Paper Gold Market Is Going to Explode, Buy Physical Bullion NOW!

Commodities / Gold and Silver 2010 Mar 13, 2010 - 02:36 PM GMTBy: Gordon_Gekko

Evidence seems to be mounting that we are headed towards some sort of implosion in the paper Gold market, and perhaps the currency/bond markets in general. Let’s take a look:

Evidence seems to be mounting that we are headed towards some sort of implosion in the paper Gold market, and perhaps the currency/bond markets in general. Let’s take a look:

Jacksonville, FL based EverBank – a bank with approximately $8 billion in assets and 1800 employees according to the company website – recently sent this notice to customers (courtesy of Warren Bevan):

"Non-FDIC Insured Metals Select Changes" -

Section 6.3.7. General Terms: We have added language clarifying our right to close your account. We may close your Metals Select Account at anytime upon reasonable notice to you. If we believe that it is necessary to close your account immediately in order to limit losses by you or us [GG: We really don’t give a s**t about you; it’s us that we care about], we may close your account prior to providing notice to you. Notice from us to one of you is notice to all of you [GG: the nerve of these people!]. If we close your account, we reserve the right to convert your Precious Metals to U.S. dollars and tender the balance to you by mail [GG: I am willing to bet my entire Gold stash that when you receive these "converted" dollars, they will be nowhere near the market price of physical. What did you think that whole "limit losses" thing meant?] .If you have a "Non FDIC Insured Metals Select" account with these people, you can pretty much say goodbye to any chances of ever seeing your metal. This is a clear sign that the (already tight) availability of physical metal at the manipulated Comex futures paper price is in danger of vanishing altogether. Think about it. What is the scenario in which they avoid catastrophic losses while at the same time sending you the US dollar value of the metal? When the official or Comex price has fully decoupled from the physical price. Expect to see more such notices from banks offering Metals "Investments".

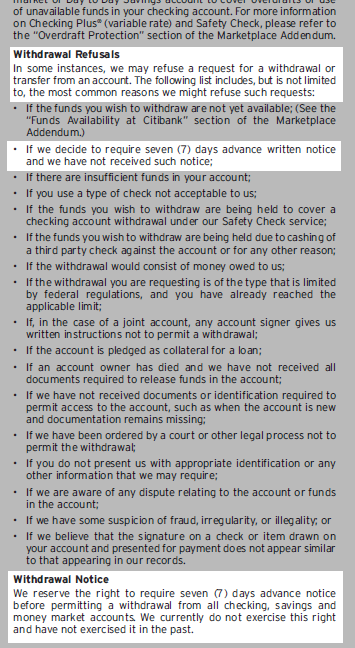

Citibank recently issued this notice to its checking account (remember the type of account where you thought you could withdraw your money whenever you wanted? Well, not anymore) customers (via Market Ticker):

Withdrawal Notice:

We reserve the right to require seven (7) days advance notice before permitting a withdrawal from all checking, savings and money market accounts. We currently do not exercise this right and have not exercised it in the past.

One of Mish’s readers Construction Insider recently sent him this little nugget:

Hi Mish

I work in the construction business and something has been creeping to the forefront of my attention for the past few weeks and now it seems to be moving full steam ahead.

Banks are forcing developers/builders (especially smaller ones) to give up their properties (unsold homes and lots).

Banks say the reason is that the properties in question are no longer performing assets. I am sure there are some loans out there that are not performing and the owners are going under. I am equally sure that there are plenty of developers that are still selling homes - just not at the pace originally planned on the pro formas.

Having inside information on one of these scenarios that happened today, I cannot help but wonder what is really going on? The bank told a small developer/builder I work for that they were taking back his ongoing subdivision.

He is selling houses and updated pro formas would indicate that the current sales pace would exhaust all remaining lots within 33 months. Yet the bank stated they would only give him until April 15 to find alternative financing. The bank is also willing to let him buy the subdivision at a 33% discount to what is currently owed.

If he is unable to obtain this backing, the bank will let him walk away without penalty or consequence so they can write it off.

I have been on the phone trying to put some of these pieces together. It seems there are many banks doing the same thing. However, there is apparently no interest [or ability - Mish] from anyone wanting to pick up land/lots at 30% - 50% discounts to today's prices.

Another interesting point is that the banks all state that they must have these situations written off or taken care of by the end of Q2.Looks to me like DaBoyz are calling in the loans while the currency still has some value. Does the government plan some type of overt currency devaluation or expect the dollar to collapse on the currency markets of its own sorry weight? The cracks are already appearing in the Bond market. Foreigners are increasingly fleeing the Treasury auctions. The only thing keeping them going is manufactured "deflation" fears from time-to-time. A recent 30 year auction (10th February, 2010 to be precise) practically failed. This is what Mr. Denninger had to say about it:

Bad. Actually, let's go worse than bad and call it what it is - by any definition this is just one step off from "Failed."

The more-worrying factor here is that we've got this "mystery" direct buyers out here again taking nearly 25% of the offered amount (who is bidding for that undisclosed?) and another 11% taken down by The Fed for the SOMA account.

Yet even with this Treasury had to pay up to get it to go and the bid-to-cover was anemic at best.

Given the Primary Dealer system we have in this country, any BTC under 2.0 is an effective fail. To get an auction that behaves in this sort of fashion, complete with mystery direct bidders and heavy SOMA (Fed) participation, yet Treasury has to pay up in the form of a significantly higher coupon is not a good sign at all.And this is what happened on 23rd February, 2010 for a 4-week $37 billion Treasury Bill auction (Per Graham Summers):

There are times in life when one witnesses something so outside the scope of normal experience, that at first you don’t see it.

Captain Cook’s diaries tell us that upon first seeing his ships offshore in Australia, the aborigines expressed “neither surprise nor concern.” Cook notes that it was not until he and his men approached the shore in smaller, more familiar vessels that the villagers reacted, arming themselves as “the sight of men in small boats was comprehensible to them: it meant invasion.”

Well, I had a similar experience during yesterday’s bond auction.

Roughly, 27% of the auction took place at the highest rate. This means nearly one third of the demand from competitive bidders (those who care about yield) came at the HIGHEST yield that was accepted. In plain terms, this alone tells you that investors want higher yields from Treasuries since nearly a full third of the debt issuance took place at the highest REQUIRED yield.

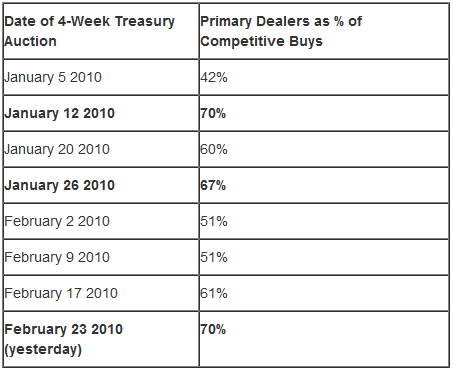

Of the competitive bids (meaning those bids coming from folks who care about yield), roughly 70% went to Primary Dealers (investors who HAVE to buy the debt and who usually turn around and try to sell it afterwards). To put this number into perspective here is the percentage of competitive purchases made by Primary Dealers in the last four 4-week Treasury issuances:

...yesterday’s auction featured MORE buys from Primary Dealers than almost any of those occurring in 2010. Remember, Primary Dealers HAVE to buy Treasuries. So to see them buying a high percentage of Treasuries at debt auctions means that few investors who can pick and choose what to buy are actually looking to buy US debt.

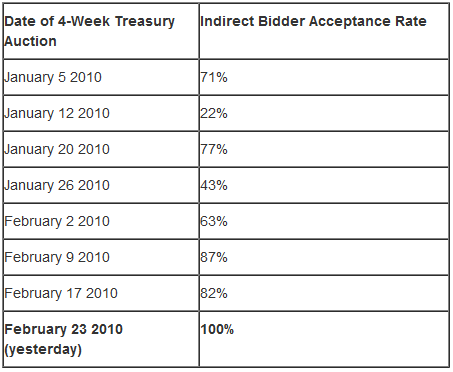

Of the remaining competitive buys (about $8.86 billion), only 32% came from Direct Bidders or those who bought debt directly from the Treasury: orders that can easily be tracked. The other 68% ($5.9 billion) came from Indirect Bidders: folks who we cannot track.

Even more bizarre, only $5.9 billion in Indirect Bidder competitive buys were ACTUALLY OFFERED. So we had a 100% acceptance rate for Indirect Bidder competitive buys.

Let’s put this in perspective:

This means that the Treasury took up EVERY single cent of competitive bids coming from indirect buyers. Remember, indirect buyers are usually assumed to be foreign governments (even the Treasury website admits this).

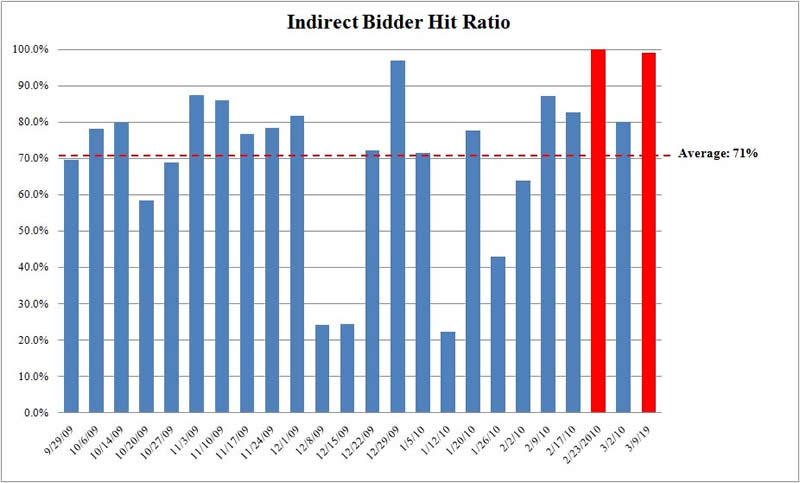

If this was the case yesterday, then foreign governments barely bought much of anything in yesterday’s auction (only 19% of total debt issued). Moreover, it implies that Primary Dealers (those having to buy) had to gorge on the auction to make up for the fact that few if any foreign governments are interested in buying our debt anymore (including even short-term debt).So basically the demand from the indirects (i.e. foreigners) for US Debt is drying up and the Treasury is taking all of whatever miniscule amounts they are offering. As if that was not enough, we had another similar auction on 9th Match, 2010 (via zerohedge):

Two weeks after the indirect hit ratio in the 4 week auction came at a record 100%, today it was once again at almost at the all time possible high, with Indirect Bids of just $6.744 billion taking down $6.683 billion, resulting in a 99.1% hit ratio. The chart of the recent Indirect hit ratio in recent 4 week bill auctions is attached:

Jim Sinclair recently had two gentlemen from Poland and Russia speak up at his Toronto meeting. This is what they had to say (in Jim’s words):

Dear Extended Family,

I believe the most important event at our Toronto CIGA meeting was the testimony of two attendees.

Two men spoke independently. One is a Canadian resident from Russia and the other from Poland.

Both said the same thing, "All the signs that preceded our inflation of more than 100% per year are here now in the West."

What more do you need to know?

Regards,

JimAny unbiased observer who knows how to put two and two together will be able to tell that something very fishy is going on. The urgency with which trillions in debt is being shoved down the market's throat at the worst possible time for the US Economy has the distinct smell of the government trying to extract every last bit of money from those stupid enough to buy the bonds before it all blows up. Rest assured, a huge chunk of this money is being funneled to the insiders who are most likely covertly using it up to buy real assets for themselves while keeping the crowds distracted with the stock market circus.

The bond market is the backbone of the US Ponzi Finance system. When it goes – and the day is not far in my opinion - the whole enchilada will come crashing down. Any type of financial asset that has a counterparty – which is pretty much all the paper assets in the world – bonds, futures, any and all derivatives and yes, even the paper currency – will crash. What will they crash against? Yes, that’s right - Gold. All the world’s capital – trillions, perhaps quadrillions of it - will come rushing into the very tiny physical (NOT paper) Gold market. Remember, the world’s real physical capital – real assets such as land, oil-refineries, mines, infrastructure, etc. will not vanish, only it will be re-priced in terms of Gold and its ownership transferred to those who hold it. Since everything stays on this planet, it is a zero-sum game and the winner will be Gold. In other words, an ounce of physical Gold will command a lot more in real purchasing power than it does today. Just like a national currency is a claim on goods and assets within that country, Gold will be a claim on global goods and assets worldwide.

Paper Gold Will FAIL

Today what you think of the price of Gold is nothing but the price of paper Gold. "What is the difference between the two? We are still getting the metal at the price we see on the COMEX, are we not?", you may ask. Sure, but the key word is still. Even today you have to pay "premium" to the futures price to get physical ranging from about $50 for some coins to about $10 for bars. When it all blows, these “premiums” will skyrocket and the price of physical WILL decouple from the official paper price (this is what the guys at EverBank are scared s--tless about), as we already witnessed in 2008 – and this is the good scenario. Indeed, we may have a situation where there is no physical available at any paper price.

1. The GLD ETF

The problems with the GLD ETF are too numerous to enlist here but why bother when they have already mentioned 'em all in their prospectus! It is simply another Wall Street scam designed to rip off the retail investor and rest assured, when the SHTF, you will be the last in line since the insiders need somebody to hold the bag in order for them to get bailed out. YOU will be the one left holding the bag. Unless you have a direct line to Ben Bernanke, I suggest you get the hell out of any paper ETF’s such as GLD, SLV, etc. Remember AIG? It’s all good until it isn’t.

2. The Gold Futures Market

The futures market is nothing but a tool for the dollar managers (US Government/Fed/Bullion banks) to manage/control the price of Gold. Any rational observer with an iota of brain who has watched the gold market for any reasonable length of time can tell that the price is intentionally driven down during the Comex trading hours. If you don’t believe this, either you’re in denial or worse – collusion - and IT WILL end up costing you big time. Given the massive, concentrated and long-term (the entire past decade - they haven't been net-long - not once - during that time period) nature of their short positions, it really isn’t that hard to deduce that the banks do not nearly have enough metal to cover their shorts and that the sole intention of the massive short position is to control the price. Whenever the price rises (or threatens to rise) the big bullion banks ala JP Morgan create massive naked shorts introducing fake supply of Gold in the market, thus driving the price down. “But the price has been rising for the past decade, hasn’t it? So how can you say they are driving it down?”, many people ask. Well, the constraint on the bullion banks has been the availability of the physical metal. If the metal is not available, the fraud of the paper market is exposed and they lose their price managing ability. So they allow the price rise to a level at which there are some weak hands willing to sell and then they hold it there till all the sellers have been exhausted (I am assuming the Fed has already sold all the US Gold during the past decade). So strong are Gold’s fundamentals that despite the massive rigging, all they have been able to do is slow its rise. The weak hands who sell the physical metal at every price rise have helped them in this endeavor. But soon, as the bond market implodes, they will run out of sellers. Treat the availability of real metal at today's paper price a gift and buy as much as you can.

To those who think that the Comex shorts will be crushed one day and the price of paper Gold will do a moonshot, to them I will say that you are dreaming. The Comex shorts will be crushed, but not in their own casino! If and when a majority of paper Gold longs demand delivery a force majure (who do you think the US Government will side with?) will be declared with cash settlements and/or offers of equally worthless GLD shares (don’t tell me you didn’t know about this). By some accounts, this is already happening. What will happen to the paper price then? That’s right – it will utterly collapse even as the physical’s price is rocketing. Paper gold holders will dump it all to buy the physical – which, unfortunately – will most likely not be available at all. Yes, yours truly has been trading the paper [Gold] markets himself, but only with the objective of converting the paper profits onto the metal. Having said that, in light of the sum total of the recent developments mentioned in this update I think it is too risky to be trading right now and one should just sit 100% in physical Gold and some currency for day-to-day needs.

Additionally, there is increasing evidence that the Europeans have withdrawn support from Wall Street’s paper Gold market (COMEX and the LBMA, which also operates on a fractional reserve basis as documented here) and are in favor of setting up a physical only Gold market (this is quite a long story - for details, I suggest you go through FOFOA’s blog). Jim Willie had this to say in a recent piece (he’s been accurate on many things so far, so I at least pay attention when he has something to say):

Fast approaching is the event of GAME OVER for London, a condition that has already reached critical level, according to a key reliable source of information with London connections and direct experience with its market events. How long can a major metals exchange sell contracts but have miniscule supply of gold in their vaulted possession? The paper gold market and the physical gold bullion market have finally separated in a practical manner, meaning actual gold has almost no role anymore in London paper contract settlement. The absence of gold in London requires extraordinary tactics to settle contracts and to obtain gold bullion. Red tape procedures delay delivery for individuals, and bribes accompany gold delivery demands as standard practice. The London Bullion Market Assn has almost zero gold, its supply having been drained in high volumes since early December, a process currently in acceleration. The opportunity to convert fiat money into precious metal at prices considered reasonable is also vanishing. The London gold banker said,

"There is going on a lot more than meets the eye. The physical system is actually consolidating bigtime and is organizing itself with lightning speed, totally hidden from pretty much anyone, even the so-called insiders. The paper precious metal market and the physical precious metal market have defacto disconnected. The paper and physical gold markets currently operate in parallel universes. The outflow of physical metal from bank vaults is happening at a mind bending pace."

Wall Street and the US Dollar are being increasingly marginalized at the global level with China having instructed its companies to renege on Wall Street’s derivative contracts last year; Russia, Middle-East and China setting up their regional currency blocs; Germany calling for an end to the CDS casino and the recent exclusion of Wall Street banks from European Government bond market. For obvious reasons, none of this is getting much play in the lapdog US media.

Physical Gold in your personal possession is the only thing that will survive the coming financial Armageddon. What we are witnessing right now is nothing but the calm before the storm. Keen observers are hearing rumblings beneath the ground signaling an imminent volcanic eruption. Once it blows it will be too late to take action. Trading paper markets for paper gains is like picking up pennies in front of the steamroller. It’s time to stop trading and just buy the physical metal. The window of opportunity to convert your casino chips (fiat money) into real money, i.e. Gold, is getting smaller by the hour. He who panics first, panics best.

GET. GOLD. NOW.

By Gordon Gekko

http://gordongekkosblog.blogspot.com

© 2010 Copyright Gordon Gekko - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.