Gold Rises On Higher Oil Prices, Low Interest Rates And Increasing Sovereign Risk

Commodities / Gold and Silver 2010 Mar 17, 2010 - 06:58 AM GMTBy: GoldCore

Gold reached a high of $1,127/oz in US trading before closing with a gain of 1.55%. It has since jumped from $1,126/oz to $1,132/oz in late Asian trading this morning as the Bank of Japan announced emergency steps to prevent continuing deflation (see below). Gold is currently trading at $1,128.00/oz and in Euro and GBP terms, gold is trading at €821/oz and £740/oz respectively.

Gold reached a high of $1,127/oz in US trading before closing with a gain of 1.55%. It has since jumped from $1,126/oz to $1,132/oz in late Asian trading this morning as the Bank of Japan announced emergency steps to prevent continuing deflation (see below). Gold is currently trading at $1,128.00/oz and in Euro and GBP terms, gold is trading at €821/oz and £740/oz respectively.

World markets have been boosted by the Federal Reserve and Bank Of Japan’s soothing words and policies regarding continuing with their zero interest rate, cheap money policies. Gold has reacted favorably to the Federal Reserve’s pledge to keep interest rates “exceptionally low” for an “extended period” of time. The dollar has come under slight pressure again this morning despite the increase in risk appetite and this is contributing to gold’s strength in European trade this morning.

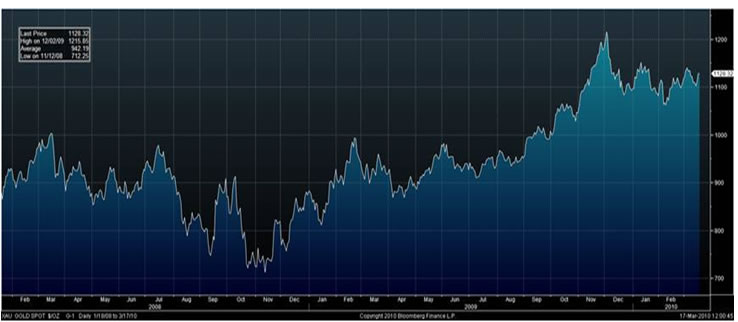

Gold - 3 Year Chart

Gold is also being supported by oil prices remaining above $80 a barrel and oil prices have risen again today after OPEC agreed for the fifth time since 2008 to keep its production limits unchanged. OPEC appears content with oil prices exceeding $80 a barrel.

The cocktail of oil prices over $80 a barrel, interest rates remaining near historic, exceptional lows for the foreseeable future and increasing sovereign risk is a potent one and could see gold target resistance at $1,145/oz and $1,162/oz. A break out above these levels would see us target the recent (nominal) high over $1,220/oz (see Gold - 3 Year Chart).

It is worth remembering that it was on this day 2 years (March 17th 2008) that gold reached new record (nominal highs) above $1,032/oz in London (see Gold - 3 Year Chart). This was the day when panic gripped the markets after the collapse of Bear Stearns and saw the dollar fall sharply and gold rise to a record nominal high. It is worth remembering that many analysts said that gold was a bubble at the time and said that gold would fall when the crisis subsided. Since then gold has reached new record highs and the international economic crisis has entered a new phase where monetary and sovereign risk has supplanted bank and financial risk.

Despite tentative signs of economic recovery we likely remain in the intermediate stages of this crisis and this is being reflected in continuing robust demand for bullion internationally. Investors and savers would be wise to maintain an allocation to gold until the outlook is less uncertain.

SILVER

Silver rose by more than 1.5% yesterday has range traded from $17.44/oz to $17.56/oz this morning in Asia. Silver is currently trading at $17.49/oz, €12.68/oz and £11.45/oz.

PGM’s

Platinum is trading at $1,639/oz and palladium is currently trading at $475/oz. While rhodium is at $2,535/oz.

NEWS

- Gold rose on the news that Japan's central bank is doubling the amount of cash being made available to banks while keeping interest rates at a record low as it tries to reignite a stuttering economic recovery. Under government pressure to help fight deflation, the Bank of Japan said it would extend emergency steps taken in December by boosting its short-term loan facility to 20 trillion yen (220 billion dollars).

- Britain's unemployment rate fell to 7.8 percent in the three months to the end of January, compared with the August-October period. The number of people seeking jobseeker's allowance fell by the most since 1997 last month, offering hope that the economic recovery is gathering pace.

-Guidance regarding inflation will be given from the US PPI figure - released at 1200 GMT

-Federal Reserve Chairman, Ben Bernanke will testify to the House Financial Services Committee later today and markets will watch for any sign of a change to the current ultra loose monetary policy.

This update can be found on the GoldCore blog here.

Mark O'Byrne

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.