China Joins Inflation Mega-Trend, Stock Market Drifts Higher Into Resistance, Delaying Correction?

News_Letter / Financial Markets 2010 Mar 19, 2010 - 06:47 PM GMTBy: NewsLetter

The Market Oracle Newsletter

The Market Oracle Newsletter

March 14th, 2010 Issue #15 Vol. 4

China Joins Inflation Mega-Trend, Stock Market Drifts Higher Into Resistance, Delaying Correction?Dear Reader The stock market drifted higher all week with the Dow closing up at 10625, meanwhile the FTSE raced ahead to a new bull market high of 5625, which is not surprising given the fact that the FTSE is mostly populated with international companies with a large % of overseas earnings, therefore a 10% drop in sterling makes these stocks 10% cheaper hence the out performance of the nominal indices. China Joins the Inflation Mega-Trend - China's inflation rate jumped far higher than academic economist expectations to stand at 2.7% for February. This is just another small step in the manifestation of Inflation Mega-Trend which the ebook covers at length, which also includes a section on China eventually exporting their inflation abroad (Inflation Mega-Trend Ebook Page 55). It should not take a genius to work out that an overheating chinese economy pumped up on stimulus steroids that is not allowing its currency to appreciate is going to experience a surge in inflation sooner rather than later. Chinese "communist party" officials are apparently more competent at handling the economy than their "capitalist" western colleagues, have already moved to raise bank reserve requirements twice in an attempt to alleviate inflationary pressures, though in my opinion there is nothing they can do to prevent the manifestation of the Inflation Mega-trend especially as China looks set to increasingly feel the impact of old age (demographics) over the coming decade, hence cheap labour will start to evaporate, again I refer you to the Inflation Mega-Trend ebook section on China. Meanwhile the deflationists that so vocally populate every crook and cranny of the internet and mainstream press remain hooked on debt deleveraging deflation. THAT IS YESTER YEARS STORY ! TODAYS STORY IS INFLATION!!!. As ever by the time it is recognised the market will have long since moved, and NO you cannot go back to 9th of March 2009 and pretend you were able to buy a bear market rally in hindsight! As I warned of in early April 2009. Stealth Economic Recovery - Whilst the UK's mini debt fuelled economic boom has yet to materialise, though forecast to manifest itself fully by the time of the next general election (Inflation Mega-trend Ebook Page 28). Sustainable growth requires jobs creation, and these jobs will have to come from the private sector, so public sector job cuts are good in cutting unproductive spending, but they must be accompanied with tax cuts and incentives for corporations that enables sustainable productive jobs to be created. Therefore the next government must be business centric as that is the only way for Britain to grow its way out of the current debt crisis. So, UK's stealth economic recovery marks time awaiting the corporate sector to be let loose FOLLOWING the next election, which should more than offset public sector contraction.

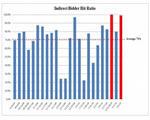

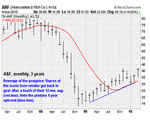

Sterling - Continues to bounce into the target zone of £/$1.52 to £/$ 1.53, however the current pattern could morph into a double bottom that would extend the rally to £/$1.55. Nevertheless this price action is still seen as correcting the preceding downtrend and therefore still suggests a downtrend that targets £/$ 1.40, remember that the U.S. Dollar is in a bull market. (Inflation Mega-Trend Ebook Page 51) . A lot of election risks mean sterling will be volatile, especially if the polls narrow as a Labour majority government would spell disaster for Britain and the currency as a consequence of 5 more years of huge deficits as Labour panders to its traditional public sector voter base. The only positive is that the Bank of England and Government have long since learned the lesson from the early 1990's that they cannot PREVENT sterling from falling, therefore there are no crackpot policies in place such as trying to peg sterling to the Euro and no announcements of wanting to defend any level against any currency, which would act as a red flag to the forex markets, without such a focal point there exists a more diverse market for sterling as market participants act on differing opinions. Crude Oil, continues to drift higher at above $80, there appears to be a building geopolitical risk that is slowly being priced into the crude oil price (More on the Peak Oil Mega-trend in Inflation Mega-Trend Ebook Page 77). Quantitative Easing Smoke and Mirrors - A few emails sent my way refer to the U.S. Fed having ended money printing this month and the Bank of England expected to follow, which is contrary to my view that money printing will not end. Whilst I don't track too closely what goes on in the U.S., however digging beneath the hood, I do see something strange in that tax payer bailed out Fannie and Freddie announced this month that they are BUYING out approx $200 billion of mortgage backed securities at par value! Think about that for a moment. This means Q.E. IS continuing by means of alternative strategies. I.e. Instead of the Fed pumping in $200 billion, it is now Fannie and Freddie effectively pumping in $200 billion into the banking system to drive mortgage interest rates lower. I expect similar slight of hand Q.E. to take place in the UK also to effectively continue Q.E. UK is forecast to print an additional £75 billion this year (Inflation Mega-Trend Ebook Page 25), it remains to be seen how this new money will be issued. Lehman's $50 Billion Fraud Report - A 2,200 page report hit the press this week that illustrates how Lehman's perpetrated a fraud estimated at $50 billion. MSNBC has prepared a good 10 minute news story that covers this in detail here. In Britain, we are still awaiting for our own fraud inquires into the bankrupt banks paying themselves billions in bonuses on the basis of fictitious fraudulent profits, but we are just not going to get one, not for perhaps 10 years or longer, even though London is at the centre of the Lehman's Fraud. Dow Quick Update - The Trend Remains Your Friend (which is UP)- Last weeks quick update concluded in an early week rally to approx 10,625 before a correction lower. Instead the Dow spent the week drifting higher into a close of the week at 10,625, the Dow remains stuck in its range as it drifts into resistance. Basically there's very little buying and selling taking place which is why the market is drifting higher (we are in a bull market after all). Short-term trading, I still await the short reversal trigger off of the current rally for a target drop into the 10,000 to 10,200 zone. But no triggers so far. Though given the fact that the Dow is now at 10,625 and the bull market peak is 10,730, well it has to be a question of now or never! More on trading in a future book / ebook. Yes there are risks, especially with regards sovereign debt default risks such as we are seeing with Greece, but the best time to invest is when the perceived risks are high. The strategy remains for accumulating on corrections into the target sectors (see ebook), so even without a general market correction materialising the strategy is to accumulate on sector corrections. The stock market analysis is due an in-depth update given the price action over the past 6 weeks (02 Feb 2010 - Stocks Stealth Bull Market Trend Forecast For 2010) which I aim to perform this coming week. I have received several comments about my portfolio breakdown, I responded with the following responses to last weeks newsletter - Portfolio Specific Comments: Bill Mohl - Gold Your gold update is way off! We'll see approx. 600 in the next 3 to 8 months!! Bill Nadeem_Walayat - Gold I only have 2.5% of my wealth in gold & silver, IF it fell to $600 then I would increase this to about 6% Angela - asset allocation for inflation mega-trend 2.5% gold and silver at present price! Please could you share with us the percentages you allocate to other asset classes/sectors? Thank you Nadeem AV Nadeem_Walayat - Portfolio My portfolio breakdown ? Cash deposits various currencies - 15% Fixed Interest Bonds (not floating) 50% Index linked Gilts 5% Stocks 20% (25% is maximum risk) Commodities 10% No property (pending conclusion of next ebook) No Bonds (floating) Craig Fisher - Bonds & Cash Why do you have 70% invested in bonds and cash if you expect inflation ? Nadeem_Walayat - Risk Profile http://www.marketoracle.co.uk/Article6675.html Younger people with smaller portfolios can probably cater for a more risk profile i.e. more in stocks & commodities, it basically comes down to what is your own personal risk profile. I.e. how long you want to invest for and for what purpose. Source and Comments here - http://www.marketoracle.co.uk/Article17891.html Your Analyst. By Nadeem Walayat Copyright © 2005-10 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.erved. Featured Analysis of the Week

Most Popular Financial Markets Analysis of the Week :

By: Nadeem_Walayat Whilst the mainstream press and financial blogosphere obsesses over doom and gloom as a consequence of the sovereign debt default scenario, the stock market continues to show underlying strength with a strong late week rally that pushed the Dow to a close of 10,562, far above the preceding swing high of 10,438.

By: Jim_Willie_CB To be sure, almost without debate, all the financial world has turned to crisis mode. One can safely describe the norm to be crisis proliferation. This theme will clearly continue for the full year in progress. The signs are everywhere. The evidence is compelling. The criticism of remedy is replete with denials. The USGovt officials grow more desperate with each passing week. The Dubai and Greek debt woes seemed to have opened Pandora's Box.

By: Anthony_Cherniawski FDIC Friday is a quiet one.The FDIC Failed Bank List announced four new bank closures for the week. 26 banks have

By: Toby_Connor I can virtually guarantee that what I’m about to suggest isn’t on anybody’s radar screen. But before I share my prediction, a little background analysis is in order.

By: John_Mauldin "The underlying principle flows from the financial balance approach: the domestic private sector and the government sector cannot both deleverage at the same time unless a trade surplus can be achieved and sustained. Yet the whole world cannot run a trade surplus.

By: PrisonPlanet Gerald Celente in a 40 minute broadcast covers some of his long-term forecasts including a breakdown of social order, rioting, food crisis and global economic collapse as a consequence of the global sovereign debt crisis.

By: Sean_Brodrick Of all the major disasters and threats to your security ahead — and all the major profit opportunities — three stand out as the most imminent of all: Disaster #1: America’s Empire of Debt. If you think Americans are living a normal life, think again. Our entire consumer economy, lifestyle, livelihood — and nearly all or wealth — is predicated on one thing: DEBT.

By: Robert_Bradshaw The gold-plated, tungsten-filled bars story hasn’t gone away. Not only has it continued to pop up in various gold and hard-money, investment-advisory letters; but even the populous press publishers, like the American Free Press and Rense.com, have found it expedient to publish material on it as well.

You're receiving this Email because you've registered with our website. How to Subscribe Click here to register and get our FREE Newsletter To access the Newsletter archive this link Forward a Message to Someone [FORWARD] To update your preferences [PREFERENCES] How to Unsubscribe - [UNSUBSCRIBE]

The Market Oracle is a FREE Financial Markets Forecasting & Analysis Newsletter and online publication. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.

UK Election Deadline Ticks Closer - The long anticipated date for a May 6th General Election is now less than 2 months away when voters will have their say at the Bailout Box, the next 2 months will generate a great deal of volatility for sterling which the next section covers.

UK Election Deadline Ticks Closer - The long anticipated date for a May 6th General Election is now less than 2 months away when voters will have their say at the Bailout Box, the next 2 months will generate a great deal of volatility for sterling which the next section covers.