Gold's Technicals Improved as Markets Await U.S. Jobs Report

Commodities / Gold and Silver 2010 Mar 04, 2010 - 07:13 AM GMTBy: GoldCore

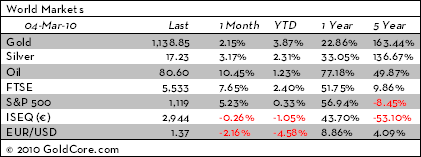

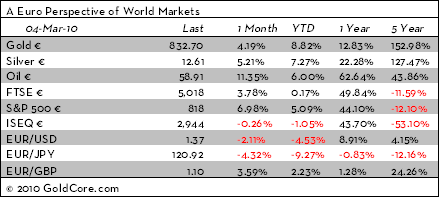

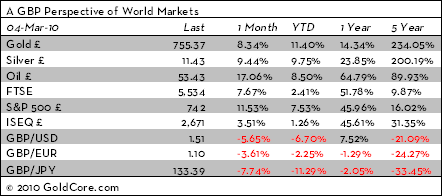

Gold had a strong run in London and the US rising to $1,144.85/oz before falling back slightly to close up 0.55% in US trading. It has dropped as low as $1,132.00/oz in Asian trading this morning before bouncing somewhat. Gold is currently trading at $1,138.00/oz and in euro and GBP terms, gold is trading at €833/oz and £756/oz respectively - near recent nominal highs in both currencies.

Gold's technical situation has improved markedly and the downward trend of recent weeks may have reversed. However, a close above $1,160/oz will be needed of gold it to again challenge its recent dollar high of $1,226.60/oz. A renewed bout of dollar weakness would likely see gold surge to new record highs. A close below $1,130/oz could see quickly fall back to support at $1,110/oz.

Markets remain cautious and gold is threading water in anticipation of the ECB interest rate decisions and US jobs data. The Federal Reserve announcing that recovery in the world's largest economy would be slow and 'modest' also contributed to cautious sentiment as it could mean that the jobs data later will be weaker than expected. Gold may remain subdued until the jobs data is recently when the volatile trading seen after recent jobs data may be seen again.

The European Central Bank is expected hold its interest rates unchanged for another month and may announce new measures related to gradual exit from monetary stimulus. ECB President Jean-Claude Trichet is widely expected to hold the key interest rate at a record low of 1% for a tenth consecutive month which could see the euro fall further versus the dollar and gold.

UK house prices unexpectedly fell 1.5 percent in February, the first drop since June last year. The decline followed a downwardly revised 0.4 percent rise in January. The fall in UK house prices surprised market participants and will make the Bank of England monetary policy more difficult. While sterling remains embattled and there is a need for higher interest rates to protect sterling from further falls, the Bank of England is constrained fearing further falls in property prices. A similar 'catch 22' faces many economies internationally and is leading to continuing safe haven demand for gold.

Silver

Silver dipped to $17.04/oz in Asia before jumping to $17.18/oz. Silver is currently trading at $17.17/oz, €12.56/oz and £11.40/oz.

Platinum Group Metals

Platinum is trading at $1,573/oz and palladium is currently trading at $450/oz. Rhodium is at $2,575/oz.

News

Oil prices rose above $81 a barrel in Asian trade today before falling back; oil over $80 a barrel is contributing to firmer gold prices. New York's main contract, light sweet crude for delivery in April, was down 31 cents to $80.56 a barrel after earlier hitting an intra-day high of $81.01. The contract had surged $1.19 in US trade yesterday. London's Brent North Sea crude for April shed 19 cents to $79.06 a barrel after climbing $1.07 dollars yesterday.

Greece says it is prepared to turn to the IMF if its EU neighbours do not come up with aid after it announced tough austerity measures. Greek Prime Minister, George Papandreou, is to meet the German chancellor Angela Merkel in Berlin tomorrow, before meeting Nicolas Sarkozy in Paris and then Barack Obama in Washington next week.

Tensions between Greece and Germany have risen after Greek Deputy Prime Minister Theodoros Pangalos last week accused Germany of failing to compensate Greece for Nazi occupation during World War II. Mr Pangalos made the remarks during a wide-ranging BBC interview about Greece's financial difficulties. "They [the Nazis] took away the Greek gold that was in the Bank of Greece, they took away the Greek money and they never gave it back," he said. Germany has rejected the allegations, describing them as "not helpful". The comments are likely part of a negotiating ploy by the Greeks in under to ensure German support for their severe fiscal and economic crisis.

This update can be found on the GoldCore blog here.

The Bullion Services Team

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.