The U.S. Dollar Index Rally Move Isn't Done

Currencies / US Dollar Mar 19, 2010 - 09:13 AM GMTBy: Guy_Lerner

I will keep this brief as my rational for the new found strength in the Dollar Index is more observational than "scientific". Some things you just can't back test or measure in a methodical fashion or I just haven't figured out how to do it.

I will keep this brief as my rational for the new found strength in the Dollar Index is more observational than "scientific". Some things you just can't back test or measure in a methodical fashion or I just haven't figured out how to do it.

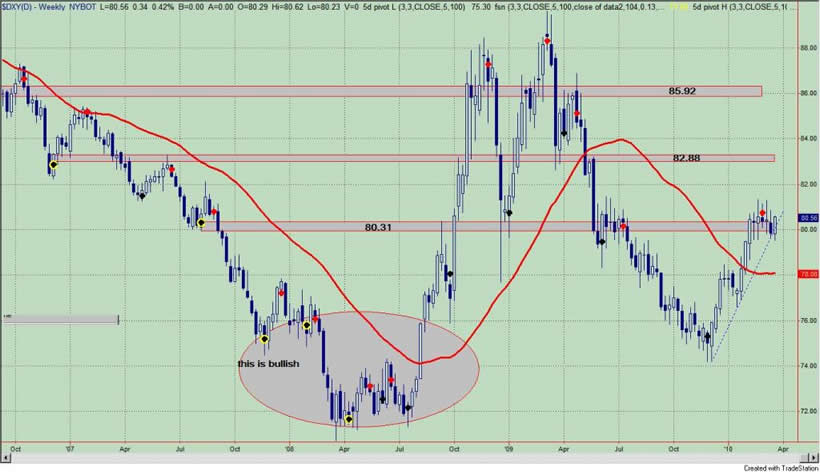

On January 19, 2010, I wrote "Expecting The Dollar Index To Rise For 2010", and I based this statement on the fact that 1) the Dollar Index had bottomed back in early, 2008; and 2) the Dollar Index was actually in a secular bull trend having found support in 2009 at those 2008 lows. Figure 1 is a weekly chart of the Dollar Index showing the close over the 3 key pivot points which is bullish.

Figure 1. Dollar Index

Not surprisingly, the equity market embarked on its most significant pullback in 6 months at a time that the Dollar Index moved higher. Conversely, the Dollar Index pulled back from its February highs at the time the equity markets were just starting to go on a month long tear.

So that is our baseline. Why is the Dollar going up now? My guess - and this is only a guess - is that the risk trade has ended for now and it will be a rotation back to safe haven assets. More specifically and from the things that I watch everyday, the Dollar Index is bouncing because investor sentiment had gotten relatively bearish on the Dollar Index. This can be seen in figure 2 a daily chart of the Power Shares DB US Dollar Bull (symbol: UUP); this is an ETF that mirrors the price moves of the Dollar Index. The indicator in the lower panel is the MarketVane Bullish Consensus for the Dollar Index, and over the past 2 days it hit an extreme (relative) low. Investor sentiment had turned bearish (relatively so) and this is a bull signal.

Figure 2. Dollar Index/ daily

Now this is the anecdotal part: 1) not all extremes in investor sentiment lead to reversals; but 2) observationally across a multitude of assets and market environments, I can tell you that the first extreme (bear) reading in investor sentiment after a strong move off the bottom is bought.

The Dollar Index is in a long term secular up trend. The first bearish sentiment reading within that up trend is a buy signal. We can ascribe all sorts of reasons why the Dollar is going higher. From this vantage point, this is just normal price movements within a longer term uptrend.

By Guy Lerner

http://thetechnicaltakedotcom.blogspot.com/

Guy M. Lerner, MD is the founder of ARL Advisers, LLC and managing partner of ARL Investment Partners, L.P. Dr. Lerner utilizes a research driven approach to determine those factors which lead to sustainable moves in the markets. He has developed many proprietary tools and trading models in his quest to outperform. Over the past four years, Lerner has shared his innovative approach with the readers of RealMoney.com and TheStreet.com as a featured columnist. He has been a regular guest on the Money Man Radio Show, DEX-TV, routinely published in the some of the most widely-read financial publications and has been a marquee speaker at financial seminars around the world.

© 2010 Copyright Guy Lerner - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Guy Lerner Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.