U.S. Economy, Banking Sector and Gold, Houdini Lives!

Stock-Markets / Financial Markets 2010 Mar 24, 2010 - 03:37 AM GMTBy: Steve_Betts

Un giorno diverrai cenere ed ombra, un nome e non piu. (One day you will become shadows and ashes, a name and nothing more.) Aulo Persio Flacco

Un giorno diverrai cenere ed ombra, un nome e non piu. (One day you will become shadows and ashes, a name and nothing more.) Aulo Persio Flacco

The banking system continues to suffer setbacks and the FDIC continues to absorb the mistakes. On Friday they announced the closure of seven more failed institutions, bring the total up to 37 for the year and well ahead of last year’s total of 21 thru March 31st. Here are the new victims:

- State Bank of Aurora, Aurora, MN, with $28.2 million in assets and $27.8 million in deposits was closed. Northern State Bank, Ashland, WI has agreed to assume all deposits.

- First Lowndes Bank, Fort Deposit, AL, with $137.2 million in assets and $131.1 million in deposits was closed. First Citizens Bank, Luverne, AL has agreed to assume all deposits.

- Bank of Hiawassee, Hiawassee, GA, with $377.8 million in assets and $339.9 million in deposits was closed. Citizens South Bank, Gastonia, NC has agreed to assume all deposits, excluding certain brokered deposits.

- Appalachian Community Bank, Ellijay, GA, with $1.01 billion in assets and $917.6 million in deposits was closed. Community & Southern Bank, Carrollton, GA has agreed to assume all deposits.

- Advanta Bank Corp., Draper, UT, with $1.6 billion in assets and $1.5 billion in deposits was approved for payout by the FDIC Board of Directors.

- Century Security Bank, Duluth, GA, with $96.5 million in assets and $94.0 million in deposits was closed. Bank of Upson, Thomaston, GA has agreed to assume all deposits, excluding certain brokered deposits.

- American National Bank, Parma, OH, with $70.3 million in assets and $66.8 million in deposits was closed. The National Bank and Trust Company, Wilmington, OH has agreed to assume all deposits, excluding certain brokered deposits

Advanta Bank Corp. in Utah was the largest failure with US $1.6 billion in assets and it has yet to be assumed by another bank unlike the other six. There are estimates that put the level of failures in 2010 as high as 500 but it is still too early to tell.

When we look at a one-year chart of the Philadelphia Banking Index, we can see that it recently struggled to a higher high, closing several points above the October 2010 high. This new high was not confirmed by SI or MACD and that seems to be a trend found in most markets today, i.e., weak technical indicators. I suspect the Index is being supported by the behavior of a very small number of very large institutions that have benefited from free government money. The real problem with the banking sector, as with all facets of the US economy, is the staggering amount of bad debt they hold in their portfolios. To date it’s a problem that no one is willing to tackle.

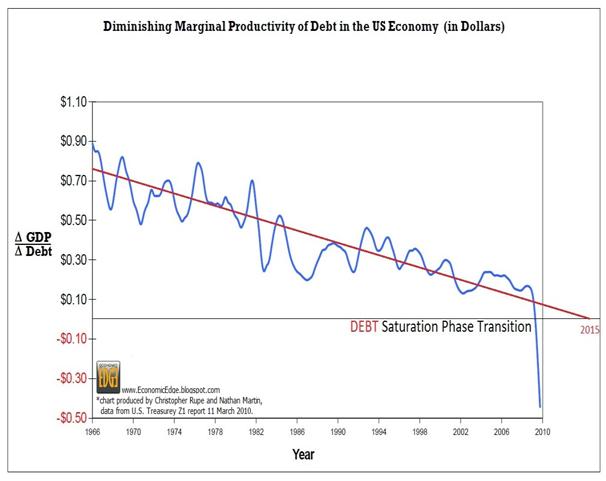

In April we’ll begin to get a look at the first quarter balance sheets of large companies and banks that have off balance sheet entities that are now required to be marked to market. The fact that debt exists is not necessarily

a bad thing, as long as it is used to produce something constructive. In other words a dollar’s worth of debt should be used to produce something that’s worth more than a dollar. Unfortunately, as the preceding chart shows, that is no longer the case in the United States. Beginning with the third quarter of 2009, each dollar of debt added to the economy a negative 15 cents of productivity, ad toady each new dollar of debt extracts 45 cents from the economy. Can anyone see a little problem here?

Finally I would like to close with a few words on gold. If you take a look at gold’s rally from October 2008 to date, you’ll see that the trend remains

remains up in spite of the decline from the top in December of last year. In fact if you look at the big picture this “decline” has been more sideways than down in spite of the gains that preceded it. To me it looks like the market had a mild decline and is now going through a period of accumulation, just as it did after the February 2009 high, in preparation for another leg up. I know that many are calling for a decline down to 920.00, or worse, but there is absolutely no justification for that in this chart. Gold is building a base, with strong support at 1,044.80, and that base will serve as support for a run up to 1,500.00. My guess is that we’ll see the beginning of the run in April and it will rally into late September or even October before we see a meaningful correction. Those who have abandoned their positions in anticipation of jumping back in at a lower price will be left standing at the altar.

By Steve Betts

E-mail: team@thestockmarketbarometer.com

Web site: www.thestockmarketbarometer.com

The Stock Market Barometer: Properly Applied Information Is Power

Through the utilization of our service you'll begin to grasp that the market is a forward looking instrument. You'll cease to be a prisoner of the past and you'll stop looking to the financial news networks for answers that aren't there. The end result is an improvement in your trading account. Subscribers will enjoy forward looking Daily Reports that are not fixated on yesterday's news, complete with daily, weekly, and monthly charts. In addition, you'll have a password that allows access to historical information that is updated daily. Read a sample of our work, subscribe, and your service will begin the very next day

© 2010 Copyright The Stock Market Barometer- All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.