Gold Price Manipulation, Fact or Fantasy?

Commodities / Gold and Silver 2010 Mar 30, 2010 - 06:23 PM GMTBy: Toby_Connor

Amazingly enough...or maybe it's not so amazing, every time gold corrects we see the conspiracy theories flying thick and heavy. I've questioned these theories I don't know how many times and I have yet to receive a logical answer. Now that I think about it, I don't believe I've ever received any answer.

Amazingly enough...or maybe it's not so amazing, every time gold corrects we see the conspiracy theories flying thick and heavy. I've questioned these theories I don't know how many times and I have yet to receive a logical answer. Now that I think about it, I don't believe I've ever received any answer.

If gold is being manipulated by the powers that be how then in the world did gold manage to rise from $250 to over $1200? I have to say if someone is manipulating the price of gold they are doing a damn poor job of it.

I have to ask, when gold was rallying hard last November, where was the manipulation then? I didn't hear a peep from the conspiracy crowd all month.

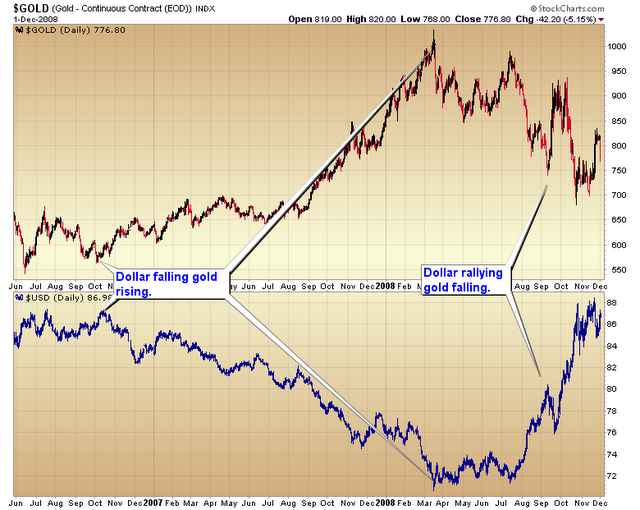

When gold was rocketing higher in late 2007 and early 2008 where, were the conspiracy buffs? Was there a conspiracy to raise the price of gold at that time?

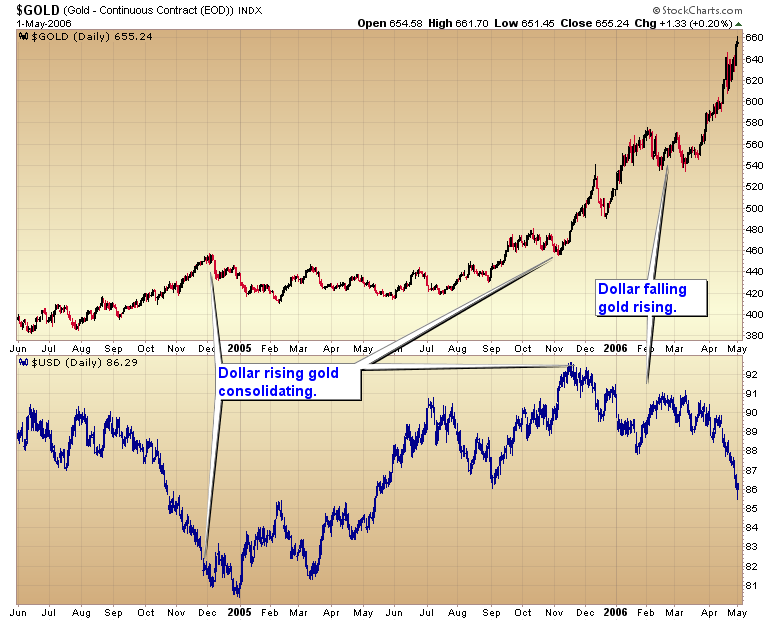

How about the monster rally in 2005 and 2006? How could this possibly happen if gold is being suppressed?

Folks, here is the truth. Virtually anything can be tampered with in the short term. It happens all the time. But no one and I mean no one, can halt a secular bull or bear market. Case in point, Greenspan and Bernanke have printed literally trillions upon trillions of dollars in the vain attempt to halt the secular bear market and it has backfired every time. Just like it's going to backfire this time too.

Let me show you three charts.

There's nothing mysterious about the gold market. It's simple, when the dollar is in its secular bear trend gold is in its secular bull trend. When the dollar is in a counter trend rally gold corrects or consolidates.

It really is that simple.

When gold gets extremely stretched above the mean it regresses, just like every other market in the world. Actually, regression to the mean is the one principle in the stock market, or any market, that you can bet the farm on.

When gold enters the final phase of a C-wave advance emotional traders spike the price irrationally far above the 200 DMA. Smart money, noticing what is happening, start selling. There's nothing evil about that. As a matter of fact it's just good commonsense.

Let’s face it, as long as the dollar is falling any attempts at manipulation will fail. When the dollar is rising gold either corrects or consolidates. I don’t see anything nefarious about that scenario.

As a matter of fact often, as the dollar is rising, gold just consolidates. That makes me wonder if there is a hidden group of gold bugs working to prop up the gold market when it should be falling. (wink wink)

I’d have to say unless you think some mysterious force is also controlling the currency markets and the law of regression to the mean, all in an effort to manage the price of the comparatively small precious metals market, I'm going to suggest one get on with the business of making money and forget about this manipulation nonsense.

Toby Connor

Gold Scents

A financial blog with emphasis on the gold bull market.

© 2010 Copyright Toby Connor - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.