Greenspan Signals warnings for Bubble-maniacs, the Break-out of Inflation Has Already Begun

Economics / Inflation Mar 29, 2010 - 05:59 PM GMTBy: Gary_Dorsch

“I guess, I should warn you. If I turn out to be particularly clear, you’ve probably mis-understood what I’ve said,” former Federal Reserve chief Alan Greenspan was fond of saying, when he controlled the Fed’s money spigots. For many Fed watchers, it was a great relief when “Easy” Al finally retired from the Fed, since there is nothing more vexing - than correctly interpreting Green-speak.

“I guess, I should warn you. If I turn out to be particularly clear, you’ve probably mis-understood what I’ve said,” former Federal Reserve chief Alan Greenspan was fond of saying, when he controlled the Fed’s money spigots. For many Fed watchers, it was a great relief when “Easy” Al finally retired from the Fed, since there is nothing more vexing - than correctly interpreting Green-speak.

“Everything depends upon proper listening. Of ten individuals who listen to the same speech or story, each person may well understand it differently, - perhaps only one of them will understand it correctly,” an eighteenth century theologian observed. So it was of great interest, listening to a March 27th, interview presented on Bloomberg TV, with the maestro, - Mr Greenspan, who is settling into the twilight years of his life-time. This time, Greenspan spoke more clearly, about such arcane subjects such as “Asset Targeting,” and the manipulation of markets.

When asked about his outlook for the US-economy, Greenspan answered by saying everything depends upon the direction of the stock market, “Ordinarily, we think of the economy affecting stock prices. I think we miss a very crucial connection here in that this whole economic recovery, as best as I can judge, is to a very large extent, the consequence of the market’s bottoming last March, and coming all the way back-up. It is affecting the whole structure of the economy, as well as creating the usual wealth effect impact,” Greenspan said.

Imagine for just a moment, that the Dow Jones Industrials has become a key instrument of national economic policy, and that by “actively managing” its direction, the government could impact the wealth of tens of millions of US households, and by extension, influence consumer confidence and spending. By ramping up the growth of the money supply, and slashing interest rates to zero percent, in order to inflate market bubbles, the Fed could in theory, fuel an economic rebound.

Greenspan generally pursued an “asymmetric” monetary policy, - in other words, - always quick to slash interest rates and flood the markets with liquidity whenever the stock market was tumbling, but was very slow in draining liquidity or raising interest rates, when stock markets were booming. There was always an inherent bias towards asset bubble inflation, under the Greenspan Fed’s policies.

Greenspan generally pursued an “asymmetric” monetary policy, - in other words, - always quick to slash interest rates and flood the markets with liquidity whenever the stock market was tumbling, but was very slow in draining liquidity or raising interest rates, when stock markets were booming. There was always an inherent bias towards asset bubble inflation, under the Greenspan Fed’s policies.

For big-time risk takers in the US stock markets, speculators could usually rely on the safety net of the “Greenspan put,” - or a quick easing of monetary policy, to cushion the market from steep losses, when risky bets turned sour. Under the tenure of the Fed chief Ben “Bubbles” Bernanke, speculators have celebrated the easiest monetary policy in history, which earned Mr Bernanke the designation of Time magazine’s “Man of the Year,” for his creativity in running the printing press.

According to Greenspan, the aggregate value of stock markets worldwide have increased by $15-trillion, with the US-stock markets recouping $5.4-trillion of lost wealth. “We’re going to get a significant rise in employment,” he predicted. All this was accomplished in coordination with the G-20 clique of central bankers that pumped more than $5-trillion of liquidity into the money markets over the past year, along with another $9-trillion of state guarantees for bank debt and deposits.

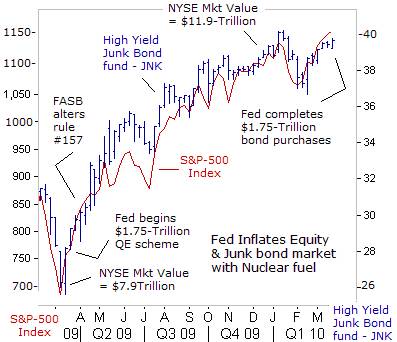

In the United States, the central mechanism for inflating the stock market and fueling the powerful recovery in junk bonds, was Bernanke’s shift to the radical “quantitative easing” (QE) scheme, in which the Fed printed $1.75-trillion of high powered money, - channeled the excess cash into the coffers of the Oligarchic banks on Wall Street, which in turn, bid-up the prices of high-grade corporate and junk bonds, thus narrowing yield spreads with US-Treasuries. In Green-speak, - the blossoming of finance – is the massive monetization of debt, and carry trades - borrowing at near-zero percent to lend longer-term, at higher interest rates.

In the United States, the central mechanism for inflating the stock market and fueling the powerful recovery in junk bonds, was Bernanke’s shift to the radical “quantitative easing” (QE) scheme, in which the Fed printed $1.75-trillion of high powered money, - channeled the excess cash into the coffers of the Oligarchic banks on Wall Street, which in turn, bid-up the prices of high-grade corporate and junk bonds, thus narrowing yield spreads with US-Treasuries. In Green-speak, - the blossoming of finance – is the massive monetization of debt, and carry trades - borrowing at near-zero percent to lend longer-term, at higher interest rates.

Thanks to the booming stock market, there were $311-billion of new stock offerings on Wall Street, including IPO’s, and secondary offerings, in the second half of 2009. Junk bond sales worldwide reached a record $38.3-billion in March 2010, as rising profits and ultra-low interest rates, attracted swarms of yield hungry buyers, who are fed-up with zero rates of return on CD’s and money market funds.

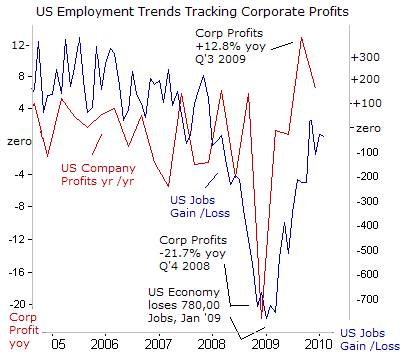

US companies have slashed 8.4-million jobs over the past 27-months, cut wages and medical benefits, but boosted their profitability. US corporate profits jumped $109-billion in Q’4, to $1.47-trillion, up 31% from a year ago. S&P-500 companies have increased their cash hoard to a combined $1.2-trillion, while simultaneously impoverishing the American middle class, to levels of three decades ago.

Yet there is great optimism on Wall Street that a virtuous cycle will soon begin, in which cash-flush S&P-500 companies would start to hire new workers. However, the vast bulk of hiring over the next several months would be for temporary workers by the US-government, for the census report. According to the Census Bureau, about 17,000 temporary workers were hired in the first quarter, with an additional 181,000 hires planned for the three months from January to March. The remaining hires for 971,000 temporary workers, are scheduled for the April-to-June period.

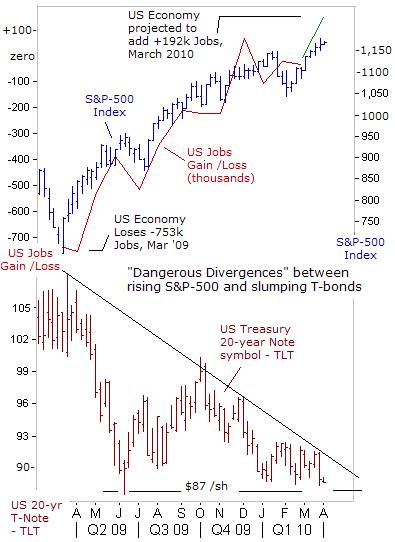

At this critical juncture, with the Dow Jones Industrials index bumping against the psychological 11,000-level, Greenspan was asked about the longevity of the “green-shoots” rally. What worries Greenspan is the slumping Treasury bond market, which has been trending lower for the past 15-months. Yields on the benchmark 10-year note, are climbing dangerously higher, towards the key resistance level of 4-percent. “It is a canary in the mine at this stage,” Greenspan warned.

“The way I would look at it, if the markets are working well, the short term outlook is one of increasing momentum. You can see it developing,” he said. “But if the 10-year note and the 30-year bond yields begin to move up, in other words, if the ten-year note begins to move aggressively above 4-percent that is a signal that we are in some difficulty. There is basically this huge overhang of federal debt which we have never seen before. It is going to have a marked impact eventually unless it is contained, on long-term rates. That will make a housing recovery very difficult to implement and put a dampening on capital investment as well,” Greenspan added.

Greenspan is describing is a “dangerous divergence” that is developing between a high and rising S&P-500 stock index, and a slumping US Treasury bond market. They are moving in opposite directions, and at a certain point in the future, if the Treasury bond market begins to tumble sharply lower, - lifting yields sharply higher, - either under the weight of massive new supplies, or Chinese dumping of T-bonds, ahead of a probable revaluation of the yuan against the US-dollar, the divergence between the asset classes would grow even wider, to the breaking point – that triggers a stock market slide or crash of unknown magnitude.

However, among today’s stock market bulls, there’s an unshakeable faith in the magical powers of the “Plunge Protection Team,” (PPT), convinced that the Fed and Treasury can prevent 10-year yields from spiraling above 4-percent, not matter how much supply hits the debt market, and prevent a replay of the Greek tragedy. For now, the Fed is putting a safety-net under the T-bond market, by promising to keep the fed funds rate pegged near zero-percent for an “extended period of time,” hoping to attract yield starved investors to the long-end of the curve.

“The economy continues to require the support of accommodative monetary policies,” Bernanke told lawmakers on March 25th. "If it were positive to take interest rates into negative territory I would be voting for that,” said the radical inflationist, San Francisco Fed chief Janet Yellen on Feb 22nd. Yet the Fed is winding down its year-long, $1.75-trillion monetization scheme this week, which could make it difficult for Washington to finance its massive budget deficit in the months ahead.

“The economy continues to require the support of accommodative monetary policies,” Bernanke told lawmakers on March 25th. "If it were positive to take interest rates into negative territory I would be voting for that,” said the radical inflationist, San Francisco Fed chief Janet Yellen on Feb 22nd. Yet the Fed is winding down its year-long, $1.75-trillion monetization scheme this week, which could make it difficult for Washington to finance its massive budget deficit in the months ahead.

Instead, there could be a torrent of T-bond sales by Beijing, if the US-Congress can marshal a veto-proof majority, for a fast track bill in May, to slap tariffs on Chinese imports, if Beijing continues to keep the yuan “misaligned” with the US-dollar. “My belief is that China will not do anything unless they’re required to, and every day we wait is a day we lose wealth, we lose economic advantage, we lose jobs,” said New York Senator Charles Schumer on March 23rd.

Senator Lindsey Graham, a South Carolina Republican, said he agreed quick congressional action was needed because China’s currency reforms are frozen in suspended animation. “I think our pressure is going to make a difference, not only to China, but to the administration,” Schumer said. “At the end of the day, China is too big to be allowed to have this under-valued currency advantage. The only thing they seem to respond to is pressure,” Graham said.

“The US internal and external deficits remain large, and its unemployment rate is extremely high. Since US politicians don’t want to blame themselves, the best available scapegoat is China and its exchange rate,” said Fan Gang, of the People’s Bank of China on March 26th. Yet Fan conceded, that China may resume a managed float of the yuan, once the uncertainty of the overall post-crisis economic situation diminishes,” he said. Yet a stronger Chinese yuan could fuel a generalized rally in the commodity markets, and ignite a whole new round of inflation worldwide.

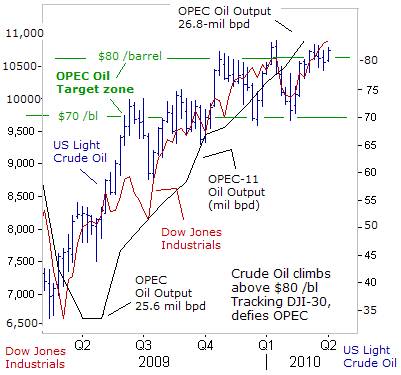

Another headache for the “Plunge Protection Team,” is the high and rising price of crude oil, which has hitched a ride to the global stock market rallies, and is now trading above OPEC’s implied target zone of $70-to-$80 /barrel. The OPEC cartel has tried to slow the surge of crude oil, by boosting its output to 26.8-million barrels per day (bpd), or roughly 2-million bpd above its self imposed quotas.

OPEC slashed it oil output quotas by 4.2-million bpd in December 2008 to stop the slide in oil prices at $35 /barrel. However, although OPEC’s compliance with the quotas has dropped to 53%, oil prices have continued to climb sharply higher, helped by stronger demand of roughly 900,000-bpd by China and India, and rapidly depleting oil output by Mexico’s giant oil company – Pemex.

Any significant rally by the Dow Jones Industrials above the psychological 11,000-level, could be matched by a similar rise in the price of crude oil, into the $85-to-$90 /barrel region, which in turn, could strengthen the Canadian dollar, Mexican peso, and Russian rouble, and the precious metals. In order to avoid another “Oil Shock” to the global economy, Washington and its European allies might ask Saudi Arabia to boost its oil output further, since Riyadh has about 2-million bpd of spare capacity that it can unleash on the market at a moment’s notice.

While Greenspan said he sees little threat of inflation now, in the long-run, inflation will pick up unless the Fed withdraws the massive stimulus it has pumped into the economy. “We are still by any measure in a disinflationary environment.” However, “unless we sterilize or unwind the big monetary base we’ve built-up, inflation will begin to take hold.” The size of the Fed’s balance is “not sustainable” and will eventually have to be reduced to “something just north of $1-trillion,” he said

“My concern is that legislation or other actions on the part of Congress may prevent the Fed from withdrawing the stimulus,” Greenspan added. Such actions have already taken place in Seoul, where the government has completely hijacked the monetary policy of the Bank of Korea. Texas Representative Ron Paul, a Republican, is leading an effort in Congress to repeal the Fed’s immunity to audits of monetary policy, which could expose any clandestine intervention in the stock index futures market by the Fed and its agents on Wall Street.

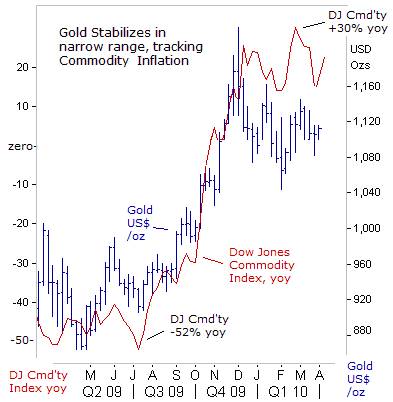

Still, there’s a deep-seeded suspicion in the gold market, that at some point, the Fed will resume its massive money printing operations, in order to prevent a surge in Treasury bond yields, sparking the next big round of inflation. Greenspan mostly lingered far behind the inflation curve when he was Fed chief, and never saw a bubble he didn’t like. According to the commodities markets, the break-out of inflation has already begun and is buoying gold above $1,100 /oz.

This article is just the Tip of the Iceberg of what’s available in the Global Money Trends newsletter. Subscribe to the Global Money Trends newsletter, for insightful analysis and predictions of (1) top stock markets around the world, (2) Commodities such as crude oil, copper, gold, silver, and grains, (3) Foreign currencies (4) Libor interest rates and global bond markets (5) Central banker "Jawboning" and Intervention techniques that move markets.

By Gary Dorsch,

Editor, Global Money Trends newsletter

http://www.sirchartsalot.com

GMT filters important news and information into (1) bullet-point, easy to understand analysis, (2) featuring "Inter-Market Technical Analysis" that visually displays the dynamic inter-relationships between foreign currencies, commodities, interest rates and the stock markets from a dozen key countries around the world. Also included are (3) charts of key economic statistics of foreign countries that move markets.

Subscribers can also listen to bi-weekly Audio Broadcasts, with the latest news on global markets, and view our updated model portfolio 2008. To order a subscription to Global Money Trends, click on the hyperlink below, http://www.sirchartsalot.com/newsletters.php or call toll free to order, Sunday thru Thursday, 8 am to 9 pm EST, and on Friday 8 am to 5 pm, at 866-553-1007. Outside the call 561-367-1007.

Mr Dorsch worked on the trading floor of the Chicago Mercantile Exchange for nine years as the chief Financial Futures Analyst for three clearing firms, Oppenheimer Rouse Futures Inc, GH Miller and Company, and a commodity fund at the LNS Financial Group.

As a transactional broker for Charles Schwab's Global Investment Services department, Mr Dorsch handled thousands of customer trades in 45 stock exchanges around the world, including Australia, Canada, Japan, Hong Kong, the Euro zone, London, Toronto, South Africa, Mexico, and New Zealand, and Canadian oil trusts, ADR's and Exchange Traded Funds.

He wrote a weekly newsletter from 2000 thru September 2005 called, "Foreign Currency Trends" for Charles Schwab's Global Investment department, featuring inter-market technical analysis, to understand the dynamic inter-relationships between the foreign exchange, global bond and stock markets, and key industrial commodities.

Copyright © 2005-2010 SirChartsAlot, Inc. All rights reserved.

Disclaimer: SirChartsAlot.com's analysis and insights are based upon data gathered by it from various sources believed to be reliable, complete and accurate. However, no guarantee is made by SirChartsAlot.com as to the reliability, completeness and accuracy of the data so analyzed. SirChartsAlot.com is in the business of gathering information, analyzing it and disseminating the analysis for informational and educational purposes only. SirChartsAlot.com attempts to analyze trends, not make recommendations. All statements and expressions are the opinion of SirChartsAlot.com and are not meant to be investment advice or solicitation or recommendation to establish market positions. Our opinions are subject to change without notice. SirChartsAlot.com strongly advises readers to conduct thorough research relevant to decisions and verify facts from various independent sources.

Gary Dorsch Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.