Crude Oil, Gold, Bonds and S&P Update from Commitment of Traders Report: Oil is Bullish

Stock-Markets / Financial Markets 2010 Apr 04, 2010 - 12:29 PM GMTBy: Shaily

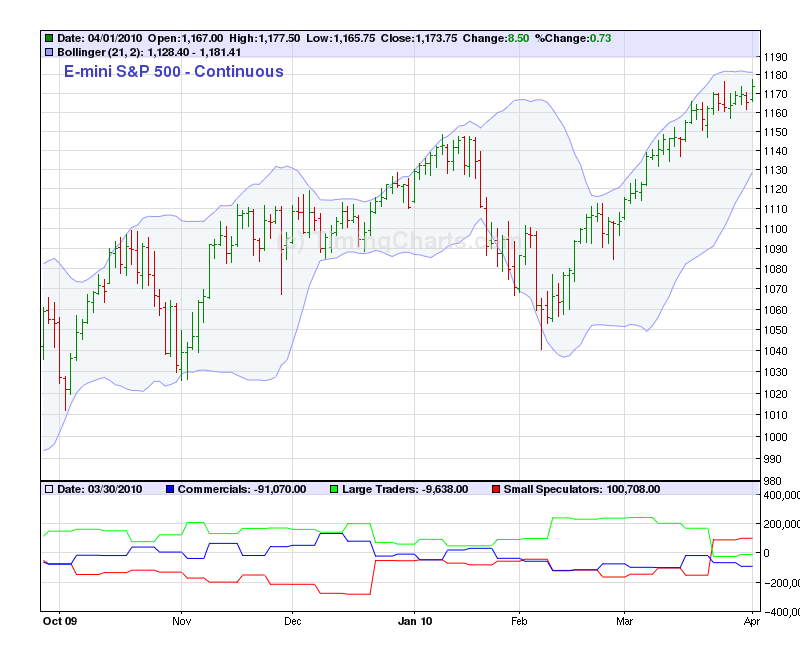

S&P short interest have hardly changed giving us very little clues after last weeks record short covering by large funds and institutions. There have been no follow up to the short covering and hence leaves the downside exposed for the coming week. We expect the S&P to correct and continue to be bearish short term. While our bearish all last week has not born fruit, it has not harmed us either as S&P still is stitting at the juncture where it can correct strongly to levels closer to 1120.

S&P short interest have hardly changed giving us very little clues after last weeks record short covering by large funds and institutions. There have been no follow up to the short covering and hence leaves the downside exposed for the coming week. We expect the S&P to correct and continue to be bearish short term. While our bearish all last week has not born fruit, it has not harmed us either as S&P still is stitting at the juncture where it can correct strongly to levels closer to 1120.

Gold

Gold has shown no interest to move either ways. The open interest in Gold continues to be confusing with no clear breakout. Long contracts shed another 11,000 contracts to end at 173,000 which is 9 month low. Whenever Gold has seen such low levels of long contracts, it has found a reason to trigger an up move that can leave many surprised.

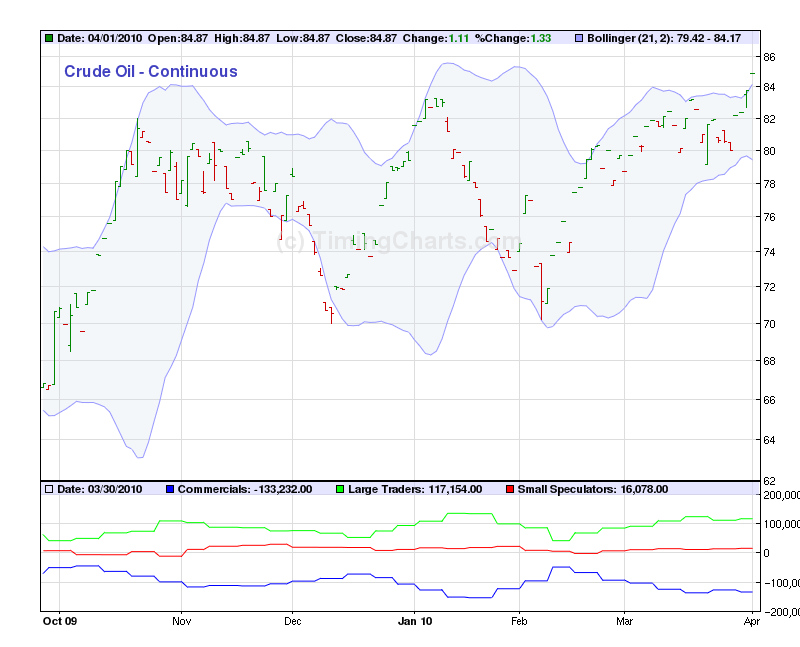

Oil

We have been bullish crude for 2010 and have termed it as “Black Gold” for 2010 with the best chances of providing a 20% rise. Long cotracts have increase by 5000 over last week to 117,000 long contracts.

You can read those at:

Given the positions, Oil is well set to take out $88 and $100 in 2010.

30 Year bonds

Shorts are rising at the rate of knots in US 30 Year bonds, an extremely bearish sign for bond holders while it is almost certainly indicating a breakout of 5% barrier for the 30 year yields.

Shorts have climbed to 117,000 which is nearly a 6 month high.

Our view given these numbers continue to bearish bonds, S&P while being bullish on Oil for 2010. We are still waiting for a trend move in Gold though we strongly believe that Gold will move down to see another unwind of positions before putting in the next rally.

Source: http://www.investingcontrarian.com/global/..

Shaily

http://investingcontrarian.com/

Shaily is Editor at Investing Contrarian. She has over 5 year experience working with Hedge funds in derivatives.

© 2010 Copyright Shaily - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.