Stock Markets Push to New Highs Despite Lingering Credit Crisis and Recession Reminders

Stock-Markets / Financial Markets 2010 Mar 14, 2010 - 07:28 AM GMT Shrugging off some lingering reminders of the credit crisis and recession, investors last week marked the one-year anniversary of the bear market low by pushing many benchmark equity indices to cycle highs.

Shrugging off some lingering reminders of the credit crisis and recession, investors last week marked the one-year anniversary of the bear market low by pushing many benchmark equity indices to cycle highs.

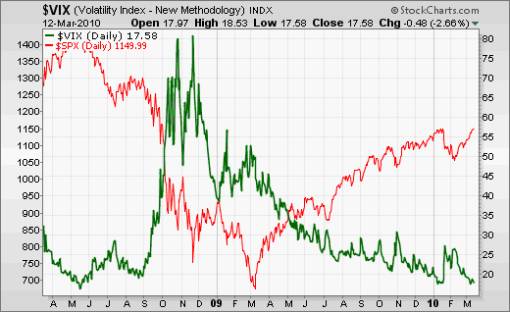

Wall Street scaled 17-month highs on the back of easing concerns of sovereign debt defaults and increased hopes for a global economic recovery as the US dollar pulled back and the CBOE Volatility (VIX) Index approached 22-month lows. The Index is also referred to as the "fear gauge" of US stock markets and is used as a contrary indicator that moves inversely to equity prices, as seen in the chart below where it is plotted against the S&P 500 Index.

Source: StockCharts.com

Meanwhile, US Senate Banking Committee chairman Christopher Dodd plans to introduce a revised version of a financial regulatory reform bill on Monday. Dodd had hoped to release a bipartisan bill but has been unable to do so. Not a moment too soon, as a 2,200-page report by Anton Valukas, appointed by a US court to probe the reasons for Lehman's failure in September 2008, raised serious questions about the bank's top management, including former CEO Dick Fuld, and auditors Ernst & Young, reported the Financial Times.

Source: Doonesbury, SlateV.com, March 1, 2010. (Hat tip: The Big Picture)

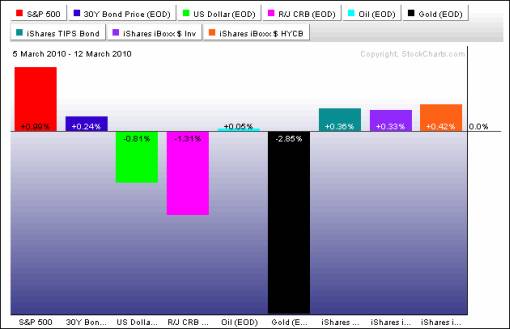

The past week's performance of the major asset classes is summarized in the chart below - a set of numbers indicating that a degree of risk taking has crept back into financial markets. Interestingly, similar to a number of stock market indices, investment-grade corporate bonds also scaled fresh cycle peaks, whereas high-yield bonds are testing their January highs. Although yields on US government bonds did not change much on the week, the bond market was actually quite strong in light of the US Treasury being able to sell $74 billion in 3-, 10- and 30-year Notes and Bonds at lower-than-expected yields. Fears of further monetary tightening in China weighed on the Shanghai Composite Index (shown in the table of global stock market performance lower down) and commodities. Gold and silver were also out of favor. (Click here for Adam Hewison's (INO.com) latest technical analysis of the outlook for gold bullion.)

Source: StockCharts.com

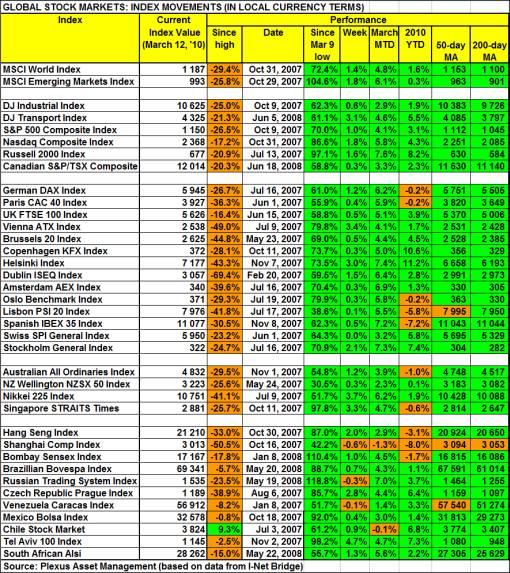

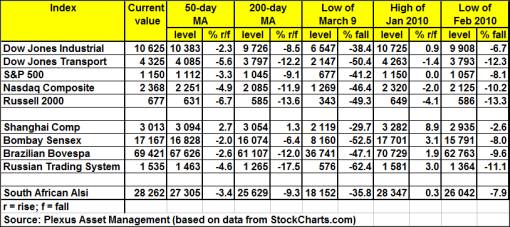

A summary of the movements of major global stock markets for the past week and various other measurement periods is given in the table below.

The cyclical bull market that commenced on March 9, 2009 celebrated its first anniversary with gains across a broad front. The MSCI World Index and the MSCI Emerging Markets Index gained 1.4% and 1.8% respectively. Among mature markets, Japan (+3.7%) reached its highest close in seven weeks in expectation that further easing of monetary policy by the Bank of Japan (BoJ) on Wednesday will weaken the yen and boost exporters. The only weak spots were a few emerging markets such as China (-0.6%), Russia (-0.3%) and Venezuela (-0.1%).

Notwithstanding the huge rally since the March lows, only the Chile Stock Market General Index has been able to reclaim its 2007 pre-crisis peak and is now trading 9.3% higher. Mexico and Israel could be the next countries to eliminate the bear market losses. The Dow Jones Industrial Index and the S&P 500 Index are still 25.0% and 26.5% respectively down on their October 2007 bull market peaks.

All the major US indices are back in the black for 2010 to date. The small-cap Russell 2000 Index, a clear leader among the indices, has registered 20 out of 23 up-days since the low of February 8.

Top performers among the entire spectrum of stock markets this week were Kenya (+8.3%), Jamaica (+6.5%), Sweden (+5.4%), Nigeria (+5.3%) and Hungary (+4.6%). Debt-burdened Greece's austerity plans gained favor with investors, pushing the Athex Composite Share Price Index up by +3.7 for the week. At the bottom end of the performance rankings, countries included Nepal (?3.4%), Bangladesh (-2.3%), Macedonia (-1.6%), Peru (-1.5%) and Botswana (-1.4%).

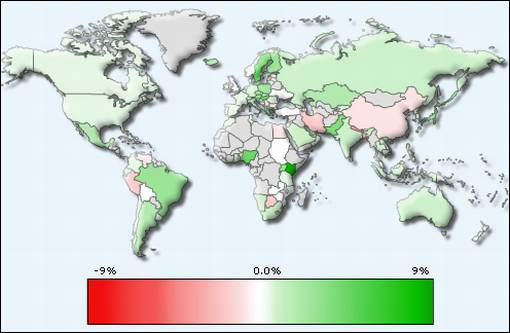

Of the 94 stock markets I keep on my radar screen, 74% recorded gains, 21% showed losses and 5% remained unchanged. The performance map below tells the past week's mostly bullish story.

Emerginvest world markets heat map

Source: Emerginvest (Click here to access a complete list of global stock market movements.)

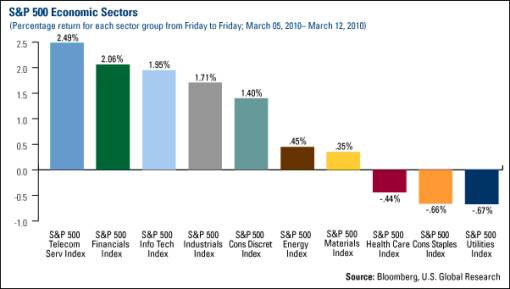

Seven of the ten economic sectors of the S&P 500 Index closed higher for the week, with defensive sectors Health Care, Consumer Staples and Utilities the only ones under water.

Source: US Global Investors - Weekly Investor Alert, March 12, 2010.

John Nyaradi (Wall Street Sector Selector) reports that as far as exchange-traded funds (ETFs) are concerned, the winners for the week included iShares MSCI Sweden (EWD) (+5.3), Claymore/Delta Global Shipping (SEA) (+5.0%), Market Vectors Indonesia (IDX) (+5.0%), First Trust Amex Biotech (FBT) (+4.5%), Claymore/NYSE Arca Airline (FAA) (+3.9%) and iShares Cohen & Steers Realty Majors (ICF) (+3.9%).

At the bottom end of the performance rankings, ETFs included iPath DJ AIG Sugar (SGG) (-12.2%), United States Natural Gas (UNG) (-4.7%), iPath DJ AIG Natural Gas (GAZ) (-4.5%), ProShares Short Financials (SEF) (-4.1%) and ProShares Short Emerging Markets (EUM) (-2.8%).

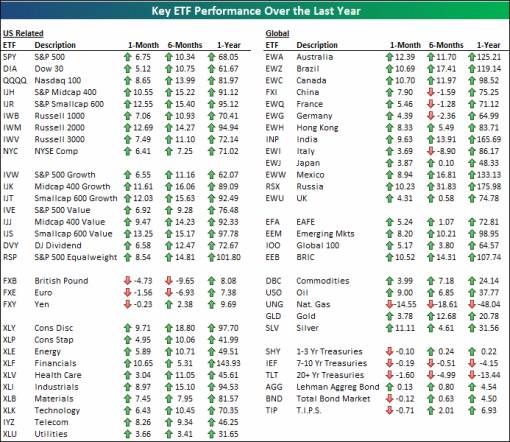

The table below, courtesy of Bespoke, highlights the performance of key ETFs across all asset classes over the last month, six months and year.

"Over the last year, just three ETFs shown are down - Natural Gas (UNG) at ?48%, 7-10 Year Treasuries (IEF) at -4%, and 20+ Year Treasuries (TLT) at ?13%. The best-performing ETF shown over the last year has been Russia (RSX) with a gain of 175%. India (INP) ranks second with a gain of 165%, and the Financial sector ETF (XLF) third with a gain of 144%," said the report.

Source: Bespoke, March 9, 2010.

Referring to the ballooning US budget deficit, the quote du jour this week comes from 85-year-old Richard Russell, La Jolla-based author of the Dow Theory Letters. He said: "The estimates of budget deficits are so huge that they defy the ability of the average citizen to comprehend them. As the US continues to create more dollars, at some point our foreign creditors are going to want higher returns (rate) before they are willing to make loans to the US. Rising rates would be an extreme danger to the US. Not only would they hurt business. Rising interest rates mean a rising cost of carrying the national debt. The process of compounding the cost of the national debt would send US finances into a death spiral'.

"I think institutional investors are holding off on buying stocks because they don't see stocks as safe long-term holdings. Big money investors are looking ahead to higher interest rates. That combined with current high valuations for stocks constitutes a red flag for seasoned investors. The key here is probably the action of the bond market, and particularly long-dated Treasury bonds. The 30-year T-bonds would be particularly sensitive to Treasury financing looking years ahead.

"It is still not clear how the US is going to finance its enormous national debt. Reneging on the debt is unthinkable. To raise taxes and at the same time cut down on spending is almost an impossibility. That leaves inflation as the most probable answer. As soon as our creditors realize our way out' is inflation, they will halt their process of lending to the US, or at least halt lending at current low, low rates."

Elsewhere, The New York Times reported that "the White House and Congressional leaders put Democrats on notice on Friday that they would push ahead next week toward climactic votes on the health care legislation."

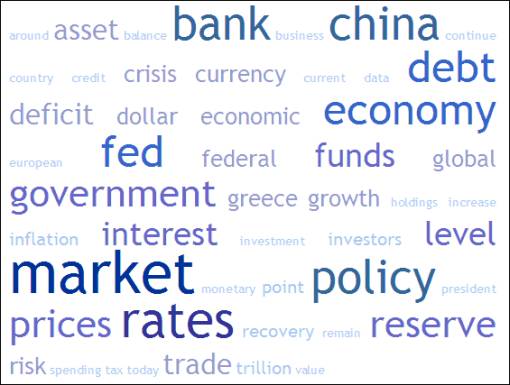

Next, a quick textual analysis of my week's reading. This is a way of visualizing word frequencies at a glance. The usual suspects such as "bank", "China", "debt", "economy", "Fed", "market", "policy" and "rates" featured prominently, with "Greece" taking a back seat after its prominence over the past few weeks.

The major moving-average levels for the benchmark US indices, the BRIC countries and South Africa (where I am based in Cape Town when not traveling) are given in the table below. With the exception of the Shanghai Composite Index, the indices in the table are all trading above their 50- and 200-day moving averages.

The table provides the February lows for the various indices as these must hold in order for the cyclical bull market to remain intact. Importantly, although the Shanghai Composite Index is trading a little below its key moving averages, it is still above the February low. On the upside, a break above 3,097 is required to again put the Index on a bullish path.

The Dow Jones Transportation Index, the Nasdaq Composite Index and the Russell 2000 Index all made new cycle highs during the week, with the S&P 500 closing at exactly the same level as its January high and the Dow Jones Industrial Index still 100 points short. (The fact that the Transports recorded a new high but not the Industrials represents a so-called Dow Theory non-confirmation.) However, the indices still have more work to do in order to reach pre-Lehman levels - 1,250 in the case of the S&P 500 (i.e. a gain of 8.7% from here).

Using Fibonacci retracement lines, the S&P 500 is now testing the 62% retracement line drawn from the May 2008 peak to the March 2009 bottom (see purple lines). According to John Murphy (StockCharts.com), a break of this key upside target raises the possibility that the Index could retrace 62% of the entire bear market that started in the fourth quarter of 2007, in which case the potential upside target is 1,232 (see green lines).

Source: StockCharts.com

Also commenting on the technical picture of the S&P 500, Kevin Lane (Fusion IQ) said: "Currently individual investor allocations towards equities are slightly below the mean, which puts us in a zone where, though reduced, buying power is still ample. With buying power relatively strong and the AAII Bull Sentiment Survey still at a relatively neutral reading, it's hard to see a big correction here. What may be a likely scenario is as follows: the market continues to move up and investors, even the non-believers, start chasing stocks, putting their last bit of buying power into the market."

Bill King (The King Report) believes the stock market could make some kind of top in the next 3-6 weeks. "The recovery rally is stretched, the Fed is scheduled to end its monetization this month, volume is contracting, the usual small cap-tech rally has accelerated and April 30 is the end of the best seasonal rally period; expiration is next week and Q1 performance gaming looms," he said. "But most importantly, March and April often contain important reversals or significant declines for stocks. Curfew hour is approaching."

From London, David Fuller (Fullermoney) adds the following perspective: "All technical evidence to date suggests we have seen a normal correction to the cyclical bull market's trend mean represented by rising 200-day moving averages. The only minor negative is that persistent rallies have replaced short-term oversold conditions with short-term overbought readings. If this matters beyond brief pauses, we would see it in the form of downward dynamics and failed upside breaks from trading ranges. However, a more important factor is likely to be the months spent by most equity indices in ranging consolidations, as they gradually worked their way over to their rising moving average mean. In the absence of downward dynamics, perhaps caused by some currently unexpected fright, stock markets remain capable of running on the upside."

On a somewhat longer-term horizon, Fuller identifies a number of possible warning signals to look out for: "1) Strong economic growth competes for capital and invites monetary tightening by central banks; 2) strong growth and too much speculation would lift oil prices over the low $80s highs for this cycle to date, towards headwind levels of $100 or more; 3) US 10-year Treasury yields above 4% would be an advance warning but the real danger area is above 5%; 4) a very weak USD could undermine confidence but this is clearly not a threat today."

Although the fat lady has not yet made her appearance to signal the end of the bull cycle, the steepness of the nascent rally, together with resistance in the area of the January highs, could result in stock markets consolidating in order to work off a short-term overbought condition. On the fundamental front, tighter money does not necessarily spell a declining stock market, but turning off the "juice" will certainly remove a tailwind, making earnings growth the key determinant for generating further gains (especially in light of stretched valuations).

The article continues here

By Dr Prieur du Plessis

Dr Prieur du Plessis is an investment professional with 25 years' experience in investment research and portfolio management.

More than 1200 of his articles on investment-related topics have been published in various regular newspaper, journal and Internet columns (including his blog, Investment Postcards from Cape Town : www.investmentpostcards.com ). He has also published a book, Financial Basics: Investment.

Prieur is chairman and principal shareholder of South African-based Plexus Asset Management , which he founded in 1995. The group conducts investment management, investment consulting, private equity and real estate activities in South Africa and other African countries.

Plexus is the South African partner of John Mauldin , Dallas-based author of the popular Thoughts from the Frontline newsletter, and also has an exclusive licensing agreement with California-based Research Affiliates for managing and distributing its enhanced Fundamental Index™ methodology in the Pan-African area.

Prieur is 53 years old and live with his wife, television producer and presenter Isabel Verwey, and two children in Cape Town , South Africa . His leisure activities include long-distance running, traveling, reading and motor-cycling.

Copyright © 2010 by Prieur du Plessis - All rights reserved.

Disclaimer: The above is a matter of opinion and is not intended as investment advice. Information and analysis above are derived from sources and utilizing methods believed reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Do your own due diligence.

Prieur du Plessis Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.