Silver Surges 5%, Ready for Break Out to New Highs?

Commodities / Gold and Silver 2010 Mar 08, 2010 - 06:13 AM GMTBy: GoldCore

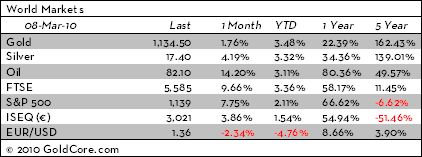

Gold reached as high as $1,140/oz in New York on Friday before closing marginally for the day at $1,134/oz but up over 1% on the week to maintain the positive technical action. It went as high as $1,138/oz so far in Asian trading this morning. Gold is currently trading at $1,137/oz and in euro and GBP terms, gold is trading at €831/oz and £748/oz respectively.

While equities in Asia were firm, European equities are more mixed this morning and appear to be giving up the early gains on hopes of economic recovery. Concerns about the European monetary union and the outlook for sovereign debt markets internationally should see gold remain firm until the outlook is less uncertain (see below).

Silver

Silver was up another 20 cents on Friday and surged 5% last week. It has range traded from $17.38/oz to $17.47/oz in Asia. Silver is currently trading at $17.45/oz, €12.76/oz and £11.49/oz.

Silver remains the laggard and has underperformed gold in recent months. This has changed in recent weeks with silver again beginning to outperform gold. The gold/silver ratio remains favourable to silver at 65 ($1,136/oz divided by $17.42/oz). "Poor man's gold" remains far from recent record highs ($21.34/oz on 27 March 2008 and long term record (nominal) highs near $50/oz in 1980.

Silver could be the surprise outperformer in 2010 as it was in 2009. Silver's industrial uses should mean that the gold/silver ratio will likely gradually regress to the average in the last 100 hundred years which is around 45:1. If the tiny silver market was to see real funds enter it than the ratio could return closer to the historical average of 15:1 as it did as recently as in 1968 and in 1980, this could result in silver surpassing its 1980 nominal high at $50/oz (see http://www.goldcore.com/research/silver-set-soar-it-did-1970s).

Technically, a close above $19/oz and $19.46/oz should set us up for a move to challenge the record highs of March 2008.

Platinum Group Metals

Platinum is trading at $1,589/oz and palladium is currently trading at $479/oz. Rhodium is at $2,525/oz.

News

Further evidence that central bank demand for gold will likely continue was seen with the announcement that Venezuela's central bank will boost its gold reserves again this year. Venezuela will buy more than half the estimated 20 metric tons of domestic production, bank director Jose Khan said. The central bank, which has about $16 billion of its $30.6 billion of reserves in gold, purchased 1.08 tons of gold from domestic mines in the first two months of this year after buying just 2 tons in all of 2009. Last week the Russian First Deputy Chairman, Alexei Ulyukayev, said that Russia's central bank wants to increase the proportion of its international reserves held in gold, and the bank added 100,000 ounces to its reserves in January. Russia remains the third largest holder of foreign currency reserves in the world, after China and Japan.

Oil rose above $82 a barrel in Asian trade today, extending last week's rally on a better than expected US jobs report. Oil prices above $80 a barrel should lead to continued inflation hedging of gold. New York's main contract, light sweet crude for delivery in April, added 46 cents to $81.96 a barrel. It struck an intra-day high of $82.04 a barrel before easing. London's Brent North Sea crude for April was up 48 cents to $80.37 a barrel.

South African trade and industry minister, Mr Rob Davies said that nationalisation of South Africa's mines is not government policy and is unlikely to become so, at least in the immediate future. "It's not by any means remotely government policy." Asked if it could ever become government policy, he said that "I don't think it's imminently so and I think it's unlikely to become so, in the immediate future anyway." Resource nationalism remains prevalent and is another factor to keep an eye on especially as it pertains to the supply demand equation for the precious metal markets.

China is continuing to explore severing the link with the dollar. A move that should see the yuan appreciate against the dollar in the medium and long term. China's central bank chief laid the groundwork for an appreciation of the renminbi at the weekend when he described the current dollar peg as temporary, striking a conciliatory tone after months of opposition in Beijing to a shift in exchange rate policy. Concerns about the value of their vast dollar holdings should see continuing investment and central bank diversification into gold.

Continuing sovereign debt risk in Dubai, Iceland and elsewhere and the risk of financial contagion is leading to continuing safe haven demand for the finite currency that is gold.

This update can be found on the GoldCore blog here.

Mark O'Byrne

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.