Distress Signals On Financial Crisis Watch

Stock-Markets / Credit Crisis 2010 Mar 10, 2010 - 06:14 PM GMTBy: Jim_Willie_CB

To be sure, almost without debate, all the financial world has turned to crisis mode. One can safely describe the norm to be crisis proliferation. This theme will clearly continue for the full year in progress. The signs are everywhere. The evidence is compelling. The criticism of remedy is replete with denials. The USGovt officials grow more desperate with each passing week. The Dubai and Greek debt woes seemed to have opened Pandora's Box.

To be sure, almost without debate, all the financial world has turned to crisis mode. One can safely describe the norm to be crisis proliferation. This theme will clearly continue for the full year in progress. The signs are everywhere. The evidence is compelling. The criticism of remedy is replete with denials. The USGovt officials grow more desperate with each passing week. The Dubai and Greek debt woes seemed to have opened Pandora's Box.

Review a scattering of distress signals, sit back and tell yourself that all is under control. It is only if you live in a Fantasy Land. Since September 2008, the fantasy has blossomed in full bloom. The list of distress signals is certain to grow, not reduce. Never in my lifetime have so many loud signals simultaneously been flashing. Forgive me if a few dozen other distress signals were overlooked or omitted.

For simplicity, and to make a point, ignore all events in Europe concerning sovereign debt. My theme all along is that not only has no remedy come for the USEconomy and US Banks and USGovt financial structure, but no remedy is even attempted. The name of the game is to create gigantic cash flows that the syndicate grabs from to its strategic position, as fraud continues with no semblance of prosecution. They control the USDept Treasury and the USCongress and the US Financial regulators. True movement toward remedy would liquidate Wall Street and much of the syndicate edifices that serve as fronts for the USGovt control tower. Details for the following stories and developments are covered in the March issue of the Hat Trick Letter, complete with analysis. Meanwhile, back at the gold mine, the gold price has remained in an unusual extremely tight range. Its pattern resembles a coiled spring. A breakout seems obvious, but timing is not. Upward is my forecast as the first quarter of 2010 ends.

GLOBAL EARTHQUAKES

The series of earthquakes in recent weeks is unprecedented. Typically, seismic events are uncorrelated across the globe. The string has prompted many questions, even from scientists. They might do well to take a close examination of some nifty powerful weapons sported by the USMilitary. Do a Google search on the HAARP and sit back for an exposure stun. Even little Costa Rica endured a 5.7 earthquake last week, which shook my building. Try to explain this lovely photo over Norway in December as naturally occurring. Explanations offered are laughable.

FANNIE MAE PUSHBACK FAULTY LOANS

Fannie Mae & Freddie Mac have begun a concerted effort to push back fraudulent loans to major banks that originated them. They reek of impropriety. Their faulty underwriting and approval process extends from lax confirmation of income, phony appraisals, and duplicate property titles. The Big Four banks have already begun to absorb losses, adapting their business structures. True to form and pattern, Fannie Mae logged another staggering quarterly loss over $10 billion. The Black Hole continues to suck in large chunks of capital. For every $1 loss in the open is another $10 loss from credit derivatives out of view.

FDIC & NEXT BIG BANK FAILURE WAVE

Several hundreds of US banks remain vulnerable. Their reserves are not prepared to defend against the next waves of commercial mortgage losses, after the residential Option ARMortgages have also begun in earnest out of first gear. Another cool $1 trillion in bank losses could occur this year and next, along with at least 300 bank failures just this year. The FDIC is again in deficit for insured bank deposits.

FDIC APPEALS FOR PUBLIC DONATIONS

In a bizarre demonstration, a public charade, the Federal Deposit Insurance Corp appealed to the United States population for donations. Why not? A decade ago they began the feature on IRS tax returns to donate money to pay down the national debt. A person has to be an utter complete moron to donate, since it only goes to the syndicate channels. The FDIC is as broke as it is desperate.

BIG BANK BONUSES CONTINUE

Showing no conscience, no remorse, and no class, the big bank executives continue their galling awards for outsized bonuses. They must feel entitled. They have avoided all charges for fraud and securities violations, thus must feel deserving of massive awards. One year after the US banking industry croaked and died, the executives are lining up for huge bonuses, even after many banks are wards of the state. The reality is that the state is a captive of the banks. They seized the USGovt finance ministry fair & square, and deserve their booty.

CITIGROUP DELAYS WITHDRAWALS

Invoking an old USFed regulation still on the books, Citigroup declared that withdrawals from many types of accounts must wait seven days to receive funds. Since highly liquid accounts are not required to maintain reserves requirements, banks are granted a 7-day leeway in the current regulatory framework. They have not used the legally available window until now. Some speculate that a Bank Holiday comes, an event the big banks might exploit by refusing depositors their money. Mass bankruptcies could follow, then bank system restructuring, but with depositors left out in the cold.

NO MARK TO MARKET FOR COMMERCIAL LOANS

In April 2009, the Financial Accounting Standards Board blessed and the USCongress approved into law the policy of permitting big banks to value their own worthless and badly impaired assets. That started the Zombie Bank era, whereby insolvent banks pretended to function, but with stock shares trading avidly. Last week, USFed Chairman Bernanke cast aside Mark-to-Market once again, so that heavy commercial loan losses could be ignored. They will instead be marked according to cash flow and income streams, thus ignoring the heavy collateral losses. Property market prices will not be factored in. Ironically, banks will suffer constipation, since they will not refinance the same loans involved. Loan to value on loans will be too excessive.

SIZE OF BIG BANKS GROWS, SO DOES FRAUD

In the last 10 to 20 years, the proportion of banking system assets coming from the biggest US banks has grown many multiples. So has their influence on the USGovt control of the purse. The argument for the USGovt suffering a coup at the hands of the big bankers is easy to make. In my view, their growth in size, influence, and control serves as a primary example of the Fascist Business Model. Its trademark is endless war, endless bond fraud, and public consternation as the bitter fruit.

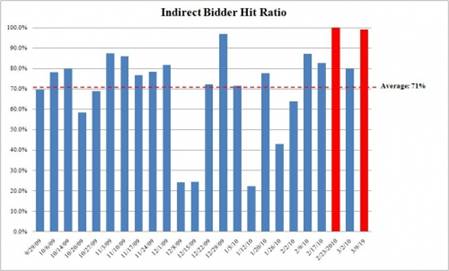

USTREASURY AUCTIONS HIT 100% INDIRECT BIDS

In recent months, the USTreasury has been saddled with the responsibility of securitizing the USGovt deficits. The debt is packaged in bonds and sold at auctions. Some auctions were close to failures. Primary bond deals are choking on inventory, obligated to buy, often almost the only buyers. The hidden degree of official monetization is astonishing. Subtract the central bank purchases and the institutional purchases from the issuance, and basic arithmetic arrives at roughly 50% Printing Pre$$ purchase in hidden fashion, half the bonds monetized. In late February an official auction showed 100% Indirect Bids, which means central banks took the entire heap of junk bonds sold by the USGovt at nearly 0%. The bubble continues, but with much strain.

QUANTITATIVE EASING TO END... REALLY??

The $1.3 trillion in QE purchases of USTreasurys and USAgency Bonds is scheduled to come to an end this month. Threats of a stern pullback are heard from the monetary easing that brought not only powerful QE but also near 0% free money to the Elite. The USFed talks tough for an agency that is badly insolvent, as in busted broke. Sure, they can print money but the asset offsets the debit. Their balance sheet is loaded to the gills, like 50%, with wrecked mortgage bonds. If they are marked down even 5% to 10%, the USFed is insolvent. Reality would dictate a 30% to 40% writedown. Anyone who believes the QE is over is a fool, and probably thought the subprime mortgages were contained. The same people who made such errors are still in charge. Besides, the 2010 election season is months away, and that means apply oil to the Printing Pre$$, revving up, and pouring out tainted money.

US JOBLESS RATE PASSES 21%

Finally in the last few months, the broader U.6 unemployment rate that counts discouraged workers has been thrust into the news. It is actually mentioned in financial press news stories. The gimmick of considering a cast aside worker to be a dead man nonentity is coming to an end. Such workers who cannot find a job, who have exhausted jobless insurance benefits, who just subsist or function as dependents, these people are humans drifting through the USEconomy. They are receiving more attention, even as the U.6 rate of unemployment hit 21.6% recently. It is still rising. Its level challenges that of the Great Depression.

TAX REVENUE REMAINS DEPRESSED

The USGovt stat-rats can doctor many statistics easily, with hedonic lifts from technological advances, from seasonal adjustments that seem to be changed to suit their needs on a monthly basis, from estimates that are routinely revised downward heavily, from reliance upon outmoded devices like the Birth-Death Model, from removal of 'One Off' events at their whim. Some of the statistics most difficult to fudge, doctor, and corrupt are basic tax receipts for state sales tax and federal income tax. They are both down, the federal down very strongly. No sign of recovery is evident in either tax series.

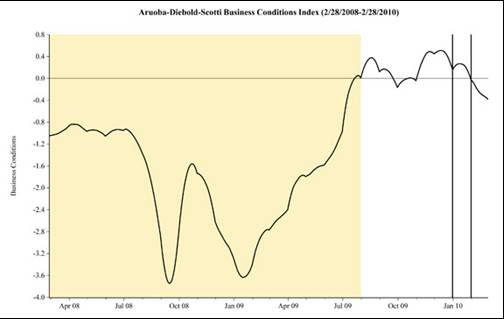

BREAKDOWN OF A-D-S BUSINESS INDEX

The Aruoba-Diebold-Scotti business conditions index is designed to track real business conditions at high frequency. Its underlying economic indicators include weekly initial jobless claims, monthly payroll employment, industrial production, personal income, manufacturing & trade sales, and quarterly real GDP. They blend high and low frequency information with stock and flow data. The ADS index has broken down in the last several weeks, signaling a Double Dip recession, or actually a continuation of the current USEconomic recession that never came to an end.

BANKRUPTCIES & FORECLOSURES RUN AMOK

The pace of personal and corporate bankruptcies is not improving. The pace of home foreclosures is not improving either. The claimed USEconomic recovery is shatterd by the continued consumer bankruptcy filings, which surged 14% in February compared with a year ago, according to the American Bankruptcy Institute. The ongoing woes at the Govt Sponsored Enterprises is an open book available for public view. Fannie showed a 5.38% delinquency rate on mortgages in December, while Freddie just passed the 4.0% threshold in January. Both GSE delinquency rates continue to rise rapidly each month.

HOUSING PRICES RESUME DECLINE

After the USGovt prop from a widely applied first buyer tax credit, and after some key state moratorium lifted rules on foreclosures, the housing sales are sliding downward. The consequent impact on housing prices is clear. They are heading back down over and above the seasonality. The USEconomy was built atop a housing bubble and mortage finance bubble from 2003 to 2007. The scourge of a housing bust and mortgage debacle still plays havoc on the national economy. Beware of what is built on shifting sands.

ONE QUARTER OF US HOMES UNDERWATER

First American reported that 11.3 million homeowners were underwater as of the end of 2009, an amount equal to 24% of all homes with mortgages. In a parallel to the sclerotic US banks, the largest of which uniformly cannot lend since they are insolvent, too many US households cannot spend and invest since they are also insolvent. The proportion of underwater homes, not submerged below sea level, but instead struggling with a loan balance in excess of the home value, is actually growing. The Zombie banks are circled by Zombie households.

HOME BUILDERS SITTING ON CDO BONDS

Orleans Builders has gone bust in the NorthEast. Their balance sheet should strike fear in the hearts of the investment community. Fully 20% of their entire debt was tied to Collateralized Debt Obligations. Questions have arisen whether such CDO toxic debt is laced throughout the major builders. Even questions whether deadly CDO toxin is laced throughout corporate debt structures generally. The commercial paper (supply chain debt securities) continues to evaporate. Perhaps CDO acid will compound the damaged debt structures for a larger swath of corporate America than expected.

TIPPING POINT OF INFLATION OR DEFLATION

Many naive economists, including Benny Bernanke, incorrectly assess the picture concerning price inflation. Ben has missed badly on every conceivable forecast of importance. Since he serves capably as the gatekeeper for the US financial syndicate in control of the countless liquidity facilities and their ample cash flow, he does receive key awards. The prices from the cost structure to the USEconomy are rising. The prices from the asset bases in the financial markets are falling. The mixture of both offers up evidence in aggregate of price stability, when actually the hurricane worsens from clashing low and high pressure zones. Look for rising costs and falling assets to worsen, still showing an aggregate zero. A tipping point comes soon that will lead either to broadly rapid falling prices or to broadly rapid rising prices. My money is ALWAYS on the rising price scenario after the initial shock waves of crisis come. The US bankers and USGovt finance ministers ALWAYS choose to put the pedal to the metal and print money in accelerated fashion, whenever in doubt. The Deflation Knuckleheads have been silent for almost a full year. They will not have their day in the sun. Herr Weimar will, as in a Weimar storm of hyper-inflation.

ASSURED CALIFORNIA & LOS ANGELES COLLAPSE

Seven big US states are in unresolvable distress, which consist of over 30% of the US population. The key state to watch is California, the nation's largest, the trend setter, since it operates in a fishbowl for all to see. The state faces a difficult decision to default or to issue another round of IOU coupons. This time, the many institutions and businesses might be ordered by law to accept the coupons as cash. A collapse of not only California, but its major city in Los Angeles are lined up assured in the near future. Municipal bonds in the Golden State and nationwide are at great risk of defaults, sure to arrive like night follows day.

FRETTING OVER CHINA USTBOND SALES

A big tizzy came after China was revealed to have sold $40 to $50 billion in USTreasury Bonds in a recent reported month. Their actual sales are difficult to pin down, since they play crafty games in using such USTBonds as collateral in large asset purchases. They are traveling troubadors crossing the globe, using USTBonds in acquisitions of strategic commodity assets. For over three years, Japan halted its USTBond purchases. Now China is going into reverse with outright sales on a net basis. If Asian buyers fail to buy, the USGovt will be isolated for recognized monetization of its debt. In fact, evidence mounts and discovery has already occurred.

CHINA NULLIFIES DEBT GUARANTEES

In a move difficult to fully comprehend, the Chinese Govt from its Beijing offices has decided not to support regional and city debt. Their provincial and local governments are on their own. Some kind of debt ripple event might be in the offing. Some sort of surprise Yuan currency devaluation might be in the offing. Some type of commodity stockpile partial drawdown sales might be in the offing. Some scheme of scheduled bankruptcies might be in the offing. Clearly, some significant major disruption cometh.

GOLD SITS ON A COILED SPRING

The gold price has an eerie sense of stabilty about it, a false stability in my view. Absolutely nothing has changed in the global pursuit of ruinous monetary inflation, as all Western currencies are fatally damaged. The monetary growth is at full throttle. Estimates for USGovt deficits are periodically being revised upward. The USDollar continues to benefit from the structurally damaged alternative pseudo-reserve in the Euro currency. Look for short covering to blast a hole in the FOREX market soon, as the Euro will begin to race higher when either kind of resolution comes. If Greece is expelled as in my forecast, the Euro will look trim, especially upon instant expectation of expulsion quickly of Italy and Spain. If Greece is rescued, then a new wave of profligate bond rescue will indeed occur. But the cloak of uncertainty will work to lift the defective Euro currency and lead to a short cover rally. Either way, the USDollar will resume its decline, the tail on the Euro dog. Mentioned before, my best sources indicate without any equivocation that German leaders will talk of solidarity, say all the right things, but offer no aid to Greece as it suffers the desired default and removal from the European Monetary Union that shares Euro currency usage. The end to German sponsored welfare has been planned and sealed.

The technical chart of the Gold price shows a core pennant pattern that begs to escape the clutches of its tightening boundaries above and below. Stability is evident, but in a queer fashion, as nothing is stable globally, and everything financial is in crisis mode. That is hardly the framework to encase a stable Gold price. The long-term trend is up, seen in the still rising 200-day moving average. The 50-day MA offered support in late February. A stealth rally in Gold is my forecast. Reaction to broad fresh new economic weakness in both the United States and Europe will trigger a second formal round of Quantitative Easing, the euphemism for grotesque monetary inflation and organized ruin of currencies. When the Gold price moves beyond the upper pennant barrier, it might move quickly.

THE HAT TRICK LETTER PROFITS IN THE CURRENT CRISIS.

From subscribers and readers:

At least 30 recently on correct forecasts such as the Lehman Brothers failure, numerous nationalization deals such as for Fannie Mae, grand Mortgage Rescue, and General Motors.

“You freakin rock! I just wanted to say how much I love your newsletter. I have subscribed to Russell, Faber, Minyanville, Richebacher, Mauldin, and a few others, and yours is by far my all time favorite! You should have taken over for the Richebacher Letter as you take his analysis just a bit further and with more of an edge.” - (DavidL in Michigan)

“I used to read your public articles, and listen to you, but never realized until I joined what extra and detailed analysis you give to subscription clients. You always seem to be far ahead of everyone else. It is useful to ‘see’ what is happening, and you do this far better than the economists! I can think of many areas in life now where the best exponent is somebody not trained academically in that area.” - (JamesA in England)

“A few years ago, I was amazed at some of the stuff you were writing. Over time your calls have proved to be correct, on the money and frighteningly true. The information you report is provocative and prime time that we are not getting in the news. I was shocked when I read that the banks were going to fail in one of your prescient newsletters.” - (DorisR in Pennsylvania)

“You seem to have it nailed. I used to think you were paranoid. Now I think you are psychic!” - (ShawnU in Ontario)

“Your unmatched ability to find and unmask a string of significant nuggets, and to wrap them into a meaningful mosaic of the treachery-*****-stupidity which comprise our current financial system, make yours the most informative and valuable of investment letters. You have refined the ‘bits-and-pieces’ approach into an awesome intellectual tool.” - (RobertN in Texas)

by Jim Willie CB

Editor of the “HAT TRICK LETTER”

Home: Golden Jackass website

Subscribe: Hat Trick Letter

Use the above link to subscribe to the paid research reports, which include coverage of several smallcap companies positioned to rise during the ongoing panicky attempt to sustain an unsustainable system burdened by numerous imbalances aggravated by global village forces. An historically unprecedented mess has been created by compromised central bankers and inept economic advisors, whose interference has irreversibly altered and damaged the world financial system, urgently pushed after the removed anchor of money to gold. Analysis features Gold, Crude Oil, USDollar, Treasury bonds, and inter-market dynamics with the US Economy and US Federal Reserve monetary policy.

Jim Willie CB is a statistical analyst in marketing research and retail forecasting. He holds a PhD in Statistics. His career has stretched over 25 years. He aspires to thrive in the financial editor world, unencumbered by the limitations of economic credentials. Visit his free website to find articles from topflight authors at www.GoldenJackass.com . For personal questions about subscriptions, contact him at JimWillieCB@aol.com

Jim Willie CB Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.