What if the Stock Market, Housing and Economy Since 1970 Was Just a Big Bubble?

Stock-Markets / Liquidity Bubble Mar 25, 2010 - 01:18 AM GMTBy: Tim_Iacono

One of the things that many people go through their entire lives without ever realizing is that conditions haven’t always been the way they remember them to be. Due to the length of a typical lifetime and the number of those years that individuals are productive, it’s reasonable to think that someone in their mid-60s could retire today and look back at the last 40 years only to conclude that what they just experienced was normal.

One of the things that many people go through their entire lives without ever realizing is that conditions haven’t always been the way they remember them to be. Due to the length of a typical lifetime and the number of those years that individuals are productive, it’s reasonable to think that someone in their mid-60s could retire today and look back at the last 40 years only to conclude that what they just experienced was normal.

But, what if the last 40 years were anything but normal?

What if, in the world of finance and economics, it was all just a big bubble?

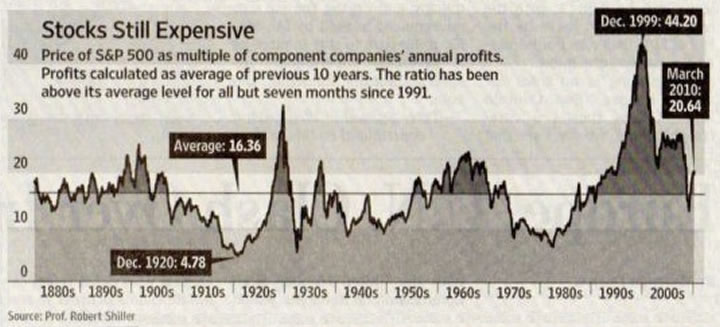

One look at the chart below from this recent Wall Street Journal story and it becomes instantly clear that stock market valuations over the last twenty years have been nowhere near normal. In fact, what were deemed “generational lows” for valuations at the peak of the financial market crisis a year ago look like nothing of the sort over the broad sweep of time.

And when you consider what happened in the natural resource sector in the 1970s and then what followed in Japan in the 1980s, it’s quite easy to come to the conclusion that, since the world left those last vestiges of sound money when Nixon closed the gold window in 1971, we live in a radically different world.

While some quickly dismiss ideas like this, reminding anyone who will listen that “correlation is not causation” while citing technological advances made during this time as just cause for the changes we’ve seen in financial markets, breakthroughs such as railroads and electricity a hundred or more years ago likely had a bigger impact on the world than computers, communication, and medical technology more recently.

The sad possibility that so few consider is that, what has happened in the last 40 years probably has much more to do with the financial system, credit, and debt than the technological advances themselves.

A brief stroll through recent history might be helpful in seeing just how accustomed we’ve become to bubbles and, as if we don’t know it already, how dangerous the financial world has become.

The Era of Disco and Inflation

Having survived World War II and emerged as the only superpower in the West, the U.S. navigated the early years of the Cold War with aplomb before embarking on Great Society spending in the 1960s and then positioning themselves for defeat in Vietnam only to go stumbling into the 1970s with, perhaps, its best years already behind it.

Having survived World War II and emerged as the only superpower in the West, the U.S. navigated the early years of the Cold War with aplomb before embarking on Great Society spending in the 1960s and then positioning themselves for defeat in Vietnam only to go stumbling into the 1970s with, perhaps, its best years already behind it.

The decisions made in the 1960s set off the first series of financial market bubbles during the previous secular bull market in the natural resource sector, an incompetent Arthur Burns at the helm of the Federal Reserve bending to political will and feeding an extended bout of inflation never before seen in the U.S.

As U.S. energy demand was soaring and U.S. oil fields were peaking, crises in the Middle East caused multiple oil price spikes and, by the end of the decade, a full-blown commodities bubble was in process.

The oil price moved from an inflation-adjusted $15 or $20 a barrel to $100 a barrel or more late in the decade and the gold price rose from its former $35 peg to a peak of over $800 just after the decade came to a close.

This was the first of many recent financial market bubbles in a new era of pure fiat money all around the world where rising and collapsing asset prices became an increasingly dominant theme, interrupted only briefly by the early-1980s “tough love” by a new, stern Fed chairman.

Not the Reagan Revolution You Thought

Many think that the main force behind the “Reagan Revolution” in the early-1980s was the embrace of free markets and a tilt toward conservatism, but, this only tells part of the story. Aided by the advancement of computer technology, credit markets in the U.S. and in other parts of world expanded by leaps and bounds and both public and private debt began to grow more quickly, bolstering economic growth.

Many think that the main force behind the “Reagan Revolution” in the early-1980s was the embrace of free markets and a tilt toward conservatism, but, this only tells part of the story. Aided by the advancement of computer technology, credit markets in the U.S. and in other parts of world expanded by leaps and bounds and both public and private debt began to grow more quickly, bolstering economic growth.

Fed chairman Paul Volcker induced two debilitating recessions during Reagan’s first few years, breaking the back of wage-driven inflation that came before the waves of cheap foreign imports and the removal of actual costs of homeownership (replaced with the nefarious “owners’ equivalent rent”) in the consumer price index that would forever distort the government’s measure of inflation.

Bond markets saw their first large-scale excesses and the stage was set for a two-decade long bull market in U.S. stocks. Meanwhile, a housing “warm-up” bubble inflated in some parts of the country, aided by a Savings and Loan crisis that now looks almost quaint in comparison to the more recent banking crisis.

But, the real action in the 1980s was in Japan where both real estate and stock prices rose to heights that, even in comparison to recent events, are still quite impressive. As always seems to be the case, too few questions were asked during the inflation of the bubble and too few lessons were learned after it burst.

By the end of the decade, people everywhere were already becoming conditioned to expect financial market bubbles – periods of rapid price increases and heady economic growth that would only accelerate in the decades ahead.

Another “New Economy” Era

Major changes in retirement planning driven by the growing use of 401k plans, ongoing advancements in personal computing, and a rapidly growing financial services industry led to the greatest expansion in stock ownership in history during the 1990s and the U.S. was primed for a major stock market bubble of its own.

Major changes in retirement planning driven by the growing use of 401k plans, ongoing advancements in personal computing, and a rapidly growing financial services industry led to the greatest expansion in stock ownership in history during the 1990s and the U.S. was primed for a major stock market bubble of its own.

Widespread use of the internet by corporations early in the decade led to a similar adoption for residential users and the great broadband infrastructure roll-out provided high speed internet access to a growing number of individuals. Meanwhile, NASDAQ stocks began to climb at a dizzying pace.

Fed chairman Alan Greenspan, who had set the tone early in his tenure through both word and deed following the 1987 U.S. stock market crash, retreated from mid-decade “irrational exuberance” warnings to embrace the “New Economy” along with its new, higher stock prices.

After being credited with “saving the world” during the 1997 Asian financial crisis, the man once referred to as “the greatest central banker ever” watched as a new century was ushered in and NASDAQ stocks soared past the 5,000 mark only to find that this bubble too would finally meet its pin.

In what would soon become a recurring nightmare, many retirement dreams were dashed as investors of all stripes reflected on what they had just seen. Though Japan had experienced much the same thing the decade before, this was the first time that the American people participated broadly in the inflation and bursting of a major asset bubble and many of them were chastened. Unfortunately, many others were emboldened.

Bursting Bubbles Everywhere

In a previous era or under different circumstances, the 2000 stock market crash might have been followed by a long period of bubble-free reflection on what had just transpired as millions of Americans looked back at how they were so caught up in such ridiculous ideas as Pets.com, but, that was not to be.

In a previous era or under different circumstances, the 2000 stock market crash might have been followed by a long period of bubble-free reflection on what had just transpired as millions of Americans looked back at how they were so caught up in such ridiculous ideas as Pets.com, but, that was not to be.

In a system of money and credit where there is virtually no limit on how much of the stuff can be created, there was a natural remedy for the economic downturn that followed the bursting of the internet bubble and the attacks that are now forever referred to as simply 9/11.

All through the 18-year bull market in stocks, the nation’s housing market had been just sitting there waiting to be goosed, experiencing only short-lived, localized bouts of irrational exuberance and disappointment in such places as Houston during the U.S. oil boom and parts of California and Massachusetts later on.

Under the guiding hand of a revered Fed chairman, interest rates were slashed and a refinancing boom was kicked off only to be followed by some of the most outrageous excesses in mortgage lending the world has ever seen.

Despite signs that were obvious to many as early as 2002 and 2003, the housing bubble morphed into a broader credit bubble and the two proceeded to inflate to ever more dangerous levels as banks, hedge funds, governments, and the real estate industry joined forces to create the biggest and most dangerous bubble yet.

Beginning in 2006 and culminating with the global financial market crash in late-2008, another massive financial market bubble met its fate and, now, the world sits and waits.

Where to from Here?

No one’s quite sure where we’ll go from here, but an increasing number of people are beginning to wonder if this is the end of the road. That is, if the last forty years were all just one big money and credit bubble, temporarily misinterpreted as prosperity, that can produce no more bubbles except for the one that is most feared – another massive bubble in natural resources as a relatively fixed supply of goods meets up with an unlimited supply of paper money.

It’s no coincidence that the almost non-stop sequence of financial bubbles over the last forty years followed the abandonment of anything resembling a system of sound money.

Contemporary economic thought posits that money is simply a “unit of account” and that there is no longer any need for it to maintain an intrinsic value of any sort. They say it’s just “notations on paper” and that the world’s economic and financial wizards, though set back a bit by their latest failure, have things squarely under control.

If you’re anything like me, you don’t believe that for a second.

In the fullness of time, the last forty years will likely be seen as an aberration – just one big bubble – as theories are abandoned and a more enlightened approach ultimately prevails.

Unfortunately, between now and then, things are likely to get worse before they get better.

By Tim Iacono

Email : mailto:tim@iaconoresearch.com

http://www.iaconoresearch.com

http://themessthatgreenspanmade.blogspot.com/

Tim Iacano is an engineer by profession, with a keen understanding of human nature, his study of economics and financial markets began in earnest in the late 1990s - this is where it has led. he is self taught and self sufficient - analyst, writer, webmaster, marketer, bill-collector, and bill-payer. This is intended to be a long-term operation where the only items that will ever be offered for sale to the public are subscriptions to his service and books that he plans to write in the years ahead.

Copyright © 2010 Iacono Research, LLC - All Rights Reserved

Tim Iacono Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.