A Hard Look at Gold, Silver Premiums

Commodities / Gold and Silver 2010 Mar 23, 2010 - 10:16 AM GMTBy: Tarek_Saab

Lost in the daily commentary about gold and silver prices is the actual cost of taking possession of these precious metals. Unless you trade in paper GLD or SLV, or you store your bullion in overseas vaults with companies like Goldmoney, the actual cost to purchase gold and silver can diverge from the COMEX spot price by as much as 36% (as I will show below). We have analyzed the premiums for these two monetary metals over the past year and a half, and we hope to offer some perspective on "real" market prices.

Lost in the daily commentary about gold and silver prices is the actual cost of taking possession of these precious metals. Unless you trade in paper GLD or SLV, or you store your bullion in overseas vaults with companies like Goldmoney, the actual cost to purchase gold and silver can diverge from the COMEX spot price by as much as 36% (as I will show below). We have analyzed the premiums for these two monetary metals over the past year and a half, and we hope to offer some perspective on "real" market prices.

For the benefit of novice investors: Spot price is the settlement price per ounce of gold and silver for future delivery through the Commodities Exchange (COMEX). This price fluctuates by the minute, like stocks on the NY Stock Exchange. The "spot" is the price referenced by talking heads when referring to the "price of gold" or the "price of silver," etc, and it is a value used by dealers when setting bullion prices. The premium per ounce is the markup charged by mints and dealers when trading consumer-grade bullion (i.e. anything smaller than 400 oz gold bars). Together, these two numbers comprise the total cost of purchasing precious metals in physical form. The same definitions apply to platinum and palladium.

In contrast to the spot price, where there is a clear historical price record, minimal reliable information exists concerning fluctuations in metals premiums. This is because measuring accurate market premiums is an inexact science and highly labor-intensive, as premiums vary considerably by mint, supplier, product, weight, order volume, and of course, demand. As part of our ongoing company research, we analyze market moves in premiums by using very basic criteria, focusing mostly on high volume dealers and popular products to paint a broad picture of price movements. Note: These are approximations only.

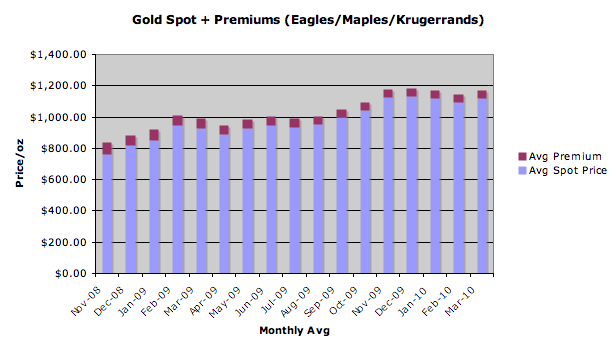

GOLD

Data through March 20th

For the purposes of this study, we have included only the most popular gold coins: the one ounce (by gold weight) US Mint Eagles, Royal Canadian Mint Maple Leafs, and the grandfather of them all, the South African Krugerrand. Over the past seventeen months, gold's average spot price has been $975.15, and its average premium per ounce for an order of twenty ounces has been $58.18. The percentage of premium to total (again, defined as 'spot' plus 'premium') is 5.6%. This percentage peaked in November of 2008 at 9.4% ($760.86 spot + $79 average premium) and currently sits at 4.2% ($1,119.85 spot + $49 average premium).

Some will argue that ancillary costs such as shipping and insurance should be factored into the total, but since the industry standard is "free shipping and insurance," these costs are not measured.

SILVER: GOVERNMENT ISSUE COINS

Silver prices vary considerably by marking. Private mints producing silver "rounds" compete for market share with government mints producing silver "coins." Additionally, the popularity of larger forms of silver such as 100 oz and 1,000 oz bars causes the silver market to vary more widely than the gold market.

We have focused specifically on the premiums for one ounce coins, and the chart below highlights the two most popular government coins: the US Mint Eagles and Royal Canadian Mint Maple Leafs.

Over the past seventeen months, silver's average monthly spot price has been $14.51, while the average premium for an order of 500 ounces of government coins has been $3.53. The percentage of premium to total is 19.5%. This percentage peaked in December of 2008 at a whopping 36.8% ($10.28 spot + $5.99 average premium) and currently sits at 12.9% ($17.17 spot + $2.55 average premium).

The incredible spike in premiums at the end of 2008 and into 2009 caused many investors to "arbitrage" their government coins. Investors would sell their coins and repurchase cheaper, private issue silver rounds. In doing so, they increased their total silver holdings without any additional cash outlay.

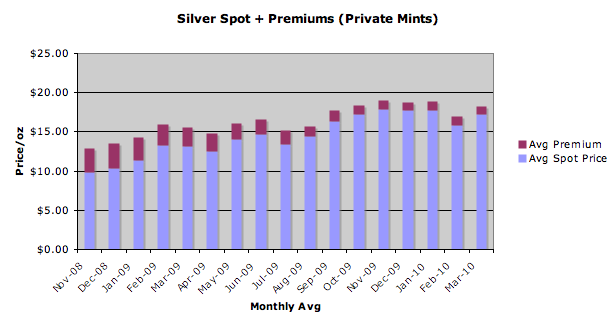

SILVER: PRIVATE MINT

Private issue mints offer a seemingly endless variety of products: from well-known rounds like Sunshine, Silvertowne, and A-Mark, to the no-name brands minting everything from Obama heads to bar mitzvah designs. If it weighs one troy ounce and its purity is .999 or greater, anything silver falls into this category.

As mentioned above, silver's average monthly spot price has been $14.51 over the past seventeen months. The average premium for an order of 500 silver rounds has been $1.87. The percentage of premium to total is 11.4%. This percentage peaked in December of 2008 at 24% ($10.28 spot + $3.25 average premium) and currently sits at 6.0% ($17.17 spot + $1.09 average premium).

CONCLUSION

Several conclusions may be drawn from the data above:

-Gold offers the best premium to total cost ratio. Following this ratio exclusively, gold is a more conservative investment than silver. Similar to spot price movements, gold's premiums fluctuate less dramatically than silver's, meaning one's investment is less beholden to upward movements in spot price in order to realize "profit."

-Silver's premiums fluctuate widely, spiking due to supply constraints at the mints and dropping when demand eases. This is especially true of government coins.

-The significant price difference in silver premiums between government coins and privately minted rounds opens arbitrage opportunities during large market disruptions, like in 2008.

If metals prices fall under deflationary pressure, expect buyers to place demand pressure on the markets - especially in silver - and the premiums to rise congruent with 2008 levels, especially with respect to government coins. Should hyperinflation ensue - a scenario I deem less likely in the near term - average buyers may be priced out of the market altogether.

'Til next time, that's my Saab Story.

By Tarek Saab

Tarek Saab is a former finalist on NBC's "The Apprentice" with Donald Trump. He is an international speaker, syndicated author, entrepreneur, and the President of Guardian Commodities. His website is www.guardiancommodities.com

© 2010 Copyright Tarek Saab

- All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.