The Scandinavian Socialist Welfare Myth Revisited

Economics / Economic Theory Mar 09, 2010 - 02:04 PM GMTBy: MISES

Obama seems hell-bent on expanding the US welfare state at any cost, and of course no welfare-state debate is complete without bringing up the Scandinavian countries as the perfect example of massive statism bringing prosperity. This seems to be a real conundrum, even for Austrians and other libertarians. Being a citizen of Sweden myself, I am often asked to give an explanation of these "bumblebee economies" that aren't supposed to be able to fly but still do.

Obama seems hell-bent on expanding the US welfare state at any cost, and of course no welfare-state debate is complete without bringing up the Scandinavian countries as the perfect example of massive statism bringing prosperity. This seems to be a real conundrum, even for Austrians and other libertarians. Being a citizen of Sweden myself, I am often asked to give an explanation of these "bumblebee economies" that aren't supposed to be able to fly but still do.

It is always good to look at the history of a country when examining its economic performance. Stefan Karlsson did just that back in 2006 in an excellent article on the economic history of Sweden. I will therefore only give a brief overview of this subject before focusing on the central point of this article.

It is always good to look at the history of a country when examining its economic performance. Stefan Karlsson did just that back in 2006 in an excellent article on the economic history of Sweden. I will therefore only give a brief overview of this subject before focusing on the central point of this article.

Karlsson wrote the following:

As a result of its free market policies, the resourcefulness of its people, and its successful avoidance of war, Sweden had the highest per-capita income growth in the world between 1870 and 1950, by which time Sweden had become one of the world's richest countries.

Indeed, thanks to its "neutrality" during WWII, Sweden was never bombed or invaded.[1] This left Sweden's industries intact and unharmed, which, along with its free-market-oriented economy, enabled the country to profit extensively from the reconstruction of war-torn continental Europe: Sweden exported huge amounts of goods and natural resources to the rest of Europe, fueling an economic boom in Sweden that lasted for over two decades.[2] As Karlsson points out, during this time "Sweden was still one of the freest economies in the world, and government spending relative to GDP was in fact below the American level."

On the back of this boom the Swedish government began setting up a massive welfare state throughout the 1950s, '60s and '70s, causing government spending to skyrocket to more than 50 percent of GDP. At one point during the mid-'70s, the top marginal tax rate was an unbelievable 102 percent.

One of the people who were burdened with this tax was Astrid Lindgren, the famous author of children's books best known for her Pippi Longstocking series. In 1976 she wrote a satirical short story published in one of Sweden's biggest newspapers, where she told the tale of a troubled children's-books author called Pomperipossa, who lived in the fictional kingdom of Monismania. Among other things, Pomperipossa pondered why the more she earned, the less she got to keep, and why people like her were being economically punished by the government simply for writing popular children's books. The story also mentions that in Monismania one could escape some of the taxes by purchasing real-estate property, which is exactly what the Swedish secretary of the treasury, Gunnar Sträng, had been doing at that time.

One of the people who were burdened with this tax was Astrid Lindgren, the famous author of children's books best known for her Pippi Longstocking series. In 1976 she wrote a satirical short story published in one of Sweden's biggest newspapers, where she told the tale of a troubled children's-books author called Pomperipossa, who lived in the fictional kingdom of Monismania. Among other things, Pomperipossa pondered why the more she earned, the less she got to keep, and why people like her were being economically punished by the government simply for writing popular children's books. The story also mentions that in Monismania one could escape some of the taxes by purchasing real-estate property, which is exactly what the Swedish secretary of the treasury, Gunnar Sträng, had been doing at that time.

Lindgren's story stirred up a fierce tax debate in Sweden, and for the first time in 44 years the incumbent Social Democratic Party lost the general elections.

The Swedish economy was in an uphill struggle throughout the '70s, mainly because the increasingly socialist policies had caused the economy to stagnate and lag behind the rest of the world. Many other European countries had caught up with Sweden and its monstrous welfare state and were now outperforming the country economically.

In an effort to save the economy, the government carried out extensive reform and liberalizations throughout the '80s and '90s, cutting taxes and welfare expenditures, abolishing government monopolies, reducing regulation, floating the currency, and permitting more private alternatives in the public sector.

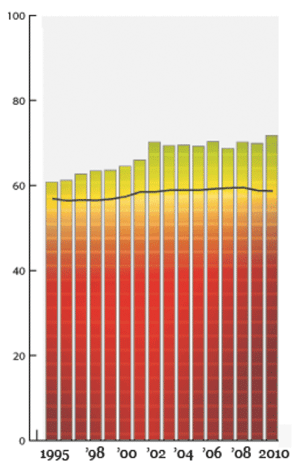

This increase in economic freedom is partially illustrated in Fig. 1, which comes from the Heritage Foundation's annual Index of Economic Freedom. The Heritage index ranks the world's countries according to their overall economic freedom. They are scored on a number of variables, including taxation, inflation, government size, labor freedom, trade freedom, etc. Karlsson critiqued the index's old methodology back in 2005 on Mises.org, but it has since been significantly improved, as Karlsson recognized in 2007. While the index is still not perfect, it does a good job of showing the general economic freedom of the world's countries relative to each other.

The index also reveals a crucial point: there's a common misperception that the Scandinavian countries are borderline Cuban in terms of economic freedom, while the rest of the developed world (particularly the United States) is far more free-market oriented. However, the reality is that the Scandinavian countries are among the top 10 and 20 "most liberalized" economies in the world, even despite their massive welfare states.

As the Heritage index shows, Sweden, Denmark, and Finland have more economic freedom than most of their European counterparts, including Germany, Austria, France, Belgium, Spain, Portugal, and Greece. While the Scandinavian countries do tend to have higher taxes and government spending than most other European states, the other states tend to have more regulation and less efficient and transparent legal systems, which cancel out the positive effects of the lower taxes.

If one compares the freest Western country on the index, which is Australia, with the least free Scandinavian country, which is Norway, the disparity is 13.2 points, or 16 percent. Comparing Australia with the top Scandinavian country of Denmark gives a difference of just 4.7 points, or 5.7 percent.

Another measurement that reveals a similar pattern is the World Bank's Ease of Doing Business Index, which measures the amount of bureaucracy and regulation one has to put up with when starting and running a business in any given country. Here too, the Scandinavian countries score in the top 10s and 20s, with their biggest burden typically being their stringent labor laws.

Denmark tends to perform better on both of these indexes than its Scandinavian neighbors, mainly thanks to far-more-flexible labor laws. In fact, as surprising as it may seem, Denmark is neck and neck with the United States on the current Heritage ranking. Denmark and the United States come in at #9 and #8 respectively. In January this year the Danish government also cut the top income-tax rate from a staggering 60 percent down to a lower (but still staggering) 50 percent. This will show up in next year's Heritage ranking, where Denmark will probably trade places with the United States.

Of course, in no shape or form are the Scandinavian countries free just because they score relatively high on these indexes, but they are nonetheless freer than most other countries, which is also why they tend to have a higher standard of living. This is the simple reason why the Scandinavian welfare states appear to "work well": because most alternatives are even worse, and in the land of the blind, the one-eyed man is king.

Conclusion

We have seen that while the Scandinavian countries have extremely high amounts of what Rothbard called binary intervention, i.e., taxation, their saving grace is their relatively lower amount of triangular intervention, i.e., regulation. This puts the Scandinavian countries on a level playing field with other developed countries and helps explain why they are able to have equal or higher living standards. The misconception that the other Western countries are a lot more free-market oriented than Scandinavia is very unfortunate; it feeds the notion that more government expansion would bring joy and happiness to all, when in fact it would make things worse.

However, the real point of all this is that the world at large is so unfree that even the massive Scandinavian welfare states can be considered among the "most free" countries in the world. While things have generally moved in the right direction in Scandinavia in terms of increased economic freedom, the very opposite trend seems to be taking place in several other countries, particularly the United States. Seeing as the United States has already descended to the level of Denmark in terms of economic freedom, one can only wonder how long it will be before it finds itself approaching Finland, Norway, and Sweden.

© 2010 Copyright MISES - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.