Obama's Health Care Bill to Contribute to Surging US Budget Deficits

Commodities / Gold and Silver 2010 Mar 22, 2010 - 07:17 AM GMTBy: GoldCore

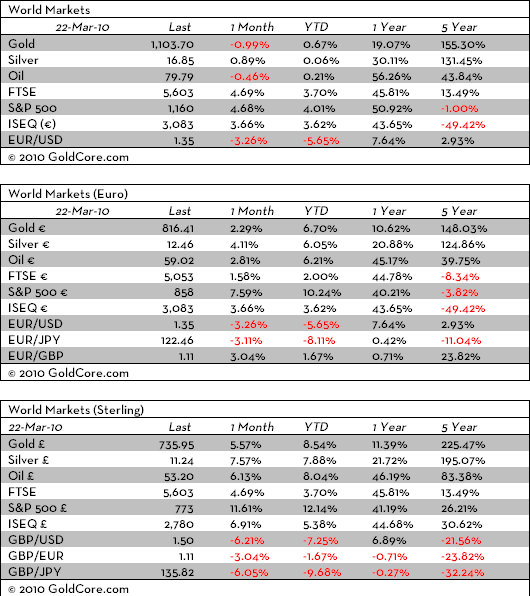

Gold sold off aggressively on Friday, closing at $1107.40/oz in New York, showing a loss of 1.8% on the day. However, it was still up 0.54% on the week which is important from a technical perspective. Gold traded nearly flat this morning in Asian trading and is currently trading at $1,104.70/oz and €816.48/oz & £736.37/oz in euro and GBP terms respectively.

Gold sold off aggressively on Friday, closing at $1107.40/oz in New York, showing a loss of 1.8% on the day. However, it was still up 0.54% on the week which is important from a technical perspective. Gold traded nearly flat this morning in Asian trading and is currently trading at $1,104.70/oz and €816.48/oz & £736.37/oz in euro and GBP terms respectively.

Friday’s fall was likely due to the dollar strength and increasing concerns about whether the EU can resolve the Greek economic crisis. Increasing tensions between eurozone partners about how to resolve the crisis is making markets nervous and leading to a selloff in the euro. Gold’s higher weekly close will embolden the technical and momentum traders.

Gold was volatile last week and the selling on Friday was very aggressive. Gold fell very sharply by some $15 ($1,122/oz to $1,107/oz) in just a few minutes leading some to surmise that a large fund liquidation may have been responsible. The dollar has been high all morning. Some such as GATA will claim that the selling was unusual and was designed to manipulate the gold market lower. The CFTC meeting on position limits takes place this Thursday March 25, where invited guests will get the chance to make a five minute presentation before receiving questions from the panel.

Fundamentally, central bank and investor safe haven demand looks set to continue while sovereign debt issues remain to the fore and this should see gold continue to perform well for the foreseeable future.

Obama’s health care reform will increase the size of the US budget deficit and increase concern about the value of US bonds and the dollar. The International Monetary Fund on Sunday urged countries, particularly those with advanced economies, to pare their fiscal deficits and debt to prudent levels by carrying out pension and health entitlement reforms (see below). IMF First Deputy Managing Director John Lipsky said in remarks delivered in Beijing that high public debt and fiscal deficits have already raised the risk premium for several countries, and could lead to higher interest rates and slower economic growth in the medium term.

Support is at $1,100/oz and a close below that level could see gold under liquidation pressure and see falls back to support at $1,090/oz and potentially to strong support at $1,060/oz.

Silver

Silver closed at $17.00/oz on Friday, remaining unchanged on the week. Silver is trading at $16.86/oz, €12.46/oz and £11.24/oz at the moment.

Platinum Group Metals

Platinum is trading at $1,581/oz, palladium at $458/oz and rhodium at $2425/oz.

News

China's commerce minister warned the US yesterday against imposing trade sanctions over Beijing's currency controls. He said his country was likely to report a trade deficit in March. Washington and other trading partners are pressing China to ease controls that have kept its yuan currency steady against the dollar for 18 months. Some US lawmakers have demanded to have China declared a currency manipulator in a US Treasury Department report due out next month, which could precede possible trade sanctions.

The International Monetary Fund warned the world's wealthiest nations Sunday to watch their surging levels of government debt, saying it could drag down the growth needed to ensure continued economic recovery. The economic crisis is leaving "deep scars in fiscal balances, particularly in the advanced economies," John Lipsky, First Deputy Managing Director, told the China Development Forum in Beijing. He said that countries that have been going into debt to stimulate their economies should now prepare for belt-tightening steps next year.

Crude oil futures fell some 0.7% last week and fell again today during Asian and early European trading hours despite a weakening US dollar.

Indian stock markets fell Monday, reacting to fears the Reserve Bank of India may raise interest rates a few more times in coming months after Friday's surprise hike amid robust economic indicators and soaring inflation.

This update can be found on the GoldCore blog here.

Mark O'Byrne

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.