A Credit Crunch, Investors Selling, and the Fed Pumping in Liquidity to Keep the Market Up

Stock-Markets / Credit Crunch Aug 09, 2007 - 12:49 PM GMTBy: Marty_Chenard

The trickle down of sub-prime problems are now accelerating across the world. France's biggest bank (BNP) stopped withdrawals from investment funds because it can't determine a fair value on their holdings. As this happened, credit default traders are now saying that the risk of holding corporate bonds increased as well this morning.

The Fed and European Central Banks are now planning to increase liquidity in an effort to stem what appears to be a deepening financial crisis.

Where does that leave Bernanke?

The BNP problem and expectations that problems will arise in both Hedge Funds and Mutual Funds is putting pressure on the Fed to lower interest rates. That would put the Fed in a situation where they ignore their inflation fears for now, put the financial markets fire out now, and deal with inflation later.

If the Fed lowers interest rates, it will create other problems. One affect would be for the U.S. Dollar to depreciate further ... and that would cause Foreign investors to sell more U.S. equities. Lower interest rates would only shift the economic pain from one area to another.

Sub-prime problems and loan defaults will take some time to unwind. Part of the reason, is that some analysts are expecting that around 1 trillion dollars in consumer defaults could happen in the next 12 months.

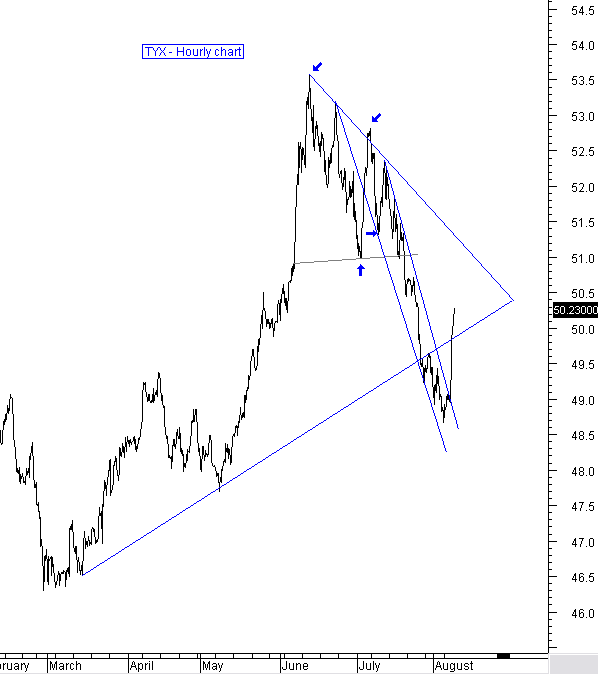

Below is an hourly chart of the 30 year bond yields ... symbol: TYX.

Note how there was a huge spike yesterday on increasing long term interest rates. That took the TYX out of its descending channel and up through the next resistance level in one day.

Financial problems are causing instability. One bank raised the bar on mortgage rates last week. It raised mortgage rates to 8% with a requirement of having at least a 30% down payment. This is all part of a credit contraction that is going on and that is a dangerous situation that could spill over to consumers spending less and corporate profits dropping.

This is the biggest problem the Fed has had to deal with since 1987. Volatility will remain high for the coming weeks as the Fed and the markets try to put band aids and duct tape on the problems.

Today, part of the stock market volatility will come from investors fearfully selling with the Fed pumping in liquidity at the same time. For example, the bad BNP news will have the market going down today, but the expected incoming Fed liquidity could actual have the market close higher by the end of the day. This is a whipsawing environment that will challenge day traders because of the speed of intra-day changes.

By Marty Chenard

http://www.stocktiming.com/

Please Note: We do not issue Buy or Sell timing recommendations on these Free daily update pages . I hope you understand, that in fairness, our Buy/Sell recommendations and advanced market Models are only available to our paid subscribers on a password required basis. Membership information

Marty Chenard is the Author and Teacher of two Seminar Courses on "Advanced Technical Analysis Investing", Mr. Chenard has been investing for over 30 years. In 2001 when the NASDAQ dropped 24.5%, his personal investment performance for the year was a gain of 57.428%. He is an Advanced Stock Market Technical Analyst that has developed his own proprietary analytical tools. As a result, he was out of the market two weeks before the 1987 Crash in the most recent Bear Market he faxed his Members in March 2000 telling them all to SELL. He is an advanced technical analyst and not an investment advisor, nor a securities broker.

Marty Chenard Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.