Stock Market Dow Theory Contrived Buy Signal or Paranoia?

Stock-Markets / Stocks Bear Market Mar 23, 2010 - 04:22 PM GMTBy: Brian_Bloom

Am I being paranoid? Was the spike in the Dow Jones Industrial Index – which took it to a new high thereby resulting in a Dow Theory buy signal – contrived?

Am I being paranoid? Was the spike in the Dow Jones Industrial Index – which took it to a new high thereby resulting in a Dow Theory buy signal – contrived?

Have a look at the chart below (courtesy yahoo.com)

5 minute chart of the Dow shows:

A false breakout from a rising wedge at close of play last Thursday – leading to a Dow Theory buy signal when the Dow “spiked” to a new high.

A price reversal on Friday morning leading to a true breakdown from that rising wedge.

A sharp rise on Monday morning, but culminating in another breakdown from another rising wedge in context of a rise that could be argued to have been a double top. Interestingly the spike rise on Monday, March 22, also occurred soon after the opening – which begs the question: “Why would the passage of the new Health Services Bill be deemed to be good news from a corporation’s perspective?”

As you know, I don’t trust short term charts anymore because of the trading noise, but this looks suspiciously to me like an attempt (and failure) to get the Industrial Index to break up through long term resistance so that it might run.

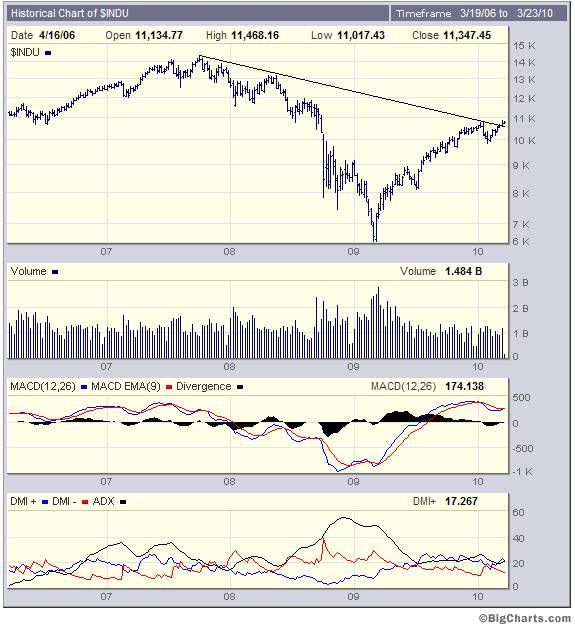

The long term (weekly chart) looks like this (courtesy Bigcharts.com):

Note how the price broke up through the down trend line on rising volume last week. However, in context of the “spike” that occurred at the close on Thursday 18th and in context of the subsequent pullback from that spike’s top, we need to allow some time to pass before we draw conclusions. I don’t like the feel of this. There is no fundamental reason I can think of why the markets should be anticipating rising corporate profits in the next year or two.

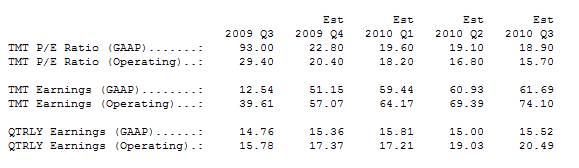

If you have a look at the forecast (GAAP adjusted) profits (twelve month trailing earnings) (courtesy Decisionpoint.com) you will see that the rate of growth of profitability (adjusted for GAAP) is being forecast by management to slow down

TMT Q2/Q1 = 60.93/59.44

= 2.5% growth

TMT Q3/Q3 = 61.69/60.93

=1.25% growth

If management is forecasting profitability growth rate to slow, why would the Dow Jones break to new highs from a base starting point P/E ratio of 19.6X? 19.6X P/E ratios manifest – fundamentally – when the market expects profitability to rise sharply. In an environment of flattening earnings, P/E ratios of closer to 12X – 15X are more appropriate.

Conclusion

Fundamentally, there is a logical disconnect here. This disconnect is being accompanied by some rather odd looking short term market behaviour. When these two factors are viewed side by side, a warning bell can be heard. Caution is advised.

Afterthought

I have been copping a lot of flack for having had the gall to suggest that the Central Banks are probably not trying to manipulate the gold price at this stage.

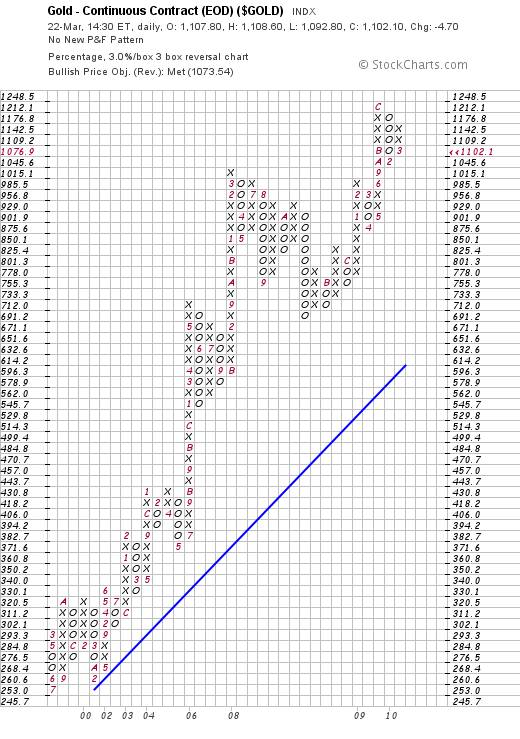

In summary, I stick by my view – which is not intended to be controversial. If one takes a ten year view of the gold price chart one sees that the price of gold has quadrupled in that time – against a background where the central banks were certainly (at one time) attempting to prevent a rise. But a fourfold increase in the face of such attempts represents a miserable failure – if the central banks were in fact trying to suppress the gold price during all that time. Frankly, one would have to assume that the central banks of the world are populated by intellectual hunchbacks if, in the face of such miserable failure, they still believe they have the capacity to change the direction of the Primary Trend of the gold price.

If one has a look at the P&F chart of gold below, one sees that the gold price is sitting on support

If the gold price falls below $1,100 a ounce it can be expected to continue falling and to break down through the rising trend line.

In context of the P&F chart below – which has been sensitized to reflect movements of 3% or more – it is clear that the gold price had risen to a point where it became overbought. (Amazing given the alleged price suppression activity of the world’s central banks)

Overall Conclusion

Paranoia can be a two way street. If the market appears to be moving contrary to expectations it pays to find a quiet place to sit and think. Logic dictates that there is no (visible) fundamental reason why the Industrial. Index should be powering upwards. Logic dictates that the gold price needs to consolidate within the confines of a primary bull market. Technically, if the “volume of cash” was what was driving the Industrial Index to new heights, then that same volume of cash should be driving the gold price to new heights. Something is out of kilter here and that something does not have a good feel to it. Perhaps, at the end of the day, it is not a happy state of affairs when the President of a country is prepared to ram a law down the throats of the broader population, who are signaling serious concerns with that law, in order the protect the interests of a minority proportion of that population.

By Brian Bloom

Once in a while a book comes along that ‘nails’ the issues of our times. Brian Bloom has demonstrated an uncanny ability to predict world events, sometimes even before they are on the media radar. First he predicted the world financial crisis and its timing, then the increasing controversies regarding the causes of climate change. Next will be a dawning understanding that humanity must embrace radically new thought paradigms with regard to energy, or face extinction.

Via the medium of its lighthearted and entertaining storyline, Beyond Neanderthal highlights the common links between Christianity, Judaism, Islam, Hinduism and Taoism and draws attention to an alternative energy source known to the Ancients. How was this common knowledge lost? Have ego and testosterone befuddled our thought processes? The Muslim population is now approaching 1.6 billion across the planet. The clash of civilizations between Judeo-Christians and Muslims is heightening. Is there a peaceful way to diffuse this situation or will ego and testosterone get in the way of that too? Beyond Neanderthal makes the case for a possible way forward on both the energy and the clash of civilizations fronts.

Copies of Beyond Neanderthal may be ordered via www.beyondneanderthal.com or from Amazon

Copyright © 2010 Brian Bloom - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Brian Bloom Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.