Americans Still Not Working

Stock-Markets / Financial Markets 2010 Mar 31, 2010 - 09:19 AM GMTBy: PaddyPowerTrader

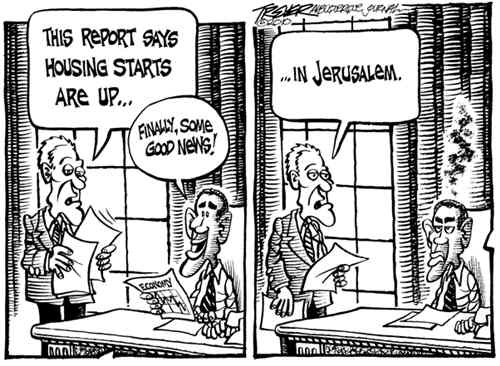

For the most part markets were little changed overnight with investors largely sitting tight ahead of Friday’s all-important US non-farm payrolls report. Indeed the S&P 500 closed exactly unchanged, with some strength in the industrials offset by some weakness in the financials. Stock wise 3M rallied 3.6% as Morgan Stanley said profit may top estimates after Danaher boosted its earnings forecast. Home Depot and Lowe’s climbed as the S&P/Case-Shiller index of home prices in 20 US cities and the Conference Board’s confidence gauge topped economists’ estimates.

For the most part markets were little changed overnight with investors largely sitting tight ahead of Friday’s all-important US non-farm payrolls report. Indeed the S&P 500 closed exactly unchanged, with some strength in the industrials offset by some weakness in the financials. Stock wise 3M rallied 3.6% as Morgan Stanley said profit may top estimates after Danaher boosted its earnings forecast. Home Depot and Lowe’s climbed as the S&P/Case-Shiller index of home prices in 20 US cities and the Conference Board’s confidence gauge topped economists’ estimates.

Today the US ADP private sector payrolls report disappointed coming in at -23k against expectations for a 40k rise. This news allied with Moody’s rating agency who has further downgraded the credit ratings of five Greek banks is giving the Dow a red hue.

Today’s Market Moving Stories

•Ireland’s National Asset Management Agency said it would apply an average discount of 47% on the first block of loans that it will purchase from the local banks, compared with the Government’s earlier estimate of a 30% discount. Ireland’s regulator estimates that the local banks may need at least €31.8bn of new capital, with banks given 30 days to submit capitalisation plans. I won’t bore you with too much NAMArama analysis as it’s well covered elsewhere. I just want to say on the all the hype about the larger than expected haircut it should be noted that this discount applies to the initial tranche only (constituting around 20% of the total), which is likely to disproportionately feature development land loans that face larger writedowns. Future loan tranches are yet to be valued by NAMA, though it is expected that the eventual average discount paid for its entire loan portfolio will be lower than today’s announced level.

•The IMF scaled back its forecasts for growth in Germany this year to 1.2% (from 1.5% previously), with growth expected to strengthen to just 1.7% in 2011 (from a forecast of 1.9% previously).

•German labour market data again came in better than expected this morning as today’s unemployment data surprised again positively. In March the unadjusted number of unemployment declined by 75,000 to 3.568mln, due to the normal spring recovery. The ILO measured unemployment rate stagnated the fourth month in a row at 7.5% in February.

•UK consumer confidence deteriorated in March, dealing a blow to Prime Minister Gordon Brown as he prepares to call what promises to be one of the closest general elections in years. The GfK NOP showed its consumer confidence index slipped to -15 in March from -14 in February. Nick Moon, the managing director of GfK NOP social research, said that although the drop was small, it was significant because confidence had risen in the first two months of the year.

•Greece may pay about €13 billion more in interest on the debt it sells this year than it would have if yields had stayed at their pre-crisis levels relative to Germany’s. Interest on the three bonds it sold this year, including a seven-year note offered this week, will amount to €7.7 billion over the life of the securities, compared with €3.8 billion if they had sold them at the average extra yield, or spread, over German debt that prevailed between 2000 and 2008. Greece will incur a further €18.9 billion of interest on this year’s remaining issuance, compared with €9.4 billion before the crisis began.

•Chinese PBOC Vice Governor Zhu Min said that “there remains the latent risk of asset bubbles. The rapid rebound for the better in market risks after the financial crisis has led to the threat of asset bubbles in capital markets”. He added that “what is worrisome is that once the US Federal Reserve embarks on interest rate increases, this USD arbitrage may return [to the US], causing these bubbles to burst.” He concluded that “fluctuations in the USD have worsened… This financial crisis has again demonstrated that a currency regime dominated solely by the USD is unstable, and the big fluctuations have had quite a big impact on the global economy and financial markets.”

•The Nomura/JMMA Japan manufacturing PMI fell to 52.4 in March from 52.5 in February. However, the index for new export orders rose to 55.7 from 55.2 – the highest level since May 2004.

•Australian retail sales fell 1.4% mom in February thereby offsetting gains in January. This was the first fall in twelve months and in the face of a consensus forecast for a 0.2% gain. Separate data showed that approvals for new homes dropped 3.3% mom in February to a four month low (despite a consensus forecast of +2%), although private credit grew as expected, rising by 0.4% mom.

•Dallas Fed President Richard Fisher told a conference that “I’m not advocating for an increase in interest rates right now.” He added that raising interest rates was ‘not on the central bank’s front burner right now’ as there was plenty of slack in the US economy.

Greece Still In The Mire

My initial reaction to the details of the Greek support package hammered out in Brussels last Thursday was that they didn’t materially add to what was already known about the European bailout package for Greece (first announced in mid-February). More specifically, other than the fact that the European Commission and the ECB seem to have the final say in when the funds could be called and the report that 2/3rds of the loans would come from Greece’s Eurozone partners, we actually learnt nothing new. Certainly, no detail was provided as to what would actually provide the trigger for a bailout (a failed auction? The subsequent threat of default?) or what options would be considered to “reinforce the legal network” of the fiscal stability pact (the ultimate threat of expulsion?). As importantly, nothing was said (or even intimated) about what would happen were another nation were to find itself in trouble. Given that it is now 18 years since the Maastricht Treaty was signed, these signs that the Eurozone still lacks a carefully thought out crisis management programme that can swing into action at a moments notice does little to inspire confidence.

It seems that I’m not alone in feeling disappointed with the outcome from last week if the results of Greece’s auction of €5bn of 7 year bonds on Monday were anything to go by. Not only did this auction price at the same level as the 10-year auction in early March but, more importantly, demand proved far more modest this time around (1.4 times coverage compared the 3.2 seen on March 4th). Worse, while much was made of the high demand from foreign investors at the previous auction (77%), Monday saw demand from this sector fall to a rather more modest 57% (with buying from outside of Europe amounting to no more than 10% of the whole).

Yesterday saw further evidence of rapidly waning interest as the unexpected reopening of an earlier issue of 12-year bonds (with the yield capped at 6%) only managed to raise €390mln compared to the €1bn available. Given that Greece has only raised about half of the €35bn they need this year, these signs that investors are increasingly shunning its debt despite the apparent promise of a Eurozone backstop are ominous. Little wonder that the benchmark 10-year Greek/German yield spread on government bonds has started widening out once again (hitting 340bp this morning) and look set to continue to do so.

This remains a bearish backdrop for the EUR/USD and EUR/GBP.

Company News

•Ryanair is suing the French government this month for what Ryanair considers illegal aid to Air France-KLM, CEO Michael O’Leary said. The lawsuit, filed March 10 at a Paris court, seeks €113 million in damages and interest. O’Leary said his company estimates that Air France has received more than €1 billion in illegal state aid since 1994. He didn’t provide details.

•Tate & Lyle reported performance in line with guidance given in January, with EU sugar margins in line with Q3, although the stronger USD will benefit the Q4 results. The currency impact will also have increased debt, although this was offset by stronger cash inflows, meaning net debt at March 31, 2010 is expected to be “broadly similar” to the £864m at Dec 09.

•Ofcom completed its review of Sky Sports packages compelling the satellite broadcaster to offer these channels wholesale to other operators at a discount of between 10% and 23% to current prices. This is roughly inline with expectations although it is a positive for BT that they can now anticipate offering live Premier League football from next season.

•Anglo American and Xstrata have had their rating outlooks from Moody’s and S&P respectively improved from negative to stable essentially on the back of improving commodity prices, the more constructive economic outlook, along with the companies’ proved and expected flexibility to manage their balance sheets in order to support credit metrics.

•Volkswagen is speeding up a facelift of the $88,000 Phaeton sedan in time to unveil the model at the Beijing auto show next month and target China’s millionaires.

•Traffic volume at Dublin airport fell 16% in February (to 1.2m), continuing the dire trend set in January (-17%). It contrasts sharply with airports elsewhere in Europe where stability and growth returned at year end. Continental EU traffic was back 16%, the UK -8% and North America -19%. Domestic Irish volume fell 31%. These figures underline yet again the crisis enveloping Irish aviation in general. Both Aer Lingus and Ryanair are also experiencing tough Q1s in Ireland but their market shares are expanding as other carriers and charter volumes are extracted at a faster rate. The data shows how challenging the Irish market is for Aer Lingus which has a 90% exposure to Irish airports.

•Yesterday it was announced that the Quinn Group had entered administration at the behest of the Financial Regulator. The group will continue to operate but under different management. The group had gone from having assets over liabilities of some €200m to an excess of liabilities of more than €200m. Shares in FBD rose 5.8% after the news, with expectations that the administration provides an opportunity to grab market share.

•BP awarded $500 million in contracts to drill wells in Iraq’s giant Rumaila oilfield, the first step in a mammoth initiative by foreign oil companies to revive the country’s energy industry. If successful, the effort at Rumaila and several other fields near Basra could be one of the largest expansions of crude-oil production ever achieved anywhere. Increased Iraq production could be the difference between a well-supplied global market with oil steadily trading below today’s $82 a barrel and a tight oil market with triple-digit prices, struggling to meet rising Asian demand.

Disclosures = None

By The Mole

PaddyPowerTrader.com

The Mole is a man in the know. I don’t trade for a living, but instead work for a well-known Irish institution, heading a desk that regularly trades over €100 million a day. I aim to provide top quality, up-to-date and relevant market news and data, so that traders can make more informed decisions”.© 2010 Copyright PaddyPowerTrader - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

PaddyPowerTrader Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.