The Implications of Velocity of Money on the Economy

Economics / Economic Theory Mar 13, 2010 - 02:58 PM GMTBy: John_Mauldin

The Velocity of Money

The Velocity of Money

Our Little Island World

GDP = (P) x (T)

P=MV

A Slowdown in Velocity

Dallas and Thoughts on the Economy

This week we do some review on a very important topic, the velocity of money. If we don't understand the basics, it is hard to make sense of the hash that our world economy is in, much less understand where we are headed.

But before we jump into that, I want to let my Conversations subscribers know that we have posted a recent conversation with two hedge-fund managers, Kyle Bass of Hayman Advisors [and his staff] here in Dallas and Hugh Hendry of the Eclectica Fund in London. Our discussions centered on what we all think has the potential to be the next Greece, but on a far more serious level. It was a fascinating time.

Then next Wednesday we will post a Conversation I had with George Friedman of Stratfor fame, and then the following Wednesday a Conversation that I just completed with Dr. Ken Rogoff and Dr. Carmen Reinhart, the authors of This Time Is Different.

For new readers, Conversations with John Mauldin is my one subscription service. While this letter will always be free, we have created a way for you to "listen in" on my conversations with some of my friends, many of whom you will recognize and some whom you will want to know after you hear our conversations. Basically, I will call one or two friends each month and, just as we do at dinner or at meetings, we will talk about the issues of the day, with back and forth, give and take, and friendly debate. I think you will find it very enlightening and thought-provoking and a real contribution to your education as an investor.

And as you can see, I can get some rather interesting people to come to the table. Current subscribers can renew for a deeply discounted $129, and we will extend that price to new subscribers as well. To learn more, go to http://www.johnmauldin.com/newsletters2.html. Click on the Subscribe button, and join me and my friends for some very interesting Conversations.

The Velocity of Money

The Federal Reserve and central banks in general are running a grand experiment on the economic body, without the benefit of anesthesia. They are testing the theories of Irving Fisher (representing the classical economists), John Keynes (the Keynesian school) Ludwig von Mises (the Austrian school), and Milton Friedman (the monetarist school). For the most part, the central banks are Keynesian, with a dollop of monetarist thrown in here and there.

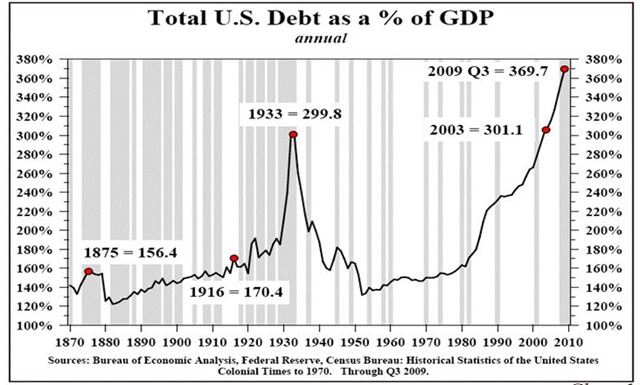

Over the next few years, we will get to see who is right about debt and stimulus, the velocity of money, and other arcane topics, as we come to the End Game of the Debt Super Cycle, the decades-long cycle during which debt has grown. I have very smart friends who argue that the cycle is nowhere near an end, as governments are clearly increasing debt. My rejoinder is that it is nearing an end, and we need to think hard about what that end will look like. It will not be pretty for a period of time. The chart below shows the growth in debt, both public and private.

But the end of this debt cycle involves more than just debt reduction. There are a number of ideas we have to get our heads around, including the velocity of money. Basically, when we talk about the velocity of money, we are speaking of the average frequency with which a unit of money is spent. To give you a very rough understanding, let's assume a very small economy of just you and me, which has a money supply of $100. I have the $100 and spend it to buy $100 of flowers from you. You in turn spend $100 to buy books from me. We have created $200 of our "gross domestic product" from a money supply of just $100. If we do that transaction every month, we will have $2400 of annual "GDP" from our $100 monetary base.

So, what that means is that gross domestic product is a function of not just the money supply but how fast that money moves through the economy. Stated as an equation, it is P=MV, where P is the nominal gross domestic product (not inflation-adjusted here), M is the money supply, and V is the velocity of money. You can solve for V by dividing P by M. By the way, this is known as an identity equation. It is true at all times and all places, whether in Greece or the US.

Our Little Island World

Now, let's complicate our illustration a bit, but not too much at first. This is very basic, and for those of you who will complain that I am being too simple, wait a few pages, please. Let's assume an island economy with 10 businesses and a money supply of $1,000,000. If each business does approximately $100,000 of business a quarter, then the gross domestic product for the island is $4,000,000 (4 times the $1,000,000 quarterly production). The velocity of money in that economy is 4.

But what if our businesses get more productive? We introduce all sorts of interesting financial instruments, banking, new production capacity, computers, etc., and now everyone is doing $100,000 per month. Now our GDP is $12,000,000 and the velocity of money is 12. But we have not increased the money supply. Again, we assume that all businesses are static. They buy and sell the same amount every month. There are no winners and losers yet.

Now let's complicate matters. Two of the kids of the owners of the businesses decide to go into business for themselves. Having learned from their parents, they immediately become successful and start doing $100,000 a month themselves. GDP rises to $14,000,000. In order for everyone to stay at the same level of gross income, though, the velocity of money must increase to 14.

Now, this is important. If the velocity of money does not increase, that means that (in our simple island world) on average each business is now going to buy and sell less each month. Remember, nominal GDP is money supply times velocity. If velocity does not increase, GDP will stay the same. The average business (there are now 12) goes from doing $1,200,000 a year down to $1,000,000. The prices of products fall.

Each business now is doing around $80,000 per month. Overall production is the same, but divided up among more businesses. For each of the businesses, it feels like a recession. They have fewer dollars, so they buy less and prices fall. So, in that world, the local central bank recognizes that the money supply needs to grow at some rate in order to make the demand for money "neutral."

It's basic supply and demand. If the demand for corn increases, the price will go up. If Congress decides to remove the ethanol subsidy, the demand for corn will go down, as will the price.

If Island Central Bank increases the money supply too much, you will have too much money chasing too few goods and inflation will rear its ugly head. (Remember, this is a very simplistic example. We assume static production from each business, running at full capacity.)

Let's say the central bank doubles the money supply to $2,000,000. If the velocity of money is still 12, then the GDP will grow to $24,000,000. That will be a good thing, won't it?

No, because with the two new businesses only 20% more goods are produced. There is a relationship between production and price. Each business will now sell $200,000 per month, or double their previous sales, which they will spend on goods and services, which only grew by 20%. They will start to bid up the price of the goods they want, and inflation sets in. Think of the 1970s.

So, our mythical bank decides to boost the money supply by only 20%, which allows the economy to grow and prices to stay the same. Smart. And if only it were that simple.

Let's assume 10 million businesses, from the size of Exxon down to the local dry cleaners, and a population that grows by 1% a year. Hundreds of thousands of new businesses are being started every month and another hundred thousand fail. Productivity over time increases, so that we are producing more "stuff" with fewer costly resources.

Now, there is no exact way to determine the right size of the money supply. It definitely needs to grow each year by at least the growth in the size of the economy, the population, and productivity, or deflation will appear. But if money supply grows too much then you have inflation.

And what about the velocity of money? Friedman assumed the velocity of money was constant, and therefore he stated that inflation is always and everywhere a function of the supply of money. And it was, from about 1950 until 1978 when he was doing his seminal work. But then things changed.

Note that nothing Friedman says contradicts the equation MV=PT, if you assume constant velocity. Almost by definition you get inflation if the money supply grows too fast.

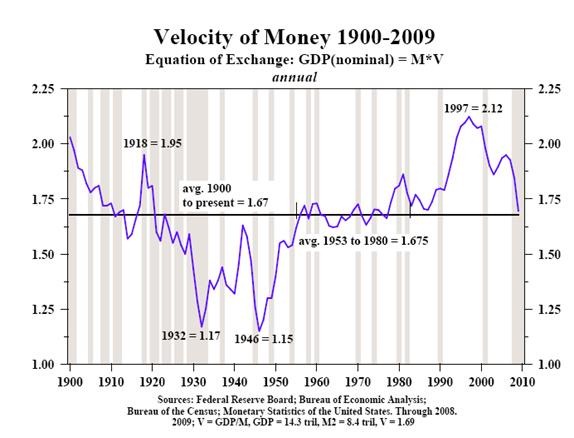

Let's look at two charts sent to me by Dr. Lacy Hunt of Hoisington Investment Management in Austin (and one of my favorite economists). First, let's look at the velocity of money for the last 108 years.

Notice that the velocity of money fell during the Great Depression. And from 1953 to 1980 the velocity of money was almost exactly the average of the last 100 years. Also, Lacy pointed out in a conversation that helped me immensely in writing this letter, that the velocity of money is mean reverting over long periods of time. That means one would expect the velocity of money to fall over time back to the mean or average. Some would make the argument that we should use the mean from more modern times, since World War II; but even then, mean reversion would result in a slowing of the velocity of money (V), and mean reversion implies that V would go below (overcorrect) the mean. However you look at it, the clear implication is that V is going to drop. In a few paragraphs, we will see why that is the case from a practical standpoint. But let's look at the first chart.

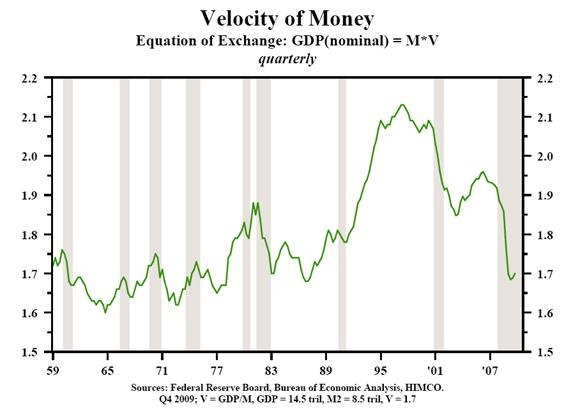

Now, let's look at the same chart since 1959 but with shaded gray areas that show us the times the economy was in recession. Note that (with one exception in the 1970s) velocity drops during a recession. What is the Fed response? An offsetting increase in the money supply to try and overcome the effects of the business cycle and the recession. P=MV. If velocity falls then money supply must rise for nominal GDP to grow. The Fed attempts to jump-start the economy back into growth by increasing the money supply.

In this chart from Hoisington, the recessions are in gray. If you can't read the print at the bottom of the chart, he assumes that GDP is $14.5 trillion, M2 is $8.2 trillion, and therefore velocity is 1.7, down from almost 1.97 just a few years ago. If velocity is to revert to or below the mean, it could easily drop 10% from here. We will explore why this could happen in a minute.

P=MV

But let's go back to our equation, P=MV. If velocity does slow by another 10%, then money supply (M) would have to rise by 10% just to maintain a static economy. But if we assume 1% population growth, 2% (or thereabouts) productivity growth, and a target inflation of 2%, then M (money supply) actually needs to grow about 5% a year, even if V is constant. And that is not particularly stimulative, given that we are in recession.

Bottom line? Expect money-supply growth well north of 7% annually for the next few years, or at least the attempt. Is that enough? Too much? About right? We won't know for a long time. This will allow armchair economists (and that is most of us) to sit back and Monday-morning quarterback for many years.

A Slowdown in Velocity

Now, why is the velocity of money slowing down? Notice the real rise in V from 1990 through about 1997. Growth in M2 (see the above chart) was falling during most of that period, yet the economy was growing. That means that velocity had to rise faster than normal. Why? Primarily because of the financial innovations introduced in the early '90s, like securitizations, CDOs, etc. It is financial innovation that spurs above-trend growth in velocity.

And now we are watching the Great Unwind of financial innovations, as they were pursued to excess and caused a credit crisis. In principle, a CDO or subprime asset-backed security should be a good thing. And in the beginning they were. But then standards got loose, greed kicked in, and Wall Street began to game the system. End of game.

The financial innovation that drove velocity to new highs is no longer part of the equation. Its absence is slowing things down. If the money supply hadn't risen significantly to offset that slowdown in velocity, the economy would have been in a much deeper recession, if not a depression. While the Fed does not have control over M2, when they lower interest rates it is supposed to make us want to take on more risk, borrow money, and boost the economy. So they have an indirect influence.

And now we come to the policy conundrum for the Fed. They have pumped a great deal of money (liquidity) into the economy. Normally, banks would take that money and multiply it by lending it out (through fractional reserve banking at a potential 9-times factor), increasing velocity and the overall money supply. In the past, the more the Fed increased the money supply, the more banks lent.

But today bank lending is still falling at an average of 15% annually, so far this year. But what if that trend stops?

Corporations in the US have more money on hand than ever in the last 54 years. They are more productive. Their debt-to-equity ratio has been dropping by about 25% for the last 3 quarters, as they repair balance sheets. Capital spending jumped 18% annually in the last quarter. If we are not at an inflection point of rising employment, we are close to it (although we do need at least 100,000 new jobs a month to make up for increased population). And thus are the stock market bulls inspired, and we hit new trend highs weekly.

While growth this quarter will not be as robust as last, it will be fairly good for an economy with 10% unemployment. If you are a Fed governor, you have to be worried that things could turn around quicker than now seems plausible. What if corporations decided to take their cash and start investing in growth?

The last chart showed a small uptick in velocity at the end of last year. What if that is for real? What if we have turned the corner? Then the Fed will have to start taking back the money they have put into the economy, unless they want to see inflation. And indeed, that is what some Fed governors are arguing. They want to raise rates now, or at least signal that they will begin to do so soon. Note there have been a number of speeches by Fed officials of late assuring the bond market that they are aware of the problem, and that they have all the tools they need to keep inflation (and higher interest rates) at bay.

But then again, while there are signs that the economy may be picking up, it is a strange type of recovery. It is what I call a statistical recovery. Let's look at this litany from my friend David Rosenberg of Gluskin Sheff. He notes that there are measures of economic health other than the stock market and GDP. To wit:

- More than five million homeowners are behind on their mortgages.

- There are over six million Americans who have been unemployed for at least six months, a record 40% of the ranks of the jobless.

- The private capital stock is growing at its slowest rate in nearly two decades.

- Roughly 30% of manufacturing capacity is sitting idle.

- Nearly 19 million residential housing units, or about 15% of the stock, is vacant.

- One in six Americans is either unemployed or underemployed.

- Commercial real estate values are down 30% over the past year.

- The average American worker has seen his/her level of wealth plunge $100,000 over the last two years, even with the recovery in equity markets this past year.

- Bank credit is contracting at an unprecedented 15% annual rate so far this year as lenders sit on a record $1.3 trillion of cash.

- Unit labor costs are down an unprecedented 4.7% over the past year, and what has replenished household coffers has been the federal government, as transfer payments from Uncle Sam now make up a record 18% of personal income (and the Senate just passed yet another jobless benefit extension bill!)."

Wow. 18% of personal income in the US is now from the US government (also known as taxpayers, current and future).

If you take away the punchbowl too soon, you risk strangling a very shaky recovery that is significantly dependent on stimulus spending, which is going to rapidly go away the second half of this year. Further, the Fed situation is complicated by the fact that taxes are highly likely to go up in 2011 (maybe the largest tax increase ever), which will put a serious strain on the economy.

I think the Fed is on hold throughout 2010 and well into 2011, as they see what effect the tax hikes, coupled with decreased stimulus, bring. Next week we will explore the potential effects of the tax hike on the 2011 economy. Stay tuned.

Let me ask for a little bit of help. I am trying to find data on the potential tax increases, and what I am finding is all over the board. In fact, I had intended to write about that topic this week, but simply don't trust the numbers I am reading. If you have a source or RECENT paper, I would love to see it. Thanks.

Dallas, and Thoughts on the Economy

What started me thinking about tax increases was the problems that so many people I know personally are having, including my kids. It is difficult watching your kids struggle with fewer work hours, the need to make car payments and buy diapers. For many, it's cuts in pay, lost jobs, and more. Lack of health insurance is often a worry, too.

And knowing it could get worse is rather sobering. Trust me, I see the human side of the need for health-care reform, but also balance it with the need for some fiscal responsibility. We have $38 trillion in unfunded Medicare liabilities. How can we add more? Does anyone really believe that this bill being offered will actually cut spending? How do you cut Medicare by $500 billion when it is already so underfunded? Really? But what about kids and families with no insurance? Something better than what we are seeing is needed to get the problem solved. More on this next week.

I will be a panelist in the inaugural "America: Boom or Bankruptcy?" summit to be held in Dallas on March 26. There will be five of us, presenting problems (plenty of those!) and possible solutions. This promises to be a no-holds-barred, full-throttle event. It should be a lot of fun. Details at www.fedfriday.com.

It's time to hit the send button. I have kids coming to the airport, and I want to be there. Spring break and all, and I look forward to it. Have a great week.

Your worried about the kids analyst,

By John Mauldin

John Mauldin, Best-Selling author and recognized financial expert, is also editor of the free Thoughts From the Frontline that goes to over 1 million readers each week. For more information on John or his FREE weekly economic letter go to: http://www.frontlinethoughts.com/learnmore

To subscribe to John Mauldin's E-Letter please click here:http://www.frontlinethoughts.com/subscribe.asp

Copyright 2010 John Mauldin. All Rights Reserved

John Mauldin is president of Millennium Wave Advisors, LLC, a registered investment advisor. All material presented herein is believed to be reliable but we cannot attest to its accuracy. Investment recommendations may change and readers are urged to check with their investment counselors before making any investment decisions. Opinions expressed in these reports may change without prior notice. John Mauldin and/or the staff at Millennium Wave Advisors, LLC may or may not have investments in any funds cited above. Mauldin can be reached at 800-829-7273.

Disclaimer PAST RESULTS ARE NOT INDICATIVE OF FUTURE RESULTS. THERE IS RISK OF LOSS AS WELL AS THE OPPORTUNITY FOR GAIN WHEN INVESTING IN MANAGED FUNDS. WHEN CONSIDERING ALTERNATIVE INVESTMENTS, INCLUDING HEDGE FUNDS, YOU SHOULD CONSIDER VARIOUS RISKS INCLUDING THE FACT THAT SOME PRODUCTS: OFTEN ENGAGE IN LEVERAGING AND OTHER SPECULATIVE INVESTMENT PRACTICES THAT MAY INCREASE THE RISK OF INVESTMENT LOSS, CAN BE ILLIQUID, ARE NOT REQUIRED TO PROVIDE PERIODIC PRICING OR VALUATION INFORMATION TO INVESTORS, MAY INVOLVE COMPLEX TAX STRUCTURES AND DELAYS IN DISTRIBUTING IMPORTANT TAX INFORMATION, ARE NOT SUBJECT TO THE SAME REGULATORY REQUIREMENTS AS MUTUAL FUNDS, OFTEN CHARGE HIGH FEES, AND IN MANY CASES THE UNDERLYING INVESTMENTS ARE NOT TRANSPARENT AND ARE KNOWN ONLY TO THE INVESTMENT MANAGER.

John Mauldin Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.