You Still Believe The Fed Can Stop Deflation?

Economics / Deflation Mar 31, 2010 - 07:03 PM GMTBy: EWI

Recent history proves that the Fed's "control" is just an illusion. March 31, 2010

Recent history proves that the Fed's "control" is just an illusion. March 31, 2010

Think back to the fall of 2007. The deflationary "liquidity crunch" that over the next year-and-a-half cuts the DJIA in half, decimates commodities, real estate and world markets is only starting. Almost no one believes that the crash is coming -- to a large degree, because everyone is convinced that the U.S. Federal Reserve Bank, with Ben Bernanke at the helm, will never allow deflation to happen: It can just print money!

The excerpt you are about to read is from EWI president Robert Prechter's October 19, 2007, Elliott Wave Theorist. If you find it insightful, read more of Bob's writings in the free Club EWI resource, "Robert Prechter's Most Important Writings on Deflation." (Details below.)

You cannot pick up a newspaper, turn on financial TV or read an economist’s report without hearing that the Fed’s latest discount-rate cut is bullish because it indicates the Fed’s decision to “pump liquidity” into the system. This opinion is so completely wrong that it is hard to believe its ubiquity.

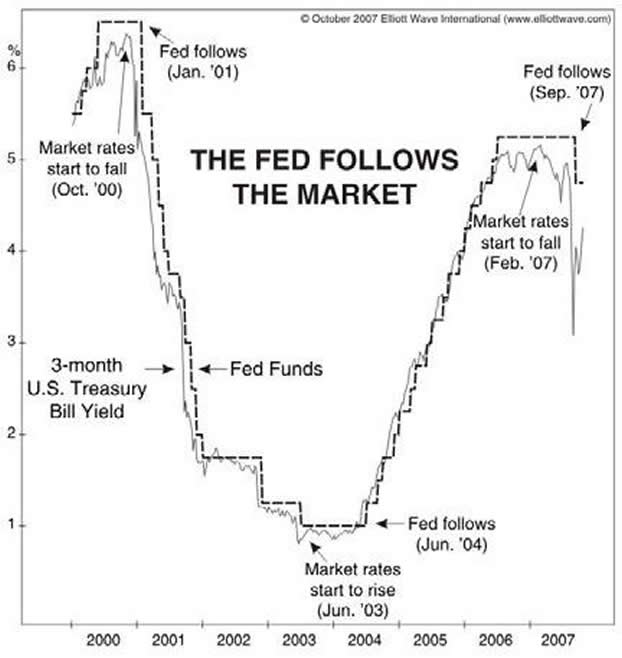

First of all, the Fed does not “decide” where it wants interest rates. All it does is follow the market. Figure 17 proves it. Wherever the T-bill rate goes, the Fed’s “target rate” for federal funds immediately follows. That’s all there is to it.

If you refuse to believe your eyes, then listen to the chairman; Alan Greenspan is very clear on this point. On September 17, a commentator on CNBC asked, “Did you keep the interest rates too low for too long in 2002-2003?” Greenspan immediately responded, “The market did.” Rates were not “too low” or the period “too long,” either, because the market, not the Fed, made the decision on the level and the time, and the market is never wrong; it is what it is. If investors in trillions of dollars worth of U.S. Treasury debt worldwide had demanded higher interest, they would have gotten it, period.

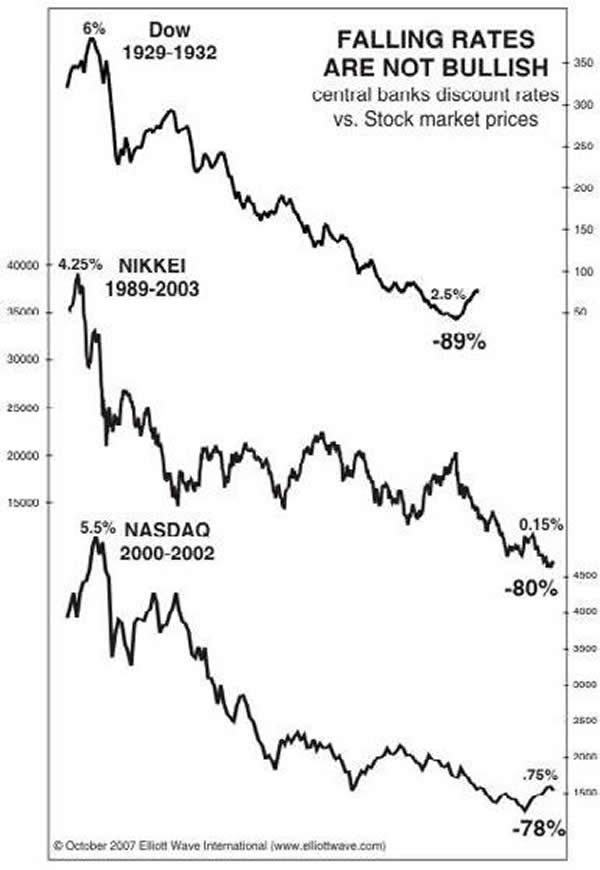

Second, falling interest rates are almost never bullish. All you have to do to understand this point is look at Figure 18.

Interest rates fell persistently through three of the greatest bear markets in history: 1929-1932 in the Dow, 1990-2003 in the Japanese Nikkei, and 2000-2002 in the NASDAQ. The only comparably deep bear market in the past 80 years in which interest rates rose took place in the 1970s when the Value Line index dropped 74%. Economists all draw upon this experience, but they ignore the others. Today’s environment of extensive investment leverage and an Everest of debt in the banking system is far more like 1929 in the U.S. and 1989 in Japan than it is like the 1970s. Why is a decline in interest rates bearish in such an environment? Because it means a decline in the demand for credit. When people want less of something, the price goes down.

The recent drop in rates indicates less borrowing, which means that the primary prop under investment prices -- the expansion of credit -- is weakening. That’s one reason why stock prices fell in 2000-2002 and why they are vulnerable now. This is the opposite of “pumping liquidity”; it’s a slackening in liquidity.

Read the rest of this important 63-page report, "Robert Prechter's Most Important Writings on Deflation" online now, free! All you need is to create a free Club EWI profile. You'll learn:

- When Does Deflation Occur?

- What Triggers the Change to Deflation

- What Makes Deflation Likely Today?

- How Big a Deflation?

- Why Bernanke Has Been Powerless Against Deflation

- The Big Bailout Bluff

- MORE

Elliott Wave International (EWI) is the world’s largest market forecasting firm. EWI’s 20-plus analysts provide around-the-clock forecasts of every major market in the world via the internet and proprietary web systems like Reuters and Bloomberg. EWI’s educational services include conferences, workshops, webinars, video tapes, special reports, books and one of the internet’s richest free content programs, Club EWI.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.