US Labor Market adds 163k Jobs? Is it for Real or another Sham?

Economics / Economic Recovery Apr 02, 2010 - 06:00 PM GMTBy: Shaily

Blog writers have been overwhelmingly negative on the increasingly deteriorating unemployment situation in the US. No matter what data is released, they are discarded as unreal or so full of holes that an elephant could walk through them.

Blog writers have been overwhelmingly negative on the increasingly deteriorating unemployment situation in the US. No matter what data is released, they are discarded as unreal or so full of holes that an elephant could walk through them.

Even the current BLS report seems to have been bashed pretty badly by most blogs.

Taking a more realistic look at the numbers, may reveal that there seems to be some kind of traction building, that is if we believe the numbers.

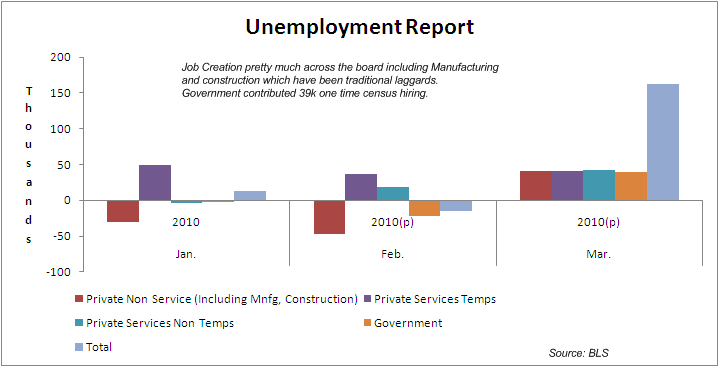

Jobs have been added pretty much across the board including traditional laggards like Manufacturing and Construction services. The charts shows the path to job creation.

All sectors have added jobs. While Jobs addition have been bloated by Government census hiring of 39k, there have been permanent hiring in manufacturing and construction services.

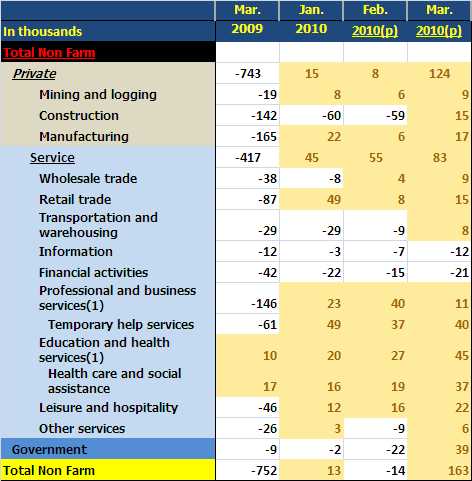

Cells with Yellow indicate addition:

•Manufacturing has seen an up tick which was absent in Jan and Feb 2010. Construction after a weak beginning to 2010 has shown a resurgence for the first time in 6 months with an addition of 15k jobs

•Government hired 39k new census workers.

•Temporary added another 40k jobs. We need to see the temps converted into permanent for the Job creation to look real and robust

•Financial sector continues to shed Jobs as 21,000 more lost their Jobs.

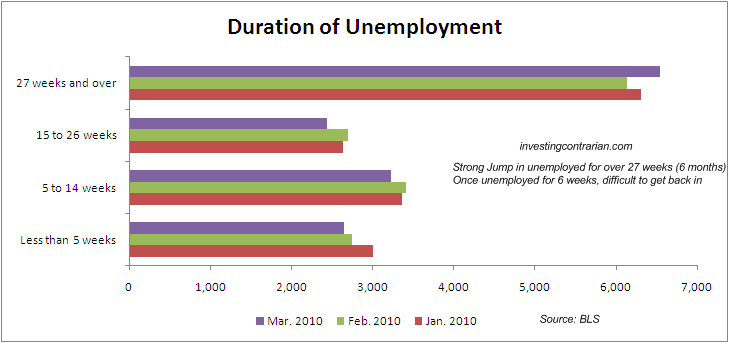

Analysing the unemployed people numbers, there is a strong jump of nearly 400,00 people who have joined the ranks of unemployed beyond 27 weeks. That is a scary number.

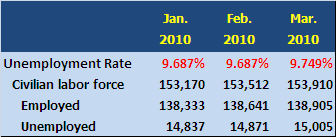

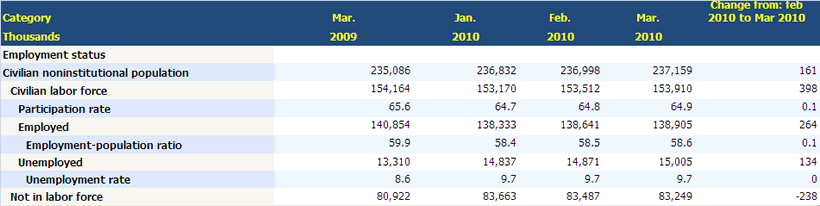

The unemployement rate stays at 9.7%. That is if you round it off.

March 2010:

The total unemployed = 15,000,000

Civilian Labor Force = 153,910,000

Unemployment Rate for March 2010 =15 /153.91 = 9.749% (March 2010)

February 2010:

The total unemployed = 14,871,000

Civilian Labor Force = 153,512,000

Unemployment Rate for February 2010 = 9.687% (February 2010)

In reality the unemployment rate again ticked up in March compared to Feb 2010. The US economy still has a rising unemployment rate.

A classic case of wall street pulling a fast one over the unsuspecting. Every single Newspaper and News channel will run with the headline of 162k jobs addition and a steady unemployment rate and yet given new labor that has joined the labor force unemployment rate has actually ticked up again.

We have not adjusted for the atrocious assumptions of BLS model and for the time being assume that we run with these assumptions, the data clearly points to some tightness in the labor market but it is so insignificant that it may statistically almost assumed to be mere noise. If this is what a $1.5 trillion stimulus could finally achieve, I have very little words to express my sadness over the state of affairs of this nation. Every News channel is right now reporting about the glorious turn around in labor market and yet they completely forget that there is real tax payer money to the tune of $1.5 trillion behind these numbers and yet this is the result of it all at the end of 12 months.

A mere 163k addition out of which half are one time addtions?

Every other country including Germany, UK and China have seen smart recoveries in their labor market at half the cost of US labor cost stimulus. The question to ask then is where has all the money gone ? Cause stimulus did work in case of other nations. How come we still have unemployment rate that has again gone up from 9.68% to 9.74%?

How come net of Government Census hiring and Private temp hiring, we only have less than 100k new additions to show when the labor force has increased by nearly 400,000 people?

I wish someone at those News channels can have the balls to ask these questions rather than praise the efforts of FED reserve in resurrecting the economy. I wish someone who had the reach could take up gauntlet and start asking the FED and treasury, where has all the money gone? It definitely has not gone to Job creation

Source:http://www.investingcontrarian.com/global/job-addition-across-the-board-is-the-recovery-really-on/

Shaily

http://investingcontrarian.com/

Shaily is Editor at Investing Contrarian. She has over 5 year experience working with Hedge funds in derivatives.

© 2010 Copyright Shaily - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.