The Stock Market Energizer Bunny Rally, Bearish Head and Shoulders Pattern?

Stock-Markets / Financial Markets 2010 Mar 07, 2010 - 07:06 AM GMT

FDIC Friday is a quiet one.The FDIC Failed Bank List announced four new bank closures for the week. 26 banks have

FDIC Friday is a quiet one.The FDIC Failed Bank List announced four new bank closures for the week. 26 banks have

failed in 2010. Are things picking up?

Elizabeth Warren discusses “Global Enron” from Greece to Wall Street

The appearance of the Chair of the Congressional Oversight Panel, Elizabeth Warren, on Charlie Rose is a must watch. In addition to an in depth discussion of the the consumer protection agency, which despite all valiant attempts to the contrary, will likely end up under the Fed's jurisdiction, thereby making the world's most powerful cabal even more powerful, Warren touches on a variety of other issues, including the sovereign debt situation, commercial real estate, and the one concept at the heart of it all: the lack of impairments by stockholders (and certainly by debtholders) in what was a bankrupt financial industry.

The Primary Source Of January's Surprising Boost To Consumer Credit?

Why, The US Government Of Course

Today, the market spiked in the last hour of trading after it was announced that total consumer credit increased for the first time in a year (not all credit, mind you, just car loans; consumers are still eagerly paying down their credit cards). And who was the source for this generosity you may ask? Why, the US Government of course.

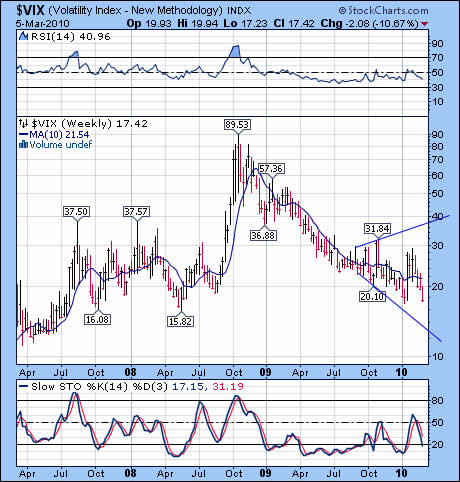

Will the VIX make a new low?

--The VIX is challenging its prior lows again. The reversal pattern since January 19th appears that it may be superseded by a new low. You cannot just ignore the Broadening pattern because it is a reversal pattern reserved for major tops and bottoms, as the case is here. Monday will settle the arguments whether the market is bullish or bearish.

The SPX closed at the 10-week moving average.

--The SPX closed above its 10-week moving average this week. The argument for a new Seasonal Cycle fits really well. If this is truly a bear market, then Friday was the likely top. The final surge in the fifth wave of (c) is complete. Wednesday’s and Thursday’s sideways action appears to be a triangle, which precedes the final move. The potential Head & Shoulders pattern should now begin its decline below 1044.

The NDX exceeds its 10-week moving average.

--The NDX went higher this week. The issue that I have had to deal with is pattern recognition. This was the week for the apparent completion of the final push in an ending diagonal pattern.

Although the indices have gone above their respective 10-week moving averages, my model still says that this is the top. I don’t know what to attribute the liquidity for this move, other than the power of derivatives and margin, since all the normal sources of cash for the market are not participating. I believe that when the turn comes (Monday?) the meltdown will be spectacular..

Gold tests its neckline…again.

-- The Head and Shoulders neckline is still a major resistance to gold. Gold seems to be caught between a rock and a hard place. If wave iii is to continue, it must do so now. The 10-week moving average must give way, as must he trendline under it.

Gold has gone virtually nowhere for the past two months and must stage a breakout either up or down. Forecasting has become extremely difficult in a choppy, sideways market such as this. I still maintain that the pattern is bearish, but am prepared to change myh opinion when the breakout occurs.

Oil may be tracing a right shoulder.

West Texas Light Crude had another positive week, but hasn’t changed the bearish tone. It, too, has completed a five wave impules from its recent low, signifying either a completion of a corrective move or the beginning of a new wave higher. In either case, it must pull back from its current position, since it is up against its intermediate Trend Resistance. A right shoulder of a Head & Shoulders pattern giving a potential target below the July low.

The Bank Index has not broken out.

The $BKX is the one index that I had expected to break out this week. It did not, bolstering the argument that this market doesn’t have the strength to go higher, but hasn’t the reason to go lower…yet. I cannot believe how little it would take to turn this market bullish, but these indices simply haven’t done it.

The Broadening Top pattern still has validity and will remain until resolved. We are four weeks into the new Seasonal Cycle, which is young, compared to its normal 5.5 to 9 months duration. We are nearing the big reversal that has been delayed so long.

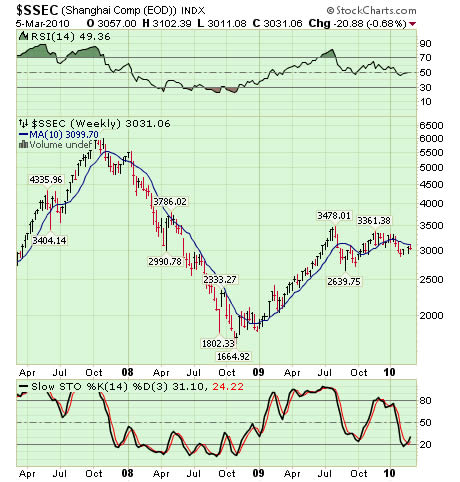

The Shanghai index may now be on the same cycle as the US market.

--The Shanghai has not been able to rise above its 10-week moving average, which now leads me to believe that its cycle may be in sync with ours. In fact, it started its decline on Thursday, within 24 hours of the latest cycle pivot. Will the Shanghai market lead the world in its decline? I have mentioned that as a probability since it first turned down last Summer. Possibly now it is taking a leadership position among the world indices. Monday may give us a good indication.

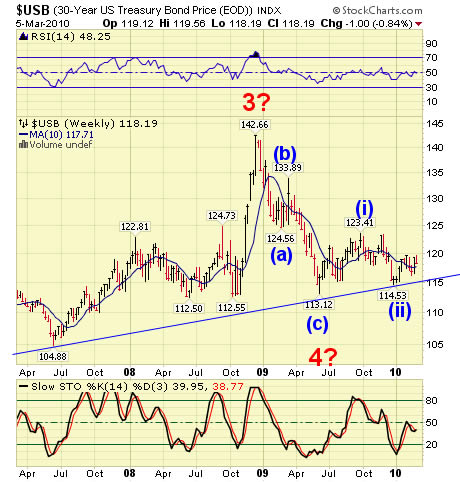

$USB remains above its 10-week moving average.

-- $USB pulled back this week, but remained above its 10-week moving average this week. This should be the moment of decision, whether it remains above and continues higher or not.

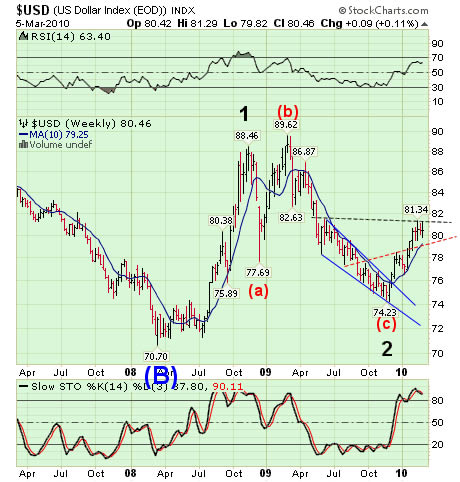

$USD had an inside week.

-- $USD has had foure inside weeks, suggesting indecision and consolidation. There is a new Head and Shoulders pattern emerging (shown at the black neckline). This promises a much stronger surge than already experienced in the dollar. The new minimum target falls just short of the February 2009 top. Although the $USD could still pull back, a sideways consolidation can store enough energy to move higher..

I hope you all have a wonderful weekend!

Traders alert: The Practical Investor is currently offering the daily Inner Circle Newsletter to new subscribers. Contact us at tpi@thepracticalinvestor.com for a free sample newsletter and subscription information.

Our Investment Advisor Registration is on the Web

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski,

President and CIO

http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.