Wildly Bullish Scenario for Gold Stocks

Commodities / Gold and Silver 2010 Mar 31, 2010 - 04:24 PM GMTBy: J_Derek_Blain

In the article I wrote on March 22 ("When it Breaks, It's Going Somewhere in a Hurry"), I stated that there were two downside possibilities for the price of gold, with the bearish move to at least $950 being the most likely, and the move down to $650 being second most likely.

In the article I wrote on March 22 ("When it Breaks, It's Going Somewhere in a Hurry"), I stated that there were two downside possibilities for the price of gold, with the bearish move to at least $950 being the most likely, and the move down to $650 being second most likely.

I also mentioned that there was a third possibility, and that the price of gold could move very rapidly to new highs somewhere around the $1325/oz level by the end of the year.

Needless to say, I received a flood of emails from gold bugs the world over, admonishing me for "in one breath saying that gold is going to make a multi-year low, and then in the other saying gold could make a record nominal high" to quote one of the least colorful ones. Accusations of useless forecasting, throwing darts at a board and getting better results, even wasting people's article-perusing time were far from scarce.

Throw in the usual "you're crazy if you think gold is ever going below $1000 again because of [insert generic laundry list money printing/central bank/government/finance argument here]", and it made for a healthy batch of reading, and even an extension of the more offensive vocabulary.

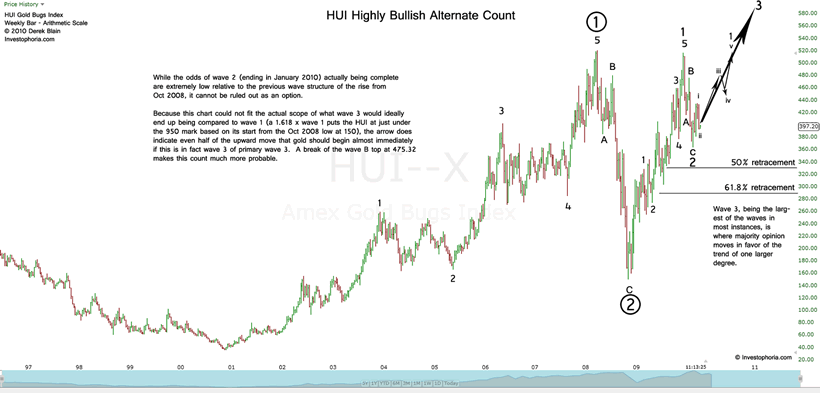

In respone to that article, I posted my most recent one. In it, I explained that I use Elliott Wave Theory as one of my primary methods of finding turning points in financial assets, and I showed two charts with the most likely wave counts for the HUI Index. Both indicate a bearish situation, one with a probable 20% further loss in the HUI, and the other with a loss of 50% from here.

There is a third scenario, with some twitching and tweaking of wave structure and small bending of the Elliott Wave rules. If one jostles enough there is a highly bullish potential wave count for the HUI (and the yellow metal itself in conjunction), which I present below.

I hope this explains to my readers why there is very little clear direction by way of gold right now - all three of these counts can work with gold at its current price level. It is the moves out of this consolidation period that will determine the larger structure of the bull or bear market.

There are times for action and times to wait and see - if you are slow accumulator of physical metal and your end goal is to have as many ounces of gold as possible, I don't recommend making any major changes. For traders, many are in the same boat and not committed to either side currently. Perhaps the market will wait until the maximum number are committed to the fake move before reversing and making its real leg, up or down - we have witnessed this time and again in the long and short term, and with any number of assets.

Consolidation can only last for so long, and eventually we will see a break and follow-through of key support or resistance, indicating the larger leg in gold and where this market is taking us.

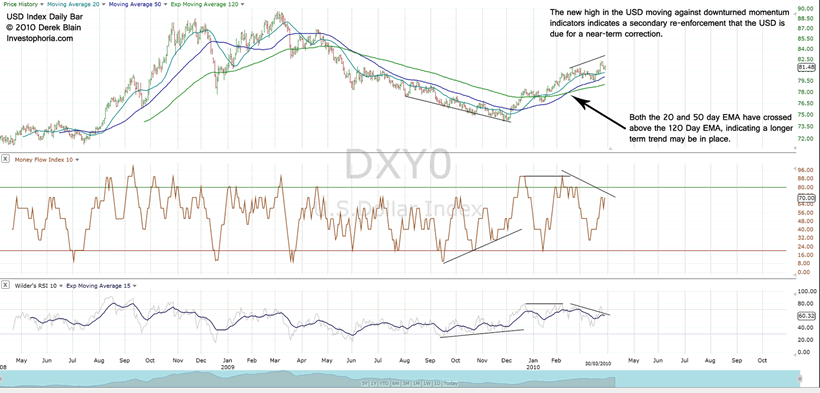

As to the very near future, although the correlation seems to be slackening of late, gold could run another $10- $20 up in light of a falling USD. The initial stages of its larger degree move seem to be complete and the USD is due for a cool-down period before another major stab upwards.

Aside from the most-likely completed wave count leading to a near-term correction, the technicals are indicating a slower momentum against the wave 1 high, and we should see the turn of the last few days develop into something stretching out over at least a few weeks.

Stay sharp - these markets may feel complacent today but these are the times that many get snared in the trap of a huge and surprising move.

By J. Derek Blain

© 2010 Copyright J. Derek Blain - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.