Gold Rises to New Record Euro High - Greek Debt Crisis is Canary in Coal Mine

Commodities / Gold and Silver 2010 Apr 07, 2010 - 07:55 AM GMTBy: GoldCore

Gold jumped to as high as $1,138/oz in New York before falling back to close with a gain of 0.16% yesterday. It has since range traded from $1,134/oz to $1,138/oz in Asian trading this morning. Gold is currently trading at $1,135/oz and in euro and GBP terms, gold has risen and is trading at €852/oz (new record nominal highs) and £744/oz respectively. Support is at $1,120/oz and resistance is at $1,145/oz. Given the gathering momentum in the gold market - a close above $1145/oz could see us rise to $1160/oz quite quickly.

Gold jumped to as high as $1,138/oz in New York before falling back to close with a gain of 0.16% yesterday. It has since range traded from $1,134/oz to $1,138/oz in Asian trading this morning. Gold is currently trading at $1,135/oz and in euro and GBP terms, gold has risen and is trading at €852/oz (new record nominal highs) and £744/oz respectively. Support is at $1,120/oz and resistance is at $1,145/oz. Given the gathering momentum in the gold market - a close above $1145/oz could see us rise to $1160/oz quite quickly.

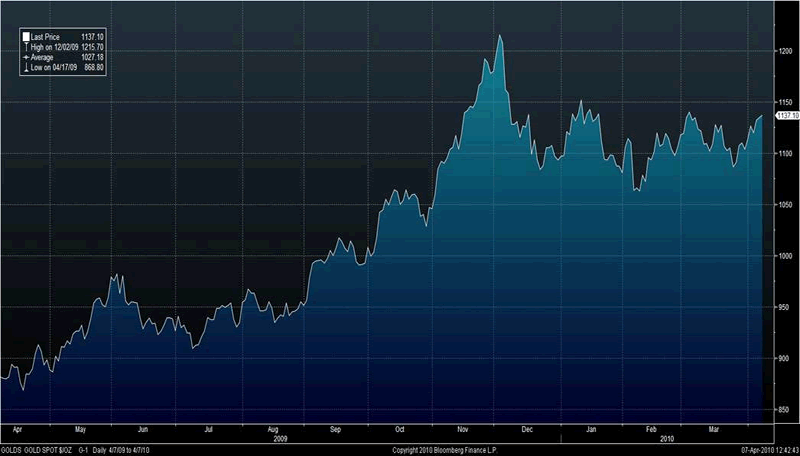

Gold in EUR - 1 Year

Euro gold has reached a new record high today just over €852/oz due to safe haven buying on concerns about debt laden Greece. Markets pushed Greece's risk premium to a euro lifetime high yesterday amid growing doubts over the country's capacity to resolve its debt crisis and fresh skepticism about the European Union-International Monetary Fund aid mechanism. The Greek sovereign debt crisis is proving quite intractable and this inflation and sovereign risk is leading to robust demand for gold. Crude oil remains above $86 a barrel which is creating inflation concerns.

The risk is that if the Greek debt crisis is not resolved it could lead to a wider sovereign debt crisis. With government balance sheets ballooning it is becoming more difficult for governments internationally to fund their growing liabilities. Greece is the canary in the coal mine and this is what the record euro gold price is telling us.

Gold in USD - 1 Year

It is important to note that there are similar fiscal challenges in the US. Los Angeles is only one month away from a fiscal crisis (according to the LA City Financial Controller) and California itself facing what has been termed a "debt timebomb" due to $500 billion worth of unfunded liabilities (see News section of our Home Page today). Many other US states such as Illinois, New York and Florida face similar significant fiscal challenges.

This would suggest that gold prices in dollars will likely follow and replicate euro gold in the coming months and reach new record (nominal) highs.

Silver

Silver has range traded from $17.92/oz to $18.02/oz this morning in Asia. Silver is currently trading at $17.95/oz, €13.40/oz and £11.75/oz.

Platinum Group Metals

Platinum is trading at $1,720/oz and palladium is currently trading at $512/oz. While rhodium is at $2,675/oz.

News

The UK's slow economic recovery remains on track, surveys showed on Wednesday, though service sector growth slowed last month and a looming public spending squeeze is making firms reluctant to invest. The health of the economy Is set to be a key factor in a May 6 election which is shaping up as the most closely fought for a generation.

China has hinted at letting the yuan appreciate. US Treasury Secretary Timothy Geithner will hold talks in Beijing on Thursday against a background of fresh signals from Chinese policymakers that they might be paving the way to let the yuan resume its rise. The National Development and Reform Commission (NDRC), the nation's top economic planner, said China would monitor exchange rate risks facing exporters, while an economist from the agency said Beijing should edge towards a more flexible yuan.

The Bank of Japan held its rates steady at 0.1% overnight and sounded a brighter note on its economic outlook. The BOJ remains open to further easing of monetary policy saying it is 'extremely important' for Japan to avoid a deflationary environment which is positive for gold denominated in Yen.

This update can be found on the GoldCore blog here.

The Bullion Services Team

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.