India Economy and Stock Market Relentless Surge

Economics / India Apr 01, 2010 - 11:36 AM GMTBy: Shaily

India has been on a relentless surge, both in the real economy and the equity markets. 100% return in 12 months is not something one would have had expected in April 2009, as Fund Managers, Hedge Funds and Private Equity funds were running for cover. Index had just dipped below 9,000 in 2009.

India has been on a relentless surge, both in the real economy and the equity markets. 100% return in 12 months is not something one would have had expected in April 2009, as Fund Managers, Hedge Funds and Private Equity funds were running for cover. Index had just dipped below 9,000 in 2009.

In fact Rahul Bhasin (MD, Barings PE) was on record: India Sensex Fair Value 7,500.

Never Mind, that Sensex never touched 7500. Poor Mr. Bhasin was kept waiting for the lows. That is a price you pay when you become a crowd follower. PE Funds esp the India focussed ones can be quite easily classified as Crowd followers who have absolutely no skill in making returns in India. These folks neither understand India nor do they have any ability to invest in any other part of the world. In fact the pre crash in 2008, the path to manage a PE fund in India had become almost too easy to do:

Indian Born Engineer -> Go to Harvard, Whartons of the world for MBA -> Make a few contacts with equally bigger nuts among the rich europeans and americans -> Market your ability to make returns in India due to your Indian ancestory and ability to speak Hindi -> And Bingo! you have $500 mn in your kitty to play around.

Now I may have exaggerated but it does exemplify the fact that most of the Investment Funds in India have no idea to invest in India and have missed out a golden opportunity to make stupendous returns in such a short span of time.

The ones who woke up late, by a good 12 months, have re started their investing programs. When you see 100 mn dollar deals at valuations (20x forward) for companies which have neither a robust business model (Am most concerned about Power EPC companies) nor credible accounting systems (remember Satyam?), it is time to question the very thesis of the bubble rally.

The funds who bought at the bottom of Sensex have now almost stopped investing and sitting back watching the last idiot fund to buy at valuations which can only be considered crazy if not unbelievable (PE funds begun and run by Harvard MBA who probably have never gone to a single village in India).

But the funds who have 10 year view on this country, there are many foundational thesis and drivers that are supporting the India growth story. I have highlighted some of these below and should form a basis if you are ever looking to invest into India. I personally believe after having invested in other parts of the world (including US, China, Canada, Australia, London) that there is not a more wonderful place to invest over a period of 10 years. That is probably testimony to the premium that India enjoys and yet I believe, you have seen nothing. Wait for 5-7 year period for this country to truly blossom.

But nothing and absolutely nothing can absolve the nut fund managers who can justify to buy suspect companies and business models at these valuations. Am looking forward to see some of these funds to fold soon.

And yet there are exceptions to these: Funds like Chrys Capital, Warburg Pincus (Ajay Relan specifically) and some more unheard of names who bucked the trend and had the ability to look 12 months forward in April 2009, and invested at the trough. Kudos to these funds!

Chronicalling Indian economy super charge in 2009/10

It has been a stupendous performance as Indian economy grew at 7.5% against a world growth of 2%, US growth of 1% Eurozone growth of 0% and Chinese growth of 8.5% (suspect calculations?)

India has beaten every GDP estimate out there including IMF, HSBC, Barclays and the likes. Infact it has even surprised me.

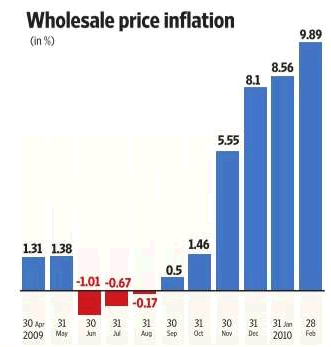

What is even more heartening is the GDP performance have come at subdued inflation though over the last 2 months we have seen an uptick in WPI.

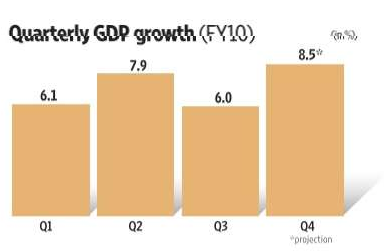

GDP performance

India GDP has grown to its pre crash levels and is very much set to cross into double digit territory. Q4 reported GDP notched 8.4% on Year which has now set the growth expectations for FY10 at 9%.

The higher GDP is reflective of the sheer ability of India to generate its own demand and hence returns that independent of eternal capital. While the external capital does help in sustaining the growth, it is not an absolute necessity as in the case of China, Brazil and Russia.

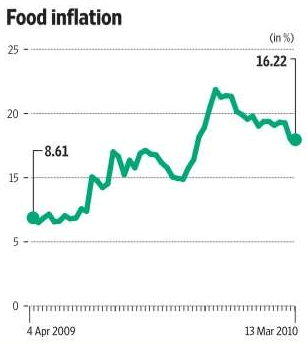

The Growth has resulted in higher levels of Inflation but inflation has been primarily found its way into food articles which have been a result of poor monsoons and hence supply led. Food Inflation touched 16.8% YoY which is threatening to trip the strong recovery.

RBI must be credited for leading a recovery with clinically low levels of heating in the economy(Inflation ex Food has been well managed, that is till now) . WPI is only now showing signs of getting into double digits. RBI responded by raising rates unexpectedly on march 20,2010.

While stable Oil prices in the range of $60-$75 have helped, but it is the tight lending regulation which has kept CPI and WPI at bay for much of the rally.

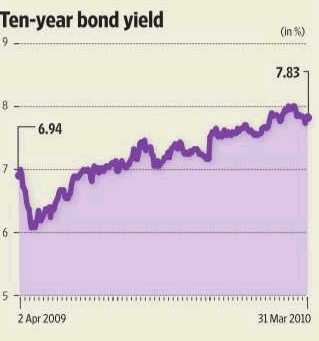

In response to Inflation rearing its head, bond yields have started to price in further rate rises. Goldman Sachs expects 125 bps hike in RBI rates by end of 2010. We expect the 10 yields to stabilize closer to 8.5%.

Indian corporates have found it easier to manage its working capital compared to global peers and hence allowed them to grow even through the powerful recession under way in the US.

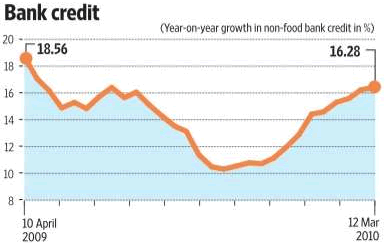

Credit Expansion

Bank Credit has come back to its previous levels and is growing at near 16.28%. Small businesses and enterprises continue to lean on the bank generosity to grow.

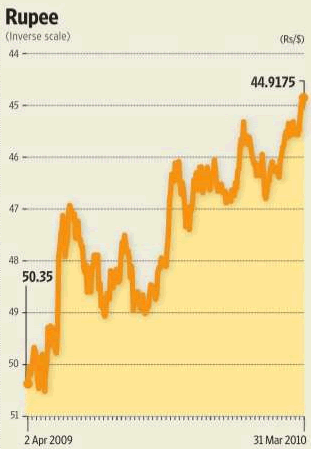

Rupee: Strength emerging against a super strong US dollar

Rupee strength in the wake of a super strong dollar (Dollar Index: 82) has kept India Oil bills well under manageable limits while increasing India Forex reserves to $280 bn as compared to $240 bn in April 2009. India has used the strong forex kitty to buy 200 tonnes of Gold from IMF at $1045. Prices today fluctuate around $1100/ounce.

Our view is that Rupee will take down 40 levels quite comfortably by 2010 end, if not below that.

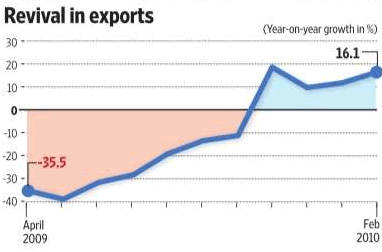

Exports: Back from the Grave

While much has been written about India domestic consumption as the heart of the India Growth story, India has not disappointed on exports either. Exports have notched 16.1% growth YoY which have led the logistics companies EPS growth. While exports have been led by US and Europe recoveries and we expect exports to moderate over the next 12 months partly due to slower growth in developed economies post phase out of government fiscal measures.

Export form less than 20% of India GDP and hence lends a low degree of dependence on Global recoveries. On a comparative scale, China has nearly 50% of 2.5 trillion GDP being formed out of exports to US and EU and hence at a greater risk to global slowdown.

The bedrock of India export story is the Bellwether IT industry. Even if a consumer led slowdown happens in the west, the IT industry may continue to grow due to the importance of technology and cost reduction through outsourcing, for US companies.

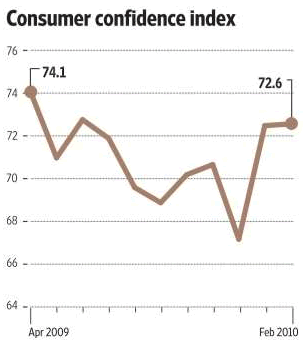

India: Optimistic Consumer

Indian consumer are among the happiest and optimistic set of folks around. Even at the plymouth of the crash of 2009, Indian consumer had a strong sense of optimism. We believe that this is very much reflective of the Indian style of life, routed in family values and social in nature. The lack of leverage to family finances helped the Indian Consumer to easily dodge the global slowdown which had wiped off many families financial duress in the US.

India Politics

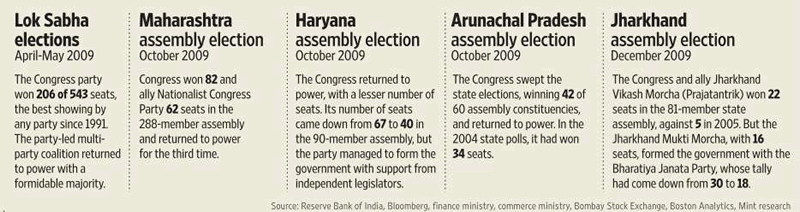

Last but not least, India has the best set of guys managing its 1.2 Trillion Economy. In PM Manmohan Singh, India has found one the finest and erudite PM of modern India. The FM, M, Pranab Mukherjee and the planning commission chairman Mr. Ahluwalia have been credited in keeping the reforms of this country under tremendous shape.

It will not be wrong to say that no Indian Political party has been able to reap the windfalls of India growing economy, as much as the Indian Congress Party.

To conclude, Indian markets will correct soon. Valuations in India have reached crazy levels.

Mark Mobius, Templeton Asset Management, believes the correction for India is on the way. The fear though is that the correction may not be deep enough and hence one may still not be able to find opportunities at valuations we want:

Mark Mobius:

Emerging market equities saw an 8-10% correction in February. Do you think a bigger correction is likely or are things okay?

Big corrections can be expected along the line in what is still a bull market. So thankfully, we haven’t seen a very big correction, but I think we have to be ready for that. Valuations are not that high, we are more or less in the middle of the range for all of the history of emerging markets. So that doesn’t concern us so much. So we think yes, correction is on the way, but it is still a bull market atmosphere.

Does that mean India is becoming a preferred market? Or are risk levels generally going down, so money is being spread out wide?

India is looking very good and we have seen more and more interest in India, but the biggest push is Bric countries and whenever you mention Bric, India of course is very large. So we are going to continue to see interest in India going forward. If we see faster action on part of the government in India on infrastructure and other investments, then we will see a lot of very good interest. But as I say, even without anyone taking any action in any direction, the interest in India is very high.

Let me conclude by once again quoting what I said initially:

India is looking in the best shape to survive the coming onslaught of lower GDP growth around the world.

Source:http://www.investingcontrarian.com/global/india-i-know-what-you-did-last-summer/

Shaily

http://investingcontrarian.com/

Shaily is Editor at Investing Contrarian. She has over 5 year experience working with Hedge funds in derivatives.

© 2010 Copyright Shaily - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.