Stocks Tread Water Awaiting A Fresh Trend Catalyst

Stock-Markets / Stock Markets 2010 Mar 10, 2010 - 09:37 AM GMTBy: PaddyPowerTrader

US stocks closed a rather modest 0.15% higher Tuesday in a real sea-saw day. Stocks opened lower, but rallied almost 1% in the morning and afternoon before selling off dramatically into the close. Stocks held onto their gains, but a low volume morning advance on no news was turned around on the highest volume of the day which came to the downside. This is a microcosm of what we have seen in recent months – low volume ascent and high volume descent.

US stocks closed a rather modest 0.15% higher Tuesday in a real sea-saw day. Stocks opened lower, but rallied almost 1% in the morning and afternoon before selling off dramatically into the close. Stocks held onto their gains, but a low volume morning advance on no news was turned around on the highest volume of the day which came to the downside. This is a microcosm of what we have seen in recent months – low volume ascent and high volume descent.

Actually, I would not have been surprised had we found US markets a touch weaker overnight. For a starter, the latest American NFIB small business survey continues to suggest that smaller firms are doing it tough. The normalised index completely reversed last month’s improvement in January to remain at recessionary levels – a sharp contrast with what we are observing in the “big firms” ISM. Within the detail, optimism regarding the economic outlook was down sharply to an 11-month low and there was no improvement in the employment index. The pessimism that remains in the small business sector is surely reflective of the more difficult credit environment that these firms operate within.

But I wonder whether the renewed decline seen this month is a hangover from the poor weather. Indeed, despite signs of improving labour market conditions, US consumers have also become more pessimistic over the last month according to the IBD/TIPP economic index, suggesting some downside risk to Friday’s University of Michigan survey too. However, on a happier note, both the ICSC-GS and Redbook retail surveys suggest that consumer spending has got off to a strong start in March nonetheless. For example the former pointed to a 2.9% rise in sales last week, making for the best annual comparison since August.

Today’s Market Moving Stories

•Today European session in foreign exchange has been dominated by yet further GBP weakness which has been driven by negative M&A speculation (below) and weak economic data. Following on from yesterday’s poor trade data, UK industrial production was weaker than expected (falling 0.4% MoM and manufacturing falling 0.9% MoM).

•The WSJ says that discussions about how to signal in advance the start of the next interest rate tightening cycle will be at the centre of discussions at the US Fed’s FOMC’s meeting next Tuesday (although no such signal will be given in that meeting’s statement). It says that Fed officials also are likely to decide at the meeting to end their purchases of $1.25trn of mortgage-backed securities by the end of this month, as planned.

• The Guardian carries a story that the UK Treasury will announce later today that the budget will be held on March 24th and that Prime Minister Gordon Brown will go to Buckingham Palace to call a May 6th election on April 6th.

The Guardian carries a story that the UK Treasury will announce later today that the budget will be held on March 24th and that Prime Minister Gordon Brown will go to Buckingham Palace to call a May 6th election on April 6th.

•Bank of England Monetary Policy Committee member Adam Posen told Sky television (when asked whether the MPC will need to extend the QE program) that “we hope we’ve done it.” When asked whether he is totally confident the UK will be able to retain its triple-A status, he said that “I am paid totally in GBP, I moved here. I’m pretty comfortable with that.” He added that the major political parties have made it clear that they will pass some form of an austerity budget. He noted that “the details do matter, but they’re all going to be big enough get us on the right track.”

•An EU draft report said that Greek tax estimates may fail to generate as much additional revenue as projected by the government with the overall government debt still on steep upward path. Meanwhile EU’s Barroso said that a European Monetary Fund could not solve the urgent issue of Greece. The head of the euro area finance minister group Juncker also said that an EMF would not be the solution for the Greek budget crisis.

•Japanese Prime Minister Yukio Hatoyama said that the government will work closely with the Bank of Japan to end deflation. He also says that he expects the bank to take appropriate steps to support the economy.

•When asked by an opposition lawmaker if he thought a formal agreement with the BOJ would help beat deflation, Finance Minister Naoto Kan said that “there’s a question over whether it’s good to have an explicit policy accord. The BOJ governor has already said in public that the bank wants inflation from plus zero to plus 2%… I am cautious about the framework of an accord.”

•Chinese exports rose 45.7% YoY in February (following a 21.0% increase in January) while imports grow 44.7% (after jumping 85.5% in January). As a result the trade surplus for February shrunk to $7.6bn, compared with $14.2bn in January (in line with forecasts).

•The China Securities Journal reports that banks made about CNY 700bn in new loans in February, down from January’s CNY 1.39trn.

The CDS Witch Hunt

Germany and France, working with Luxembourg and Greece, are planning a joint anti-speculation initiative to galvanise action by the European Commission to tighten regulation of derivatives trading, and in particular of CDS in the sovereign debt markets. Angela Merkel called for the “fastest possible” adoption of new rules to clamp down on the most speculative elements of derivatives trading, including so-called naked CDS. The four-nation initiative was aimed to speed up the regulatory process for CDS in particular.

On his visit to Washington, George Papandreou, told the press that the G20 group will consider a European initiative. US regulators meanwhile stepped up calls for greater disclosure of prices of credit default swaps. There are still differences between France and Germany that appear unresolved. “While Germany favours a ban, France is more inclined to give regulators the power to suspend such trading. Berlin also wants to make the market for credit derivatives more transparent by forcing buyers to register trades with a European equivalent to the US Depository Trust and Clearing Corporation. Earlier José Manuel Barroso had announced that the European Commission was examining “the relevance of banning purely speculative naked sales on credit default swaps of sovereign debt”.

Back in the real world short-capitulation is the order of the day in Sovereign CDS space this morning as the risk of adverse headlines recedes (for now anyway) and speculation mounts surrounding potential regulatory pressure on speculative Sovereign CDS trading. By way of example Greece 5 year CDS protection now costs 2.75%, down from 4.30% at the height of the crisis, so if you paid 4.3% you are now WAY out of the money and possibly facing margin calls.

More Troubled Skies Ahead for Aer Lingus

Aer Lingus is proceeding to implement agreed restructuring with those employees who supported Operation Greenfield. That incorporates changed work practices, salary adjustments and about 440 voluntary redundancies. For cabin crew who rejected the proposals (there are 1100 of these) a period of intense negotiation kicks off this morning. If those do not make progress compulsory redundancy notices over 230 employees that are being issued will proceed and probably create industrial strife.

In case anyone has trouble appreciating the pressures on Aer Lingus they should consider Dublin airport traffic volumes. They fell no less than 17% in January. That follows double digit falls in 2009 and is a direct consequence of a deep consumer recession and the introduction of an insane, totally counter productive €10 tax per departing passenger last spring. These numbers also precede the start of a 40% rise in airport charges that will also threaten future capacity plans by airlines. The January figures are in stark contrast to trends in the UK and other EU states where airport volumes have stabilised since year end.

By way of example, BAA has reported a 3% increase in traffic for its two London airports in February, and a 0.6% increase for the first two months of the year. Heathrow February traffic was up 5.3%, but was flattered by February 2008 being a month of extreme snow, although the underlying increase adjusted to take account of the weather problems last year was still 2.7%. Conditions remain tough for Stansted, which reported a 4.5% drop for February despite the weak comparative, but this is a relatively minor contributor to BAA.

Company News

•In London, broker Tullett Prebon surged 21% after saying it’s in “preliminary discussions” with a third-party it didn’t identify. ICAP gained 3.5% in sympathy. Tullett and GFI Group, the largest inter-dealer broker of credit derivatives trades, ended merger talks in 2008.

•F&C Asset Management is up 5% after the firm that oversees the oldest UK investment fund posted full-year net income of £15.9 million compared with a loss of £52.5 million a year earlier.

•Inchcape dropped 2.2% after the company forecast “difficult trading conditions” in the second half of this year and said it is not recommending a dividend payment. Full-year revenue declined 11%.

•Laird shed 8.9%, heading for the biggest drop since October. The largest maker of electromagnetic shields for mobile phones posted a full-year loss as revenue dropped on customers’ running down stocks.

•Melrose rose 7.7% on comments from Finance Director Geoff Martin who said he expects analysts may raise profit estimates as an acquisition did better than the company anticipated.

•UK Coal rallied 5.1% after Hargreaves Services said it is in the “early exploratory stages” of reviewing a potential merger with the largest producer of the fuel from British mines.

•On European bourses today Valeo, France’s 2nd largest car parts maker jumped 6.6% after commenting that it aims to outpace auto-industry growth in the next decade by developing fuel-saving engine technology and expanding in emerging markets.

•Glanbia released full year 2009 results in line with expectations with EBIT of €121.2m and adjusted eps of 30.68c Dividends are up 5% to 6.84c. Regarding 2010 the company expects “better pricing” in the US, a “marked improvement” in Dairy Ireland and a “reasonable” result from Joint ventures amid a “challenging” outlook. Consensus forecasts of a 10% rise in earnings are supported by that guidance. A potentially more significant development is news that Glanbia Co-op, which owns 54.6% of the plc, has expressed an interest in acquiring the Irish dairy, agritrading, property, business services and related JVs. These units accounts for at least 50% of group revenues.

•Tullow Oil today reported full year results broadly inline with market expectations, posting revenues of £582m down 16% YoY and operating profits down 68% to £95m. Encouragingly the company have reported the start to 2010 as “excellent” and that the first oil in Ghana from the Jubilee field later this year will result in considerable production growth and increased cash flows. Tullow expects 2010 performance prospects to remain very strong, with a drilling programme of up to 30 wells proposed to be drilled throughout the year.

•There is speculation that Barclays is looking for a big retail bank in the US. The FT reports that strategy proposals are going to the board in the next 2-3months. Some banks that have been referred to include Suntrust (market capitalisation $15bn), Fifth Third (mkt cap £10bn) and Comerica (mkt cap £6bn). US Bancorp was also heard but at mkt cap of £47bn this has got to be too big and looks good on its own. Barclays own market cap is £41.6bn. If Barclays wishes to take advantage of a battered domestic US retail bank market than it is not a bad way to go considering new regulatory proposals that riskier investment banking ops need to hold more capital to run. Barclays have already expressed a desire to expand its other businesses.

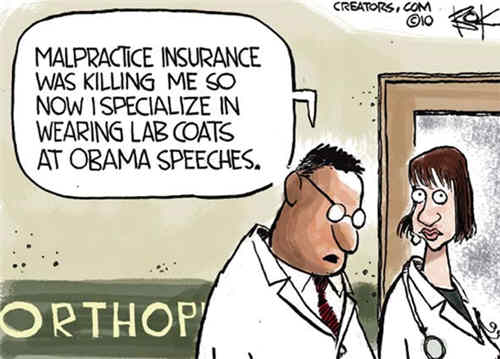

And Finally… Obama’s Real Plan B Revealed

Disclosures = None

By The Mole

PaddyPowerTrader.com

The Mole is a man in the know. I don’t trade for a living, but instead work for a well-known Irish institution, heading a desk that regularly trades over €100 million a day. I aim to provide top quality, up-to-date and relevant market news and data, so that traders can make more informed decisions”.© 2010 Copyright PaddyPowerTrader - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

PaddyPowerTrader Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.