Stock Market Softer on Fears Tighter Chinese Policy

Stock-Markets / Financial Markets 2010 Mar 11, 2010 - 01:02 PM GMTBy: PaddyPowerTrader

A pretty moribund Wednesday but market sentiment has remained tilted towards the positive. In the US, the S&P500 took another stride towards eclipsing the 19 January high with a further 0.5% gain, helped by solid increases in the financials and the IT sector (of course the Nasdaq has already made new highs). US Treasury bonds were a bit weaker after the $21 billion 10 year auction. The auction itself was quite strong, with the bid-to-cover ratio of 3.45 comparing with the average of 2.77 over the last ten 10 year auctions.

A pretty moribund Wednesday but market sentiment has remained tilted towards the positive. In the US, the S&P500 took another stride towards eclipsing the 19 January high with a further 0.5% gain, helped by solid increases in the financials and the IT sector (of course the Nasdaq has already made new highs). US Treasury bonds were a bit weaker after the $21 billion 10 year auction. The auction itself was quite strong, with the bid-to-cover ratio of 3.45 comparing with the average of 2.77 over the last ten 10 year auctions.

Citigroup advanced 3.7% as the bank sold trust preferred securities to raise capital. American International Group surged 11% amid speculation asset sales will improve the insurer’s viability. Financial shares in the Standard & Poor’s 500 Index climbed for a ninth straight day, the longest streak in 12 years. But equities trimmed gains in afternoon trading amid growing concern China may need to increase borrowing costs to combat inflation

There wasn’t a whole lot for markets to react to yesterday. US wholesale shipments were up a healthy 1.3% in January, with inventories down 0.2% as a consequence. The monthly budget deficit was $221bn in February, a record for that month (though in line with the market pick). These data followed mixed news in Europe. UK IP fell 0.4%mom in January, the first decline since August (the market had been looking for another gain), with the fall led by the 0.9% decline in factory output. The IP growth pulse is still reasonable, however, so it’s a little premature to say the nascent UK recovery has stalled. In contrast to the UK result, IP was much stronger than expected in both France and Italy. German export data disappointed, however. German exports declined 6.3% in January against a market consensus for a gain of 0.2%. Market commentary suggests that one-off factors must have been behind the surprising decline. In other European related news, former EC President Prodi said that “for Greece, the problem is completely over” and “I don’t think there is any reason to think the euro system will collapse or will suffer greatly because of Greece.” I’m not quite as sanguine given that the real test for Greece (and others) will be the actual implementation of the fiscal austerity programme.

Today’s Market Moving Stories

- Eurozone: Chairman of the Eurogroup, Jean-Clause Juncker, says that there are thousands of questions to clarify in order to establish a European Monetary Fund. He also notes that such a fund will not help Greece’s problem.

- ECB President Jean-Claude Trichet says that he doesn’t “reject” the idea of a European Monetary Fund. He also reiterates that the ECB’s governing council doesn’t yet have a position on the EMF as of now.

- French Prime Minister Francois Fillon, says that the USD’s exchange rate against the EUR is “destabilising”.

- German Chancellor Angela Merkel says she supports France’s demand that the issue of global imbalances should be discussed with the United States and China in the Group of 20.

- US: Standard & Poor’s says that the USD is still the most important world currency. However, it argues that this could be undermined by rising levels of debt and a continued dependence on foreigners for financing. It adds:”In our opinion … inflation figures, trade volumes, foreign exchange volatility and the current account will be the leading indicators if the USD’s role were to diminish. Such a scenario could even weigh on the ‘AAA’ rating of the United States.”

- China data, Feb: February’s data provided few surprises. CPI inflation of 2.7% was higher than consensus, but the underlying trend looks stable. Inflation should hold around this level for several months before reaching 3% in June. Food inflation of 6.2% was higher than January’s 3.7%, but base effects are to blame and there is no evidence of a spike in prices. New loans of CNY700b broadly met expectations. New loans during the first two months of the year typically account for 20-25% of the annual total. Assuming the same pattern this year, loans are on track to reach CNY7,500b this year, in line with official targets and below last year’s CNY9,500b. Industrial production growth of 20.7% in the first two months of the year was largely unchanged from December. Fixed investment growth of 26.6% over the same period was modestly stronger than December, but spending is often volatile at the start of the year owing to cold weather.

- Commerce Minister Chen Deming says that rising inflation (imported via global commodity prices), is China’s major policy concern this year.

- PBOC deputy governor Su Ning says: “Consumer inflation will be mild and controllable this year.” He adds that food prices, particularly for vegetables and fruit, rose quickly in February this year because of the Lunar New Year and heavy snow. He adds: “We believe with the arrival of spring and good weather, the seasonable impact will gradually disappear.”

- The Ministry of Land and Resources publishes details of its new rules for land sales for property developments, including a higher down payment for land purchases.

- Chairman of the China Banking Regulatory Commission, Liu Mingkang, says that the big banks must balance their pace of lending this year to avoid risks in credit expansion

- Chinese economic data highlighted the need for further policy tightening. February data releases included CPI, IP, retail sales and fixed-asset investment showed stronger than expected inflation and economic activity at the beginning of 2010. In recent months, I’ve have noted that increasing liquidity withdrawal operations have been the central bank’s main tool to try to get a handle on accelerating inflation. At the current pace, however, the PBOC looks to be lagging inflation again, which implies either a further reserve requirement ratio (RRR) hike over the next two weeks or that another form of monetary tightening is likely to take place.

- Japan GDP, Q4 (revised): Growth was nudged down from 1.1 to 0.9%.

- For a change the GBP is the strongest performing currency during the European morning session following the Bank of England quarterly inflation attitudes survey which showed a rise in consumers’ inflation expectations over the coming year from 2.4% to 2.5% which is the highest since 2008.

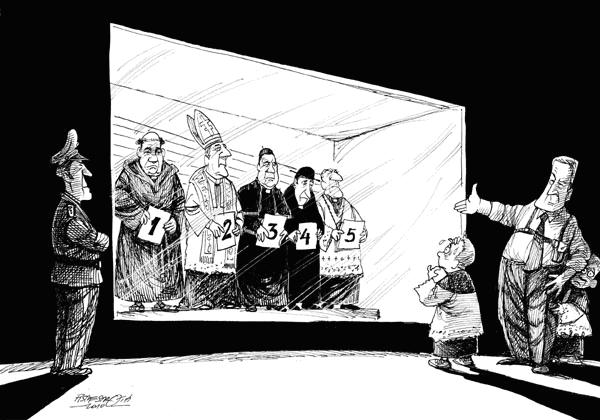

The CDS Bogey Man

The momentum for a ban on naked CDS is getting stronger. Germany and France on Wednesday called on the European Union to consider banning speculative trading in credit default swaps and set up a compulsory register of derivatives trading, the FT reports. Angela Merkel and Francois Fillon sent a letter to Jose Barroso yesterday, asking for an immediate investigation of the role and effect of speculative trading in CDSs in the sovereign bonds of European Union member states. Fillon assured after talks in Berlin, that both governments are “very much in agreement in tackling extreme speculation”. Earlier this week, Mario Draghi indicated that tighter regulation of CDS could become a G20 issue when he confirmed that the subject will be on the agenda of the Financial Stability Board (FSB), Reuters reports.

An FT editorial says that the proposal has the purpose to “deflect attention from their inability to deal with the Greek debt crisis” and does “nothing to solve the crisis or make future ones less likely”. But banning naked CDS would be “silly”.

Bloomberg reports that Merrill Lynch and INvesco warn investors to avoid Spain’s bonds as the euro region’s highest levels of joblessness stifle the country’s ability to cut its budget deficit.

Company / Equity News

- UK food retailer Morrison this morning released a strong set of 2009 results in my opinion with underlying profit before tax up by an impressive 21% to GBP767m (consensus was for GBP757m) on the back of a 6% increase in sales to GBP15.4bn. This serves to underscore the strong operational gearing of the business, although the profitability improvement also reflects a reduction in lower margin fuel in the sales mix

- BP has agreed to buy certain upstream assets in Brazil, Azerbaijan and the US deepwater Gulf of Mexico from Devon Energy for USD7bn in cash, less USD500m for BP’s Kirby oil sands interests that it is selling to Devon to create a 50:50 joint venture. The deal is subject to regulatory approval.

- Home Retail Group which owns Argos and Homebase has released a end of year trading statement (y/e 27 February) in which it outlines that PBT for the full year will circa £290m, which is slightly ahead market expectations (3% above bloomberg consensus at £282m). At Homebase, like for like sales fell 0.6% in the last 8 weeks of financial year with adverse weather having an impact on the trading performance. For the 12 months ended 27 February 2010 Homebase like for like sales were ahead by 2.7% (H2: +2.6%). Given the weather effect in the final period the group states that it is difficult to assess any shift in underlying trends.

- No specific outlook for 2010 is provided with management stating it continues to plan cautiously for the year ahead given the uncertainties that still remain. Grafton last week also stated that trading in the first two weeks of January had been affected by severe adverse weather conditions, however that sales since then had been close to expectations and the comparable period as it benefited from increased activity from the UK new housing sector

- UK home builder Barratt Developments gained 6% yesterday (March 10th) on speculation that Persimmon was readying a bid for the builder. Reuters reported that Persimmon was mulling a bid that would value Barratt at 170p per share. Similar rumours have surfaced in recent weeks surrounding a possible bid for Bovis Homes. On the face of it, a bid for Barratt by Persimmon looks unlikely, especially given management comments at the full-year results last week. Persimmon was clearly focussed on the need to continue to manage both costs and debt lower and was adopting a cautious approach to land acquisition. While a lot can change in a week, management’s overall tone was cautious and certainly did not suggest they were prepared to do a £2.2bn acquisition.

- In London UK pub chain JD Wetherspoon is up 2.8%, a sixth day of gains, after the company signed a £530 million credit line to refinance debt. The company also reported a 41% increase in first-half net income to 24.4 million pounds and resumed paying a dividend.

- Thomas Cook Group rallied 2.6% after Europe’s second-biggest tour operator said at an investor presentation in London yesterday that it can achieve an operating-profit margin of 5.5% to 6% over the next three to five years.

- On the Continent Volkswagen rallied 3.7% after the carmaker said two-month sales across its nine brands, excluding truck maker Scania surged 27% helped by growing demand in emerging markets. The increase outpaced a 20 percent gain in the global market in the period, the company said. And BMW gained 2.6% after reporting full-year net income of 210 million euros. And GEA Group whose machines milk a third of the world’s dairy cows soared 7.2% after the company said full-year net income rose to 161.7 million euros from 101 million euros.

Disclosures = None

By The Mole

PaddyPowerTrader.com

The Mole is a man in the know. I don’t trade for a living, but instead work for a well-known Irish institution, heading a desk that regularly trades over €100 million a day. I aim to provide top quality, up-to-date and relevant market news and data, so that traders can make more informed decisions”.© 2010 Copyright PaddyPowerTrader - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

PaddyPowerTrader Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.