In our view, things are no different today than they were then.

However, radically different today, is the extreme influence that various concentrations of monopoly-authorities have imposed upon local and global audiences.

Until a critical mass of reasoned dissent inevitably engulfs the masses of citizenry subjected to such concentrated voices of authority, we should expect such voices to continue laying claim to all that they so graciously provide for us.

For us, questioning the voice of concentrated authority in mainstream market analysis is no different from expressing dissent that is political in nature, specifically when it comes to those in possession of authoritative-monopoly on the dissemination of Elliott Wave Theory.

What do you call five-clear-waves up off the March ‘09 low?

In short, we would call this an extreme hyper-inflationary victory for helicopter Ben and a rather perplexing dilemma for deflationist Bob.

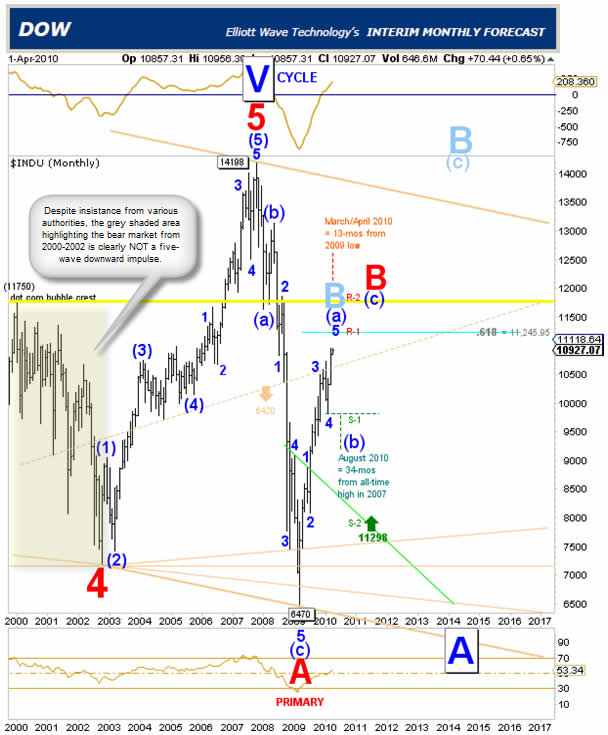

Many well-respected Elliott Wave authorities espoused that the decline from 2000-2002 was somehow five-waves down, and held to such determinism until the market reached fresh historic highs some four years later in 2006.

Many in the same contingent are now telling you why you should not view the move up off the March low as the five-wave upward structure that it clearly is.

Just as the decline from 2000-2002 was clearly not a five-wave downward impulse, will these same authorities again hold to the view that the clearly observable five-wave ascent from the March low is somehow something else other than what it clearly appears to be?

Only time will tell, however one thing is certain. Overtime, bull markets end, and bear market begin. This process will generally repeat itself in one form or another for as long as markets exist.

To claim authoritative ownership of foreseeing the precise timing or construct of either eventual inevitability is truly akin to the broken clock being right twice per day.

Though wildly entertaining, be advised that such deterministic pronouncements should by no means translate into long-term investing or short-term trading religions.

Despite insistence from various Elliott Wave authorities, the grey shaded area highlighting the bear market from 2000-2002 was clearly NOT a five-wave downward impulse.

Upon the markets move to fresh historic highs in 2006, dissenters vindicated their corrective interpretation of the prior cycle's two-year decline.

How would Mr. Elliott label the five-waves up off the March '09 low?

For ardent Elliott Wave enthusiasts around the globe, we posit that our dissenting labeling of the Dow is supreme and far more objective than those emanating from the voices of concentrated authority.

Furthermore, we trust students devoted to the theory may find our dissenting interpretations better aligned with the tenets founded by Mr. Elliott himself.

So, what is the takeaway from all of this? Quite simply, deal with the problem directly (take the bull by the horns) and arrive at your own conclusions just as we have.

Be they political leaders, professors, or market analysts, one should not reflexively assume that the collective voices of any concentrated monopoly-authorities, in any realm of influence, are automatically correct in their proclaimed assessments on matters of import.

If interested, one may view our entire dissenting line-up of products here.

By Joseph Russo

Chief Publisher and Technical Analyst

Elliott Wave Technology

Email Author

Copyright © 2010 Elliott Wave Technology. All Rights Reserved.

Joseph Russo, presently the Publisher and Chief Market analyst for Elliott Wave Technology, has been studying Elliott Wave Theory, and the Technical Analysis of Financial Markets since 1991 and currently maintains active member status in the "Market Technicians Association." Joe continues to expand his body of knowledge through the MTA's accredited CMT program.

Joseph Russo Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.