Stocks Bull Market Continues Grinding Higher, Fear is Good!

News_Letter / Financial Markets 2010 Apr 01, 2010 - 03:37 AM GMTBy: NewsLetter

The Market Oracle Newsletter

The Market Oracle Newsletter

March 27th, 2010 Issue #18 Vol. 4

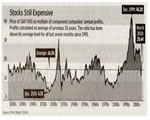

Stocks Bull Market Continues Grinding Higher, Fear is Good!Dear Reader Alistair Darling delivered his master stroke budget in advance of a May 6th General Election. The Tory's were put on the defensive as to where and what they would cut. The voters were left confused as the Tory high command accused Labour of stealing their policies again, why vote tory if Labour are offering very similar though less austere policies? Hence a narrowing in the polls into hung parliament territory. The tories need to develop a backbone and think up radical policies that differentiate them from the Labour party AND appeal to most voters else they really will blow their chances in about 6 weeks time. Stock Market - Whilst most analysts and investors remained focused on the global debt crisis, the Dow closed up 108 points on the week to close at 10850, the last analysis (23 Mar 2010 - Stocks Stealth Bull Market Trend Forecast Into May 2010 ) projects the Dow to 12,000 by mid May 2010. Gordon Gekko had it all wrong, its Not "Greed is Good", Its "Fear is Good". Its this FEAR that has kept the mainstream press and Financial BlogosFear on the WRONG side of the stocks stealth bull market for the past 12 months and highly likely will continue to do so for the next 12 months. Fear Sells! "The point is, ladies and gentleman, that fear, for lack of a better word, is good. Fear is right, fear works. Fear clarifies, cuts through, and captures the essence of the evolutionary spirit. Fear, in all of its forms; fear for loss of life, of money, of love, knowledge has marked the difference between those that take informed risks and make money and those that remain petrified by fear in a perpetually state of inaction." Politicians, the chief peddlers of fear recognised this centuries ago! U.S. Dollar - The U.S. Dollar bull market closed up on the week at 81.68 breeaking above the last high of 81.30, last analysis (01 Nov 2009 - U.S. Dollar Bull Market Scenario Update ) projected the USD to rally towards a target of 84. British Pound - The British Pound fulfilled its correction target of a rally to 1.52 to 1.53 last week before resuming its downtrend as per the last analysis (02 Mar 2010 - Election Risks, Debt and Inflation Push British Pound Below £/$1.50 Towards £/$1.40 Target ). GBP closed at £/$1.49 and continues to target 1.40 as part of a trading range of 1.55 to 1.40 for 2010. My 100 page Inflation Mega-trend Ebook remains available for immediate FREE download, covering mega-trend investment and wealth protection strategies. New FREE Ebook - What the Fed Does Not Want You to Read! Our friends at EWI have just released a free 34-page eBook, Understanding the Fed. It’s the free report the Federal Reserve doesn’t want you to read! This free report represents more than 10 years of research which goes beyond the Fed's history and government mandate; it digs into the Fed's real motivations for being the United States' "lender of last resort." In this 34-page report, you'll discover how the Fed's actions, combined with public outrage, may ultimately lead to its demise, plus much more about its secret activities and how it affects your money. Download your free copy of EWI’s Understanding the Fed eBook, here. Source: http://www.marketoracle.co.uk/Article18233.html Your Analyst. By Nadeem Walayat Copyright © 2005-10 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved Featured Analysis of the Week

Most Popular Financial Markets Analysis of the Week :

By: Gary_North To understand what is going to happen to America's health care delivery system, we must first understand what has happened to Detroit.

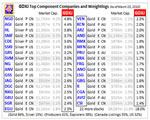

By: Nadeem_Walayat This in depth analysis seeks to update the stock market forecast for 2010 (Stocks Stealth Bull Market Trend Forecast For 2010 ) as included in the Inflation Mega-Trend Ebook (Download Now). This analysis specifically seeks to conclude towards a trend forecast for the next 2 months into Mid May 2010.

By: F_William_Engdahl A decisive vote against NATO - On February 14 Ukraine's Election Commission declared Viktor Yanukovych the winner in that embattled country's Presidential runoff vote, defeating former Prime Minister and Orange Revolution instigator Yulia Tymoshenko. Contrary to the positive spin Washington is trying to put on the events, they mark the definitive death of Ukraine's much-touted “Orange Revolution.“

By: Dian_L_Chu In a Business News Network interview on Mar. 18, Jim Rogers, famous investor and creator of the Rogers International Commodities Index (RICI) speaks about the recent currency and trade confrontation between the US and China:

By: Submissions Central Banks printing money are driving stocks higher, but has not bought any shares since November 2008. Does not pay any attention to the Fed because they do not know what's going on. Expects U.S. Economy to have a worse recession than 2008-09 which will be worse because of the huge debt burden.

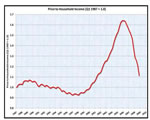

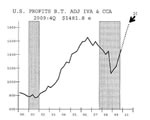

By: Jon D. Markman Sometimes we get a little carried away talking about esoteric subjects like bulls, bears, supply, demand, moving averages and the like. But if you just want to focus on something real, then look at corporate profits. When they're rising from a low, that's good; when they're flat-lining or declining, that's bad. Pretty simple.

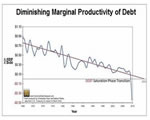

By: Jim_Willie_CB The USEconomy is bifurcated, with price inflation advancing on the cost side while price deflation harms on the asset side, to produce a nasty storm that is unlikely to abate. When high pressure zones clash with low pressure zones, hurricanes and tornadoes occur. Calling the resulting near 0% or low 2% price inflation on a net basis a good sign completely ignores the forces pulling the national economy apart. Economists prefer to view the landscape in aggregate, but they miss the picture composed of two important parts enduring very different forces. The financial sector has grotesquely grown, to an extreme.

By: Prof_Rodrigue_Trembl It is well enough that people ... do not understand our banking and monetary system, for if they did, I believe there would be a revolution before tomorrow morning." Henry Ford, American industrialist

You're receiving this Email because you've registered with our website. How to Subscribe Click here to register and get our FREE Newsletter To access the Newsletter archive this link Forward a Message to Someone [FORWARD] To update your preferences [PREFERENCES] How to Unsubscribe - [UNSUBSCRIBE]

The Market Oracle is a FREE Financial Markets Forecasting & Analysis Newsletter and online publication. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.