Silver Surges as Copper, Crude Oil and Gold Rise

Commodities / Gold and Silver 2010 Mar 30, 2010 - 06:35 AM GMTBy: GoldCore

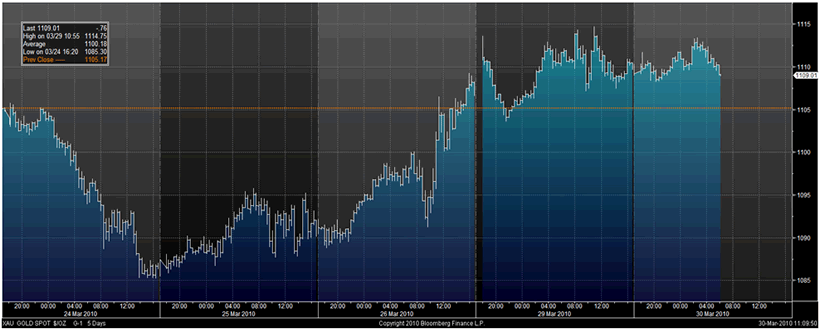

Gold went from as low as $1,106/oz up to $1,114/oz in US trading before closing with a gain of 0.53%. It has range traded from $1,109/oz to $1,113/oz in Asian trading this morning. Gold is currently trading at $1,110/oz and in euro and GBP terms, gold is trading at €824/oz and £738/oz respectively.

Gold went from as low as $1,106/oz up to $1,114/oz in US trading before closing with a gain of 0.53%. It has range traded from $1,109/oz to $1,113/oz in Asian trading this morning. Gold is currently trading at $1,110/oz and in euro and GBP terms, gold is trading at €824/oz and £738/oz respectively.

While gold was only up marginally yesterday, trade continues to be more volatile than usual. Oil prices rose some 2.4% yesterday and remain firm above $82 a barrel (NYMEX), while copper jumped to an 11 week high yesterday and this should support gold. The large rise in US government bond yields seen in recent days may the start of a reevaluation of the risk free rate of return which will be favourable to gold from an asset allocation point of view.

Resistance is at $1,115/oz and there appears to be a very determined seller at this level. A breakout above $1,115/oz could see us challenge $1,130/oz in short order. Support is at $1,100/oz and $1,085/oz.

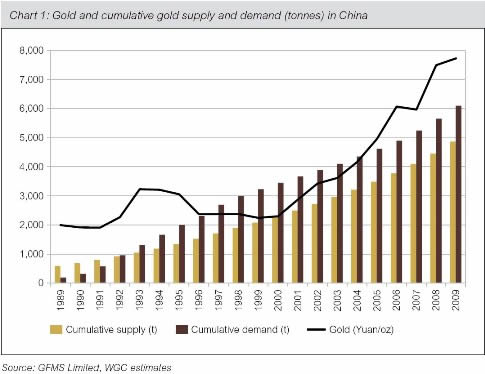

Physical demand remains robust internationally, particularly in China, as investment demand continues due to concerns about the emergence of inflation. We have seen a gradual evolution of the crisis from a financial crisis affecting banks, to an economic crisis affecting major economies and now to a fiscal crisis affecting governments internationally. The risk is now that these fiscal crises lead to an international monetary crisis. With sovereign and currency risk elevated investment demand will likely remain robust as will central bank reserve demand, particularly from China.

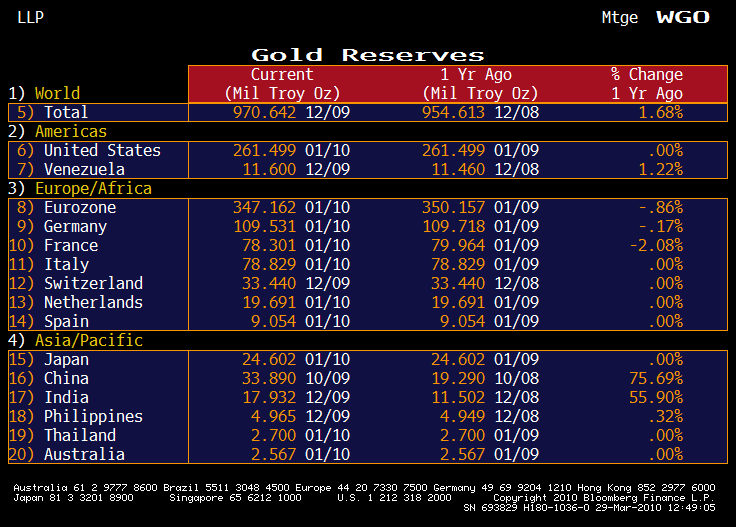

China is the world's sixth-largest holder of gold but is significantly behind other official holders who own substantially more gold, such as the US, the IMF, the Bundesbank and several European countries. The Chinese central bank holds far less gold than other states as a percentage of total reserves - only 1.6 percent of total reserves, which is very low by international standards. The world average is over 10%.

And this despite China having quietly and secretly increasing its reserves in recent years from 600 metric tonnes to the 1,054 metric tonnes reported in April. Rumours and speculation about Chinese buying have been rife for years, but many market participants remained in denial until this irrefutable proof was given by the People's Bank of China themselves.

China, which is the largest US treasury bonds holder, is likely continuing to diversify into gold due to the ongoing uncertainty about the future direction of the US dollar. China's total reserves are $2.4 trillion, and therefore even a small increase in its gold allocation could lead to sharply higher prices. However, the Chinese are astute and will not announce to the world on a regular basis their purchases and telegraph in advance their intent regarding purchasing gold. This would be unwise as it would lead to them having to buy gold at higher prices and could see the value of their dollar reserves fall.

Silver

Silver surged 3% yesterday and has range traded from $17.34/oz to $17.45/oz this morning in Asia. Silver is currently trading at $17.36/oz, €12.89/oz and £11.52/oz.

Platinum Group Metals

Platinum is trading at $1,630/oz and palladium is currently trading at $475/oz. Rhodium is at $2,575/oz.

News

European equities have given up their earlier gains despite US and Asian stock markets advancing on Tuesday. Greek government bonds were under pressure Tuesday and this may be leading to risk aversion. Markets are questioning Greece's future borrowing power after Monday's launch of a new €5 billion, seven-year bond issue.

Britain's economy came out of an 18-month recession in the fourth quarter of last year with more momentum than expected, official data showed on Tuesday. The Office for National Statistics said the economy grew 0.4% in the last three months of 2009, the first quarter of growth since the first quarter of 2008 and above analysts' expectations for an unrevised reading of 0.3%.

Foreign ministers from the Group of Eight leading industrial nations will call on the international community to take "appropriate and strong steps" to show its resolve over Iran's nuclear activities. A draft of the G8 final communiqué also said that the G8 remained open to dialogue with Tehran, which denies widespread western charges that it is seeking to make atomic weapons. It is the latest step in a campaign of pressure by many of the world's most powerful nations to force Iran to comply with demands from the UN Security Council and co-operate with the International Atomic Energy Agency.

This update can be found on the GoldCore blog here.

The Bullion Services Team

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.