Gold and Stocks 1-2-3 Reversal

Commodities / Gold and Silver 2010 Mar 19, 2010 - 07:18 AM GMTBy: Toby_Connor

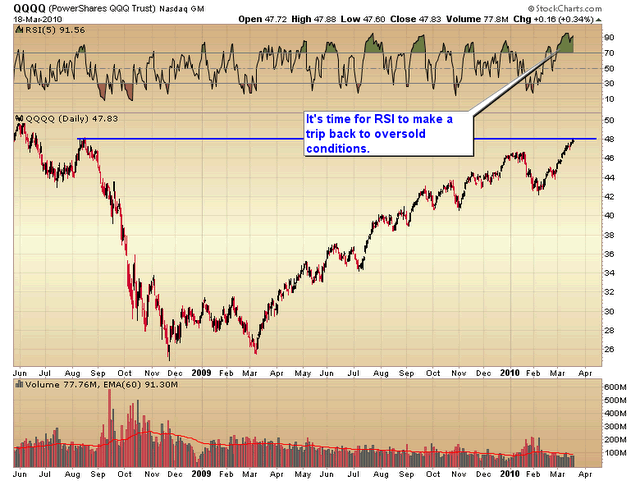

Today will be the 28th day of the rally out of the February 5th bottom. We are now in the trading band for the daily cycle in stocks to bottom. (The cycle rarely lasts much longer than 35-40 days). So, as I said in my last post, we are due for a short breather any time now.

Today will be the 28th day of the rally out of the February 5th bottom. We are now in the trading band for the daily cycle in stocks to bottom. (The cycle rarely lasts much longer than 35-40 days). So, as I said in my last post, we are due for a short breather any time now.

The consensus seems to be that the market will hang in until the end of the month. It may, but I tend to think we've probably seen about all the upside we are going to see at this point.

The leading tech sector is pushing up against a major resistance level. I doubt this level is going to be penetrated on the first try.

It's time for RSI to make a trip back down to the oversold levels. (Daily cycle bottoms almost always push the 5 day RSI into oversold levels).

Starting sometime next week the market should begin a minor profit taking correction to ease overbought technical and sentiment levels.

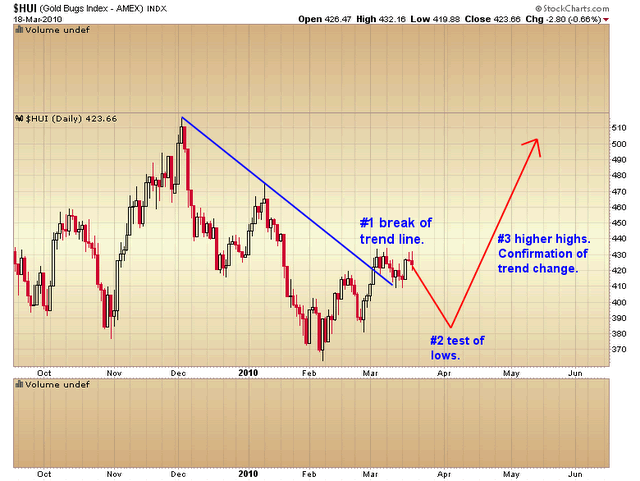

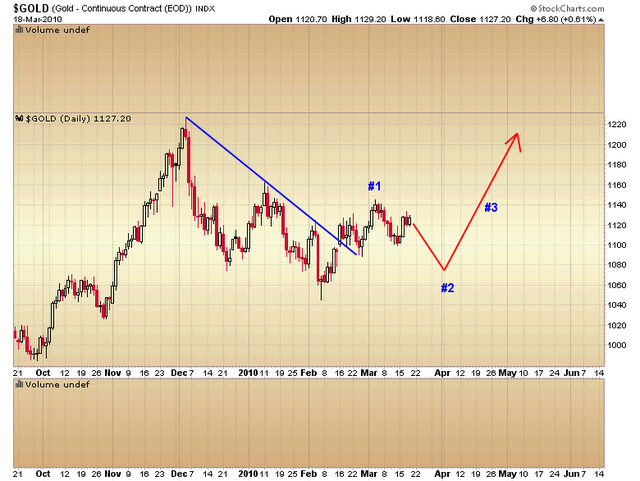

I expect this will rub off on the precious metals sector as well (it almost always does).

That should result in a 1-2-3 reversal process in the miners and gold.

The expectation is for both gold and miners to hold above the February lows and then move to higher highs as the market rallies out of the cycle bottom.

I wouldn't be surprised if markets bottom on the next employment report on Apr. 2nd. That would allow the market time to ease the overbought conditions and set it up for a powerful rally through earnings season.

So I guess it's possible the market hangs on until the end of the month, but I doubt it. I suspect we are going to start to see weakness next week.

Toby Connor

Gold Scents

A financial blog with emphasis on the gold bull market.

© 2010 Copyright Toby Connor - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.