Gold Price in No Mans Land

Commodities / Gold and Silver 2010 Mar 07, 2010 - 04:48 PM GMTBy: Fresbee

Gold is in what I call “No Mans Land”. It is one of the most difficult situations to be in as there are equal number of Gold bears and bugs around. Mind you Gold bugs: Bears have their case and it is not as bad as it looks like for the bears.

Gold is in what I call “No Mans Land”. It is one of the most difficult situations to be in as there are equal number of Gold bears and bugs around. Mind you Gold bugs: Bears have their case and it is not as bad as it looks like for the bears.

But I personally think the bugs have a stronger case and will ultimately win but not as emphatically as they are expecting it to be. For example a $5000 /ounce is out of question!

The time may be ripe to take a quick look at Gold and where is vis vis monetary standard and inflation.

Gold in 4 currencies

Gold continues to batter EURO while it has taken a breather in dollar terms. My understanding is that in Gold will again start dominating dollar while it tones down in EURO terms. Watch for a decisive break of dollar index below 80.

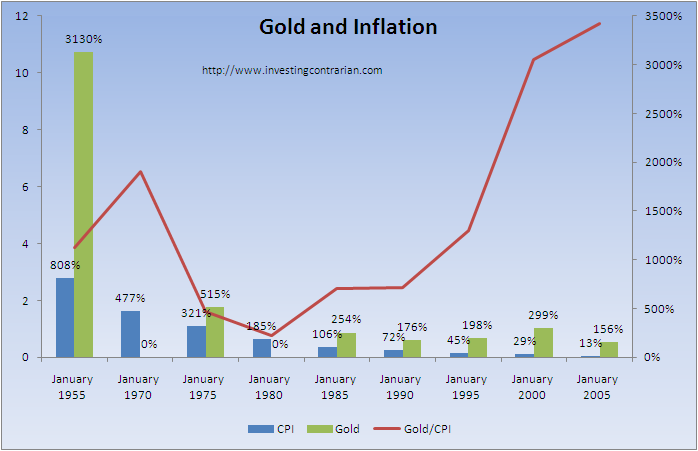

Gold and Inflation

Gold is one of the best inflation hedges of all times. While CNBC keeps shouting that Gold may not an inflation hedge citing example of 1980, but the fact remains, that except 1980 CPI figures, Gold has outperformed CPI by a massive margin. The above chart displays CPI performance from 1955 to 2009, 1970 to 2009, 1975 too 2009, 1980 t0 2009 and so on till 2005 to 2009. Increasingly Gold/CPI ratio has exploded from 1 in 1980 to 12 in 2005.

Gold is a brilliant inflation hedge.

Greenspan, Paulson and Gold: Heavy concoction

He is undenaiably one of the best investment managers of all time and probably beats Buffett hands down when it comes to sheer performance in this decade. While the sleepy old man makes his slow and steady bets, Paulson smashed a record $12 bn cash profit in 2008 shorting the subprime markets.

He has now turned his attention to Gold. He has failed to garner much AUM to manage under Paulson Gold fund, but he still continues to focus on Gold.

Greenspan joined Paulson as an advisory member. Read here.. Soon after Paulson took 8% in Gold ETF. Was that a related? Sure it was. Greenspan knows the game inside out and he has been on record:

“Gold still hold sway over financial markets”. This coming from a central banker should surprise one and all.

One or other, hold onto Gold as fast as you can. Even leverage yourself as Gold is ready to move very high. $1500 / ounce is on the cards before 2010 books are closed.

Source :http://investingcontrarian.com/goldsilver/gold-updates-and-introspection/

Fresbee

http://investingcontrarian.com/

Fresbee is Editor at Investing Contrarian. He has over 5 year experience working with a leading Hedge fund and Private Equity fund based out of Zurich. He now writes for Investing Contrarian analyzing the emerging new world order.

© 2010 Copyright Fresbee - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.