Stock and Commodity ETF Trading Sector Rotation

Stock-Markets / Financial Markets 2010 Mar 18, 2010 - 02:39 AM GMTBy: Chris_Vermeulen

Earlier this week I noticed a pattern in the market throughout an entire trading session that has inspired me to write a short piece on sector rotation.

Earlier this week I noticed a pattern in the market throughout an entire trading session that has inspired me to write a short piece on sector rotation.

On Tuesday March 16th, my quote screen was flashing green as sectors reached new intraday highs or 52 week highs. The interesting part was that every sector that was flashing green happened to be in sectors that strengthen at the end of a bull market cycle or strong rally. This would include basic materials, staples, services, utilities and financial.

Today I investigated the different sectors and came across some interesting numbers between the January market peak and this week’s price action as I show in the charts below.

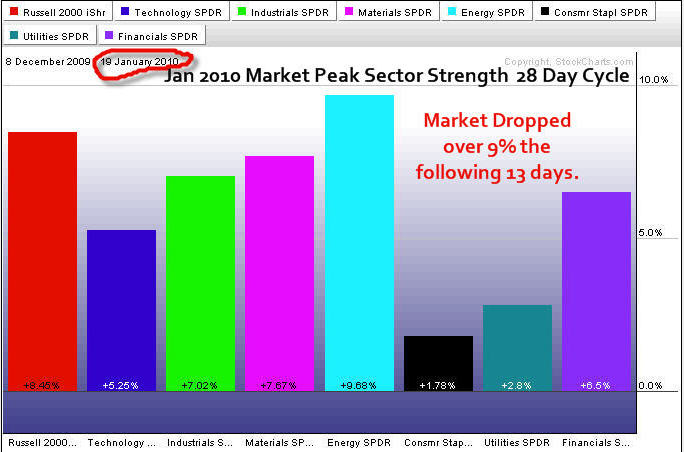

JANUARY – ETF Sector Rotation Trading – 28 Day Cycle

I may not explain this well but try to follow me here

Just before the market rolled over and lost over 9% last January, all the proper bull market sectors were very strong during the previous 28 days. This is normal and a strong sign that market participants were bullish on the overall market.

But the market was overbought; trading volume was light indicating that not many people are willing to buy at these lofty prices. And the VIX (volatility index) had reached an extreme low (a level that has triggered large sell offs in the past). All this means one thing to me. And that is, trade with caution and tighten your protective stops.

General rule, if everyone is buying all the hot stocks at these over bought levels then you can’t help but think its time for the market to roll over and shake them all out.

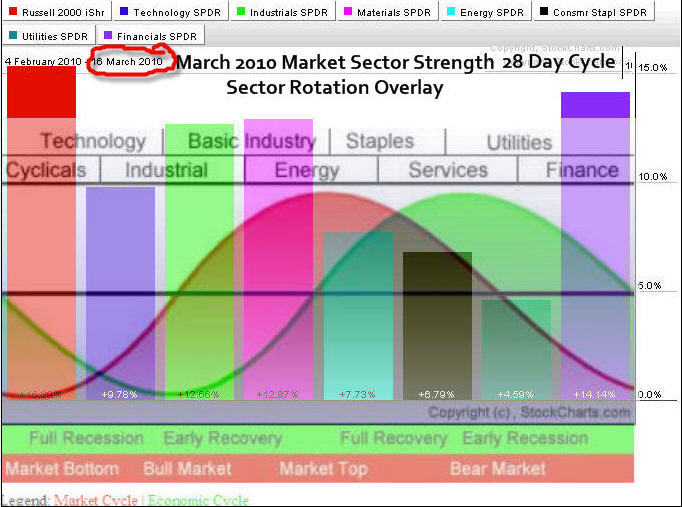

MARCH – ETF Sector Rotation Trading –28 Day Cycle

The chart of March shows where the sectors have finished over the past 28 days. Notice how similar the sectors have appreciated in price…

I have overlaid John Murphy’s sector rotation image to show which sectors are strongest in a bull market.

Now the interesting part is that it appears to be the setup as in January. My quote system is flashing new highs for the bear market cycle sectors which are the one which have not performed well (Stapes, Services & Utilities) and I have to think the market is about to take a breather or do a swan dive.

Don’t get me wrong, I am not saying we are on the verge of a bear market. I actually think the market is strong and will trade sideways in a large range for most of this year or just continue to trend up.

What I am saying is that these sectors go in and out of favor during smaller market cycles and that can be very useful information.

Sector Rotation Explained

You can learn more about sector rotation from this detailed course How to Profit From Sector Rotation Using ETFs. This course explains how different sectors are stronger during different points within the economic cycle. The chart above shows the relationships and which of the various sectors should strengthen from the economy. The financial Market Cycle leads the Economic Cycle because traders try to anticipate the economy.

Market Update & Trading Conclusion:

Stock Indexes: The market in my opinion is way over bought on the daily chart and needs a breather. Volume is light, VIX is at the same level we saw in January just before the top and the bullish sectors are firing on all pistons. You won’t catch me buying up here. Any type of pullback will most likely be sharp and there is no need to put money to work right now.

Precious Metals: Gold and silver had a nice pop this week off of a support level. I did not have a low risk setup as momentum was not on my side at the time of the pop. Also the large gap up on GLD makes me nervous as gaps tend to get filled. I am just waiting for something to unfold which looks to be a few days away still.

Oil: It has popped higher also and is trading at resistance. As I mentioned in Sundays report, if the USD dollar completes this breakdown then we will see commodities and stocks surge to higher prices and most likely post a nice multi month rally.

Natural Gas: We are seeing natural gas prices dip below support, shaking out traders who had their protective stops set just beneath the previous low. Natural gas is a silent killer as it will shake even the best traders out of the market. I feel natural gas is over sold and ready for a bounce but until I get a low risk setup I remain on the side lines.

If you would like to receive my free weekly trading reports please visit at: TheGoldAndOilGuy

Hello, I'm Chris Vermeulen founder of TheGoldAndOilGuy and NOW is YOUR Opportunity to start trading GOLD, SILVER & OIL for BIG PROFITS. Let me help you get started.

To Your Financial Success,

By Chris Vermeulen

Chris@TheGoldAndOilGuy.com

Please visit my website for more information. http://www.TheGoldAndOilGuy.com

Chris Vermeulen is Founder of the popular trading site TheGoldAndOilGuy.com. There he shares his highly successful, low-risk trading method. For 6 years Chris has been a leader in teaching others to skillfully trade in gold, oil, and silver in both bull and bear markets. Subscribers to his service depend on Chris' uniquely consistent investment opportunities that carry exceptionally low risk and high return.

This article is intended solely for information purposes. The opinions are those of the author only. Please conduct further research and consult your financial advisor before making any investment/trading decision. No responsibility can be accepted for losses that may result as a consequence of trading on the basis of this analysis.

Chris Vermeulen Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.