US Retail Stocks Sector Surges. Consumer Confidence Returns

Stock-Markets / Sector Analysis Mar 14, 2010 - 03:32 PM GMTBy: Donald_W_Dony

In the February newsletter I highlighted the consistent upward strength of the S&P Retail Index. This leading indicator of consumer confidence and thus economic health, had consistently outperformed many industry sectors throughout 2009 and also the broad-based S&P 500. Fundamental data generally looked unimpressive last year and many market watchers doubted the return of this important industry.

In the February newsletter I highlighted the consistent upward strength of the S&P Retail Index. This leading indicator of consumer confidence and thus economic health, had consistently outperformed many industry sectors throughout 2009 and also the broad-based S&P 500. Fundamental data generally looked unimpressive last year and many market watchers doubted the return of this important industry.

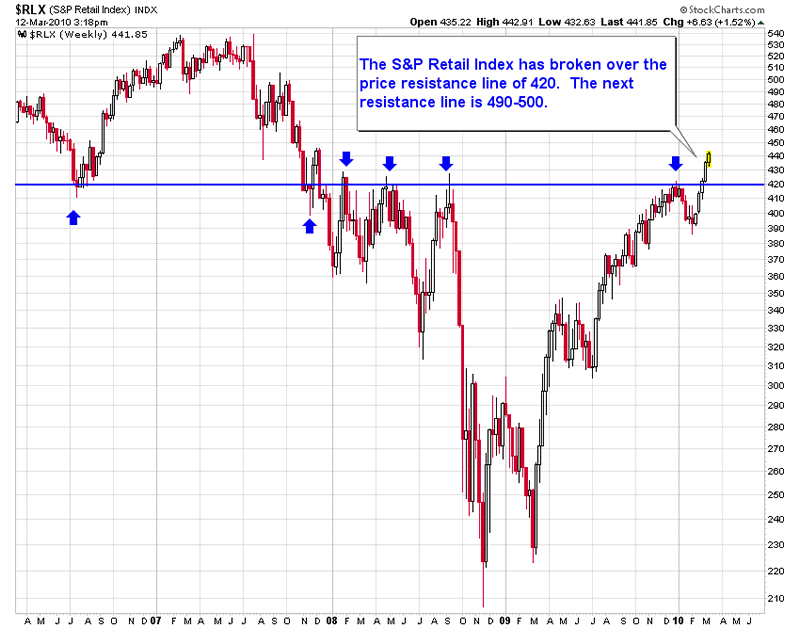

This week, however, the US Retail Index soared through a technical price resistance level on the coattails of stronger than expected overall sales. The S&P Retail Index (Chart 1), led by consumer electronics, pushed through the 420 line for the first time since early 2008. The supporting numbers for the technical bullish price advance had finally occurred. U.S. retail sales increased by a seasonally adjusted 0.3% in February. Sales have advanced in four of the past five months, and were up 3.9% compared with 2009. The gains in the industry are broad-based. Most retail sectors recorded month-over-month increases. The fundamentals had finally caught-up to the technicals.

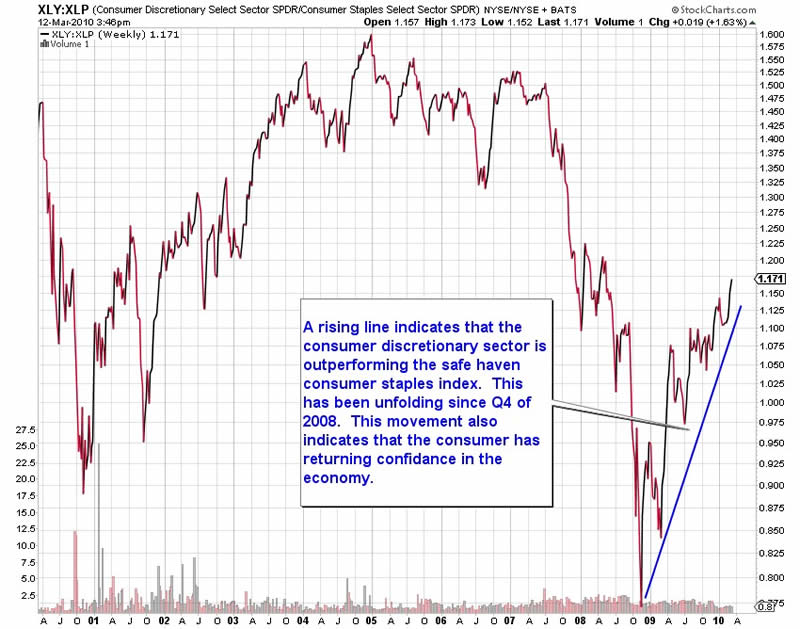

Though the news about the retail sector is encouraging, the direction of the consumer spending within the retail group is perhaps even more important.

Traditionally, consumers start to shift away from the safe haven staples at the bottom of the stock and business cycles. This has always been the pattern. Yet, this market and economic retrenching in 2008 was not at all common. However, though the causes of the worst recession in 70 years were unique, the affects were remarkably similar to most market lows. Consumers began to migrate toward those items that they want (discretionaries) verses those products that they need (staples) by early 2009 (Chart 2).

By mid-2009, the consumer discretionary sector was vastly outperforming the consumer staples group. During the last bear market (2000-2002), discretionaries were also outperforming staples. The bear market low was in October 2002 and the swing to consumer 'wants' began in 2001. This transfer is one of the first signs of a recovering economy.

Bottom line: The consumer equals about 2/3rds of the economy. The impressive growth in the retail sector and the consumer discretionary group adds important evidence that the US economy is recovering and also points to a low probability of re-entering negative growth.

Investment approach: Business cycles last, on average, 4.5 years. This new cycle has only been unfolding for about one year. Investors should recognize that there is likely several more years of expansion coming before this economic pattern peaks. Staying invested in index funds is one of the best methods of keeping up with the expected market's growth.

Your comments are always welcomed.

By Donald W. Dony, FCSI, MFTA

www.technicalspeculator.com

COPYRIGHT © 2010 Donald W. Dony

Donald W. Dony, FCSI, MFTA has been in the investment profession for over 20 years, first as a stock broker in the mid 1980's and then as the principal of D. W. Dony and Associates Inc., a financial consulting firm to present. He is the editor and publisher of the Technical Speculator, a monthly international investment newsletter, which specializes in major world equity markets, currencies, bonds and interest rates as well as the precious metals markets.

Donald is also an instructor for the Canadian Securities Institute (CSI). He is often called upon to design technical analysis training programs and to provide teaching to industry professionals on technical analysis at many of Canada's leading brokerage firms. He is a respected specialist in the area of intermarket and cycle analysis and a frequent speaker at investment conferences.

Mr. Dony is a member of the Canadian Society of Technical Analysts (CSTA) and the International Federation of Technical Analysts (IFTA).

Donald W. Dony Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.