Gold Rises as Chinese Investment Demand to Double in "Exponential Growth"

Commodities / Gold and Silver 2010 Mar 29, 2010 - 06:35 AM GMTBy: GoldCore

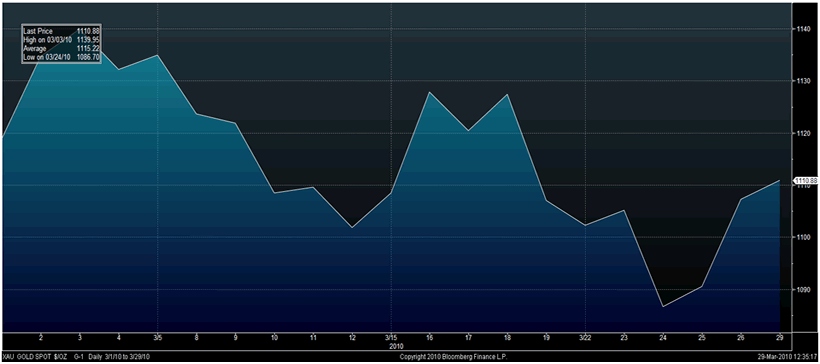

Gold closed at $1104.45/oz Friday night with a gain of 1.09% on the day in dollar terms, but a loss of 0.27% on the week. Prices were volatile this morning in Asian trading as gold surged in price to $1,114.60/oz prior to falling to $1,103/oz. Gold then gradually recovered in Asian trade and European trade as the dollar weakened. Gold is currently trading at $1,112.00/oz and €824.18/oz & £741.28/oz in EUR and GBP terms respectively.

Gold closed at $1104.45/oz Friday night with a gain of 1.09% on the day in dollar terms, but a loss of 0.27% on the week. Prices were volatile this morning in Asian trading as gold surged in price to $1,114.60/oz prior to falling to $1,103/oz. Gold then gradually recovered in Asian trade and European trade as the dollar weakened. Gold is currently trading at $1,112.00/oz and €824.18/oz & £741.28/oz in EUR and GBP terms respectively.

Gold (1 day)

Geopolitical tensions in Russia and North Korea are supporting gold. Terrorism remains a risk and the risk of a military confrontation between North Korea and South Korea remains real.

Gold is also being supported by the World Gold Council's projections regarding future demand for gold in China. Chinese demand may double in the next decade according to the World Gold Council and importantly this significant increase in demand comes at a time when production internationally has been falling in recent years.

Investment demand for gold is expected to see "exponential growth". While this may seem like hyperbole, it is not as the gold market in China was only liberalised in 2001; Chinese people could not own gold bullion since 1950. Thus per capita ownership of gold is well below western levels and massively below the per capita ownership seen in India.

Chinese demand from investors and the jewellery industry, which now accounts for 80% of purchases in China, reached 423 metric tonnes in 2009, while domestic mine supply was 314 tonnes. The output shortfall will create a "snowball effect" as the country's production fails to keep pace with the annual leap in consumption.

The World Gold Council is right when they say that higher mine development costs, potential supply disruptions, tougher safety regulations and depleting ore bodies could put a much higher floor under the gold price. Indeed the favourable supply demand fundamentals mean that gold should be very well supported with a floor above $1,000/oz.

Gold Daily (1 Month)

Silver

Silver closed at $16.86/oz on Friday a gain of 1.08% on the day, but a loss of 0.82% on the week. Silver is currently trading at $17.09/oz, €12.69/oz and £11.41/oz.

Platinum Group Metals

Platinum is trading at $1,604/oz, palladium at $741.28/oz and rhodium at $2,400/oz.

News

The outlook on Britain's triple-A rating remains negative due to worries over the government's rising debt burden, ratings agency Standard & Poor's said on Monday. S&P said it expected to review the rating once the medium-term fiscal outlook became clearer after the election, expected on May 6.

The "Rio Tinto four" have been jailed for lengthy periods in China. The four executives have been found guilty of bribery and stealing secrets by a Chinese court. Australian Stern Hu was handed a 10-year sentence. Wang Yong was given 14 years, Liu Caikui seven years and Ge Minqiang eight years. The four colleagues were also fined and had assets confiscated.

Crisis-hit Toyota said on Monday global sales rose 13 percent year-on-year in February, but analysts warned that the fall-out from recent mass safety recalls would continue to hang over the car giant. The Toyota group, which includes brands Daihatsu and Hino trucks, sold 613,845 vehicles worldwide last month, up from 543,435 a year earlier, a spokesman said.

US Treasuries have fallen again, pushing 10-year yields toward the highest level since June, before government reports this week that economists say will show consumer spending rose and the U.S. added the most jobs in three years. Concerns about the very large supply of US government debt is also weighing on the market.

This update can be found on the GoldCore blog here.

The Bullion Services Team

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.