Gold Heading for Technically Bearish Down Week, But Fundamentals Still Positive

Commodities / Gold and Silver 2010 Mar 12, 2010 - 06:23 AM GMTBy: GoldCore

In New York yesterday, gold saw a gain of $2.29/oz at its session high of $1109.94/oz before falling to see a loss of $7.10/oz at $1100.55/oz shortly afterwards. It then climbed higher for most of the rest of day and ended near its earlier high with a marginal gain of 0.005%. Silver dropped to see a loss of $0.16/oz. It fell as low as $16.83/oz before it also climbed higher and ended near its late session high of $17.15/oz with a gain of 0.9%.

In New York yesterday, gold saw a gain of $2.29/oz at its session high of $1109.94/oz before falling to see a loss of $7.10/oz at $1100.55/oz shortly afterwards. It then climbed higher for most of the rest of day and ended near its earlier high with a marginal gain of 0.005%. Silver dropped to see a loss of $0.16/oz. It fell as low as $16.83/oz before it also climbed higher and ended near its late session high of $17.15/oz with a gain of 0.9%.

Gold rose in Asian trading and has continued its positive momentum in European trade as the dollar has weakened ahead of U.S. retail sales data for February, which could show falling consumer spending. A surprise figure could result in further volatility in the gold market.

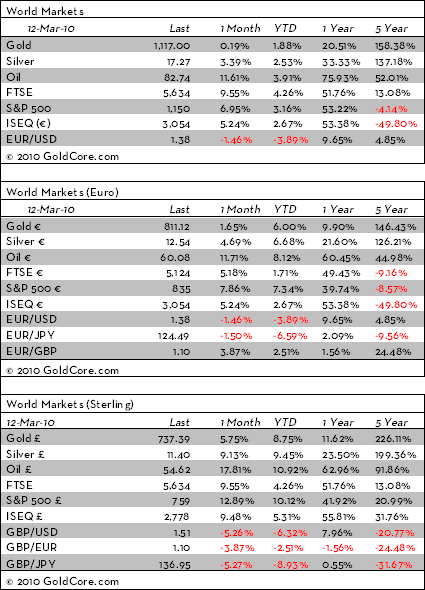

Gold is currently trading at $1,117.70/oz and in euro and GBP terms, gold is trading at €812/oz and £737/oz respectively.

Gold looks set to incur its first weekly loss in seven weeks after the falls seen this week. After the sharp rise seen in the last month (gold was trading at a low of $1,061/oz on February 8th and rose as high as $1,145.10/oz on March 3rd) when gold rose nearly 8%, gold was due a correction and profit taking was to be expected. Another factor contributing to the fall may be the unsubstantiated rumours of central bank selling and liquidations from gold exchange-traded funds and of long positions by hedge funds and banks on the COMEX.

Technically, gold had risen some $85/oz from low to high and often corrections see prices give up 50% of the preceding gain. This would see gold fall some $40/oz to $45/oz from the recent high of $1,145/oz and interestingly the low yesterday was just above $1,100/oz. This is now support and a lower weekly could see us test this support again and there is the potential for falls to lower support at $1,090/oz and strong support at $1,060/oz.

A higher weekly close (close above $1133.80/oz) would be very bullish and should lead gold to challenge the recent high at $1,145.10/oz and resistance at $1,160/oz. The favourable fundamentals and lingering concerns about the economic recovery and sovereign debt issues in the UK, Europe and the US could see gold achieve a new record (nominal) high above $1,225/oz in the coming weeks.

Silver

Silver has slowly risen from $17.15/oz this morning in Asia. Silver is currently trading at $17.31/oz, €12.52/oz and £11.52/oz.

Platinum Group Metals

Platinum is trading at $1,621/oz and palladium is currently trading at $461/oz. Rhodium is at $2,550/oz. Platinum has risen the most of the precious metals this morning (up more than 1%) and bargain hunters and value buyers appear to have an appetite at this price level.

News

Diplomatic tensions between China and the US continue. China has told the US and President Obama to leave the yuan to China and not "politicise" the currency issue. The United States should not make a political issue out of the yuan, a Chinese central banker said on Friday, as the two countries lurched toward a potential bust-up over Beijing's currency regime. The tensions arose after comments by President Obama calling on China to move to a "more market-oriented exchange rate." Tensions may come to a head next month when President Barack Obama's administration decides whether to brand China as a "currency manipulator."

President Barack Obama is planning to nominate Janet Yellen, president of the Federal Reserve Bank of San Francisco, to take over as vice chairman of central bank in Washington. Yellen is considered "dovish" and some investors will be concerned that she underestimates the risk to the dollar and of inflation.

Crude oil has been steady over $82 per barrel overnight after rallying in the follow-up to yesterday's employment report.

Japanese Prime Minister Yukio Hatoyama today made a rare call for 'firm steps' to stem the strength of the yen after the currency's recent advances hit exporters' earnings. Hatoyama said the current high value of the yen gave a misleading impression of the world's second-largest economy, adding: 'Japan's economy and industries aren't necessarily strong'.

This update can be found on the GoldCore blog here.

Mark O'Byrne

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.