Risk of Eurozone Sovereign Debt Contagion Bolsters Gold's Status as Currency Hedge

Commodities / Gold and Silver 2010 Mar 25, 2010 - 07:06 AM GMTBy: GoldCore

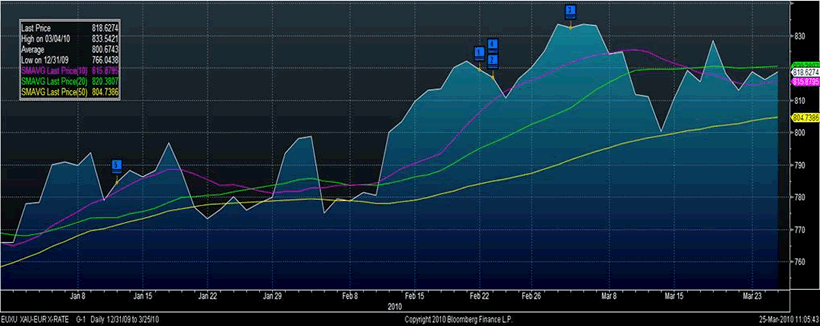

Gold closed at $1089.10/oz last night, having lost 1.36% on the day in dollar terms. Gold recovered in Asian and early European trading this morning and at the moment is trading at $1,093.40/oz. In EUR and GBP terms, gold is trading at €819.21/oz and £730.74/oz respectively . Gold rose in euro terms due to the risk of contagion in the eurozone and remains near record (nominal) highs of €833.54/oz reached on the March 4th (see chart).

Gold closed at $1089.10/oz last night, having lost 1.36% on the day in dollar terms. Gold recovered in Asian and early European trading this morning and at the moment is trading at $1,093.40/oz. In EUR and GBP terms, gold is trading at €819.21/oz and £730.74/oz respectively . Gold rose in euro terms due to the risk of contagion in the eurozone and remains near record (nominal) highs of €833.54/oz reached on the March 4th (see chart).

Should gold close above the recent record nominal high at €833/oz, there is no chart resistance and traders would look to psychological levels of €850/oz and €900/oz as possible next levels of resistance. Given the real challenges facing the euro, this seems very likely.

Gold in euro (YTD)

The eurozone's continuing financial problems were further hindered by the downgrading of Portugal's credit rating by Fitch (to AA- from AA with a negative outlook) which saw the euro fall versus the dollar, gold and some other currencies. Indeed, risk aversion saw equities, commodities, bonds and US Treasuries sell off yesterday as concerns continue about sovereign debt markets and how governments will fund surging budget deficits.

Increasingly frantic and frenetic efforts to contain the real risk of financial contagion continue. The eurozone is 'not out of the woods yet,' says EU Economics Commissioner Rehn and the significant fiscal challenges facing the PIIGS (Portugal, Italy, Ireland, Greece and Spain) look set to keep the euro under pressure for the foreseeable future. The risk of a break up of the euro currency is real and with the euro’s status as an international reserve currency being questioned, gold’s status as an international reserve asset and important currency hedge is being bolstered.

Gold in euro (1 Year)

Zhu Min, deputy governor of the People's Bank of China comments that the Greek debt crisis the “tip of the iceberg” are not helping sentiment in the currency and wider markets. He said that Chinese growth was likely to slow further in March, that China should and could move towards a floating currency regime, and that the Greece debt crisis was only the beginning of a wider global debt problem.

In these historic times, it is important to keep a long term historical perspective. Gold remains well below its inflation adjusted high reached in 1980 in all major currencies. Gold reached some $2,400/oz in inflation adjusted terms in 1980 and well over €1,200 per ounce (DM converted to euro). Thus, given the real risk of international contagion and an international monetary crisis, gold may challenge these inflation adjusted highs in the coming months.

Gold in euro in nominal terms (non-inflation adjusted) 1971-2010

Silver

Silver also ended the day with a loss, dropping 2.24% to $16.60/oz. Silver is currently trading at $16.74/oz, €12.55/oz and £11.19/oz.

Platinum Group Metals

Platinum is at the moment trading at $1,584/oz, palladium at $446/oz and rhodium at $2300/oz.

News

Gordon Brown’s imprudent and short sighted decision to sell some half of all the UK’s gold reserves may become an issue in the coming UK election. The decision taken when he was Chancellor – is increasingly being regarded as one of the Treasury's worst financial mistakes as it has cost British taxpayers almost £7 billion. Mr Brown and the Treasury have repeatedly refused to disclose any information about the gold sale amid allegations that warnings were ignored. In the event of an international monetary currency crisis, the UK’s now small gold reserves would not aid an embattled pound.

China looks set to be the primary driver of worldwide demand for gold, according to a new report from the Bank of America. "China's gold jewellery demand and retail investment will stay healthy in the coming years, which should provide continued support to the global gold market," the report stated. The Chinese government has opened up the investment market for the precious metal, as well as liberalising the jewellery market, allowing more consumers to put their money into gold, the bank's Merril Lynch analysts said. Not to mention China’s continuing central bank “stealth” increase in their gold reserves.

UK Chancellor Alistair Darling’s budget has received a mixed response with some thinking it reasonable and others seeing it as unrealistic, imprudent and a missed opportunity to steady the precarious state of the UK finances.

The Commodity Futures Trading Commission (CFTC) is to hear today from GATA who allege that the gold and silver markets are manipulated through large concentrated short positions by Wall Street investment banks. Reuters reports that the advocates for free markets will get a turn in the spotlight because of the hearing. According to GATA's blog, Bill Murphy’s, the Chairman of the Gold Anti-Trust Action Committee, invitation to speak at the hearing spurred an explosion of invitations for media interviews.

This update can be found on the GoldCore blog here.

The Bullion Services Team

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.